What's Netra telling us: June 2023

The June edition of Netra is special. This “2nd-anniversary” report offers some unique insights on unleashing the power of long-term investing. It explores the benefits of aligning with steadfast entities, avoiding speculation, seizing opportunities, navigating market volatility, and harnessing the magic of compounding.

Loyalty Bonus: The potential of sticking to long-term players

In the dynamic realm of investing, discovering individuals and organisations committed to the long-term game is like finding precious gems amidst shifting sands. Yet, forging alliances with such steadfast players can unlock immense rewards.

We live in times when the average lifespan of human beings is continuously increasing, and the mortality rate is falling. However, the scenario is quite the opposite when we look at firms. Many businesses struggle to survive in this changing landscape. Companies either wind down or they get ‘disrupted’, and this is happening at a much faster pace. It's tough to find individuals and organisations committed to the long haul. Should you find them, stick with them because they hold the secret to long-term success, and possibly, financial abundance.

The relentless speed of modern life impedes our ability to act with a long-term perspective. However, those who can consciously prioritize long-term thinking and identify enduring people, organizations, and investments gain a distinct advantage.

— DSP Mutual Fund (@dspmf) June 5, 2023

Download: https://t.co/JxyMzoklFx pic.twitter.com/jamKgBjxNI

The Value of Time and Patience

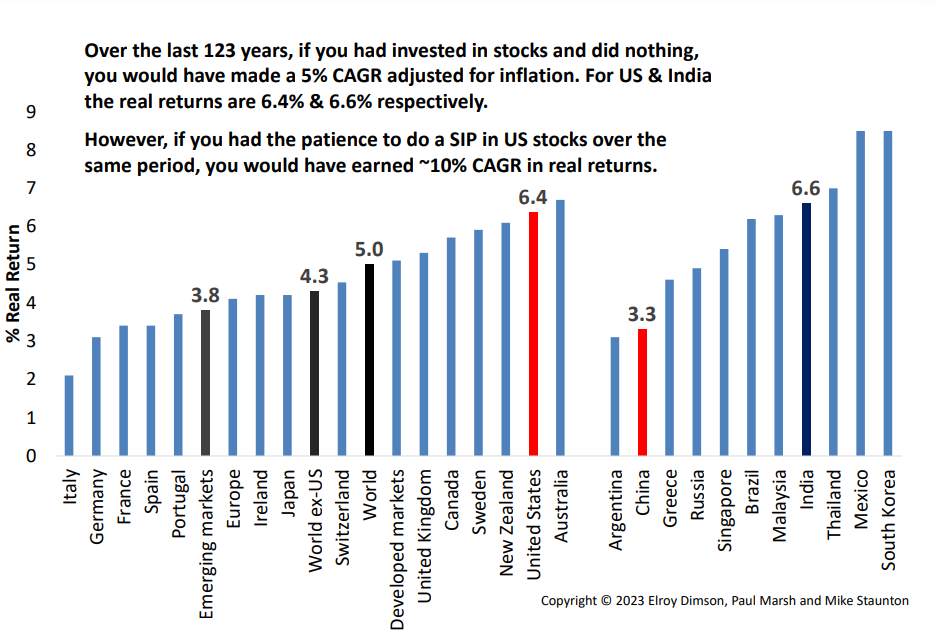

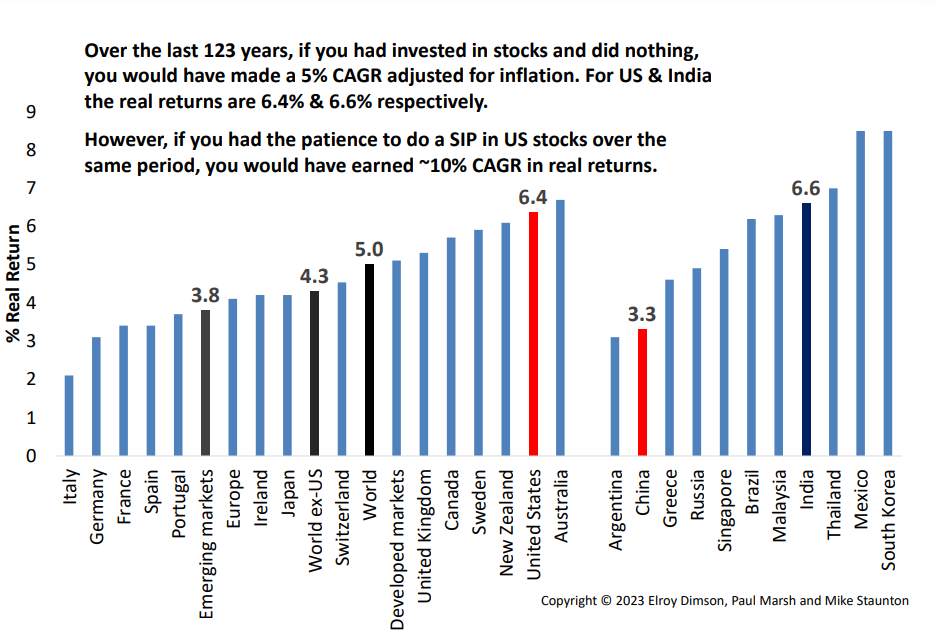

When it comes to long-term returns, setting realistic expectations is crucial. Historical data indicates that global equity markets have achieved ~5% CAGR (Compound Annual Growth Rate) over the past 123 years, before considering costs and taxes. However, should the investment have been through a simple SIP in US equities, it might have yielded an approximate ~10% inflation-adjusted CAGR over the same 123-year period. This means, a modest $100 investment could’ve turned into $11.8 million today. This proves that Dollar Cost Averaging indeed works to preserve purchasing power over time.

Source: DQDYDJ, NBER, Credit Suisse (Copyright © 2023 Elroy Dimson, Paul Marsh and Mike Staunton), DSP Data as on May 2023

Avoiding the Perils of Speculation

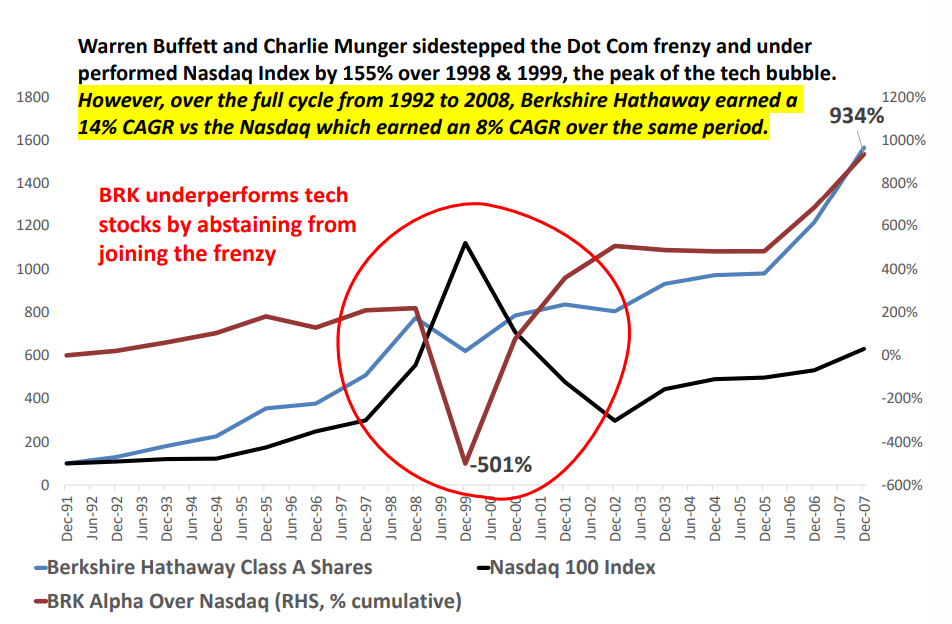

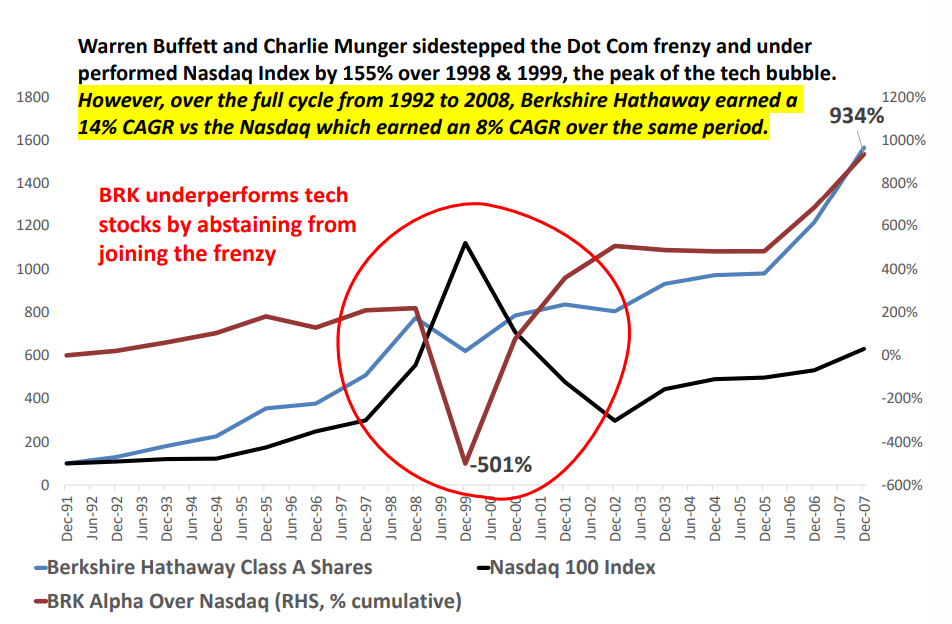

The allure of quick gains often entices investors into speculative behaviour, particularly during periods of market triumphs. However, the consequences of overstaying the festivities can be dire. Warren Buffett's timeless words during the dot-com bubble serve as a cautionary reminder against speculative investments that may possess inflated valuations relative to future cash generation capabilities. Recognising the significance of rational decision-making and avoiding market euphoria can help investors navigate the risks associated with speculative bubbles.

Source: BRK, Nasdaq, DSP as of May 2023

Seizing Opportune Moments

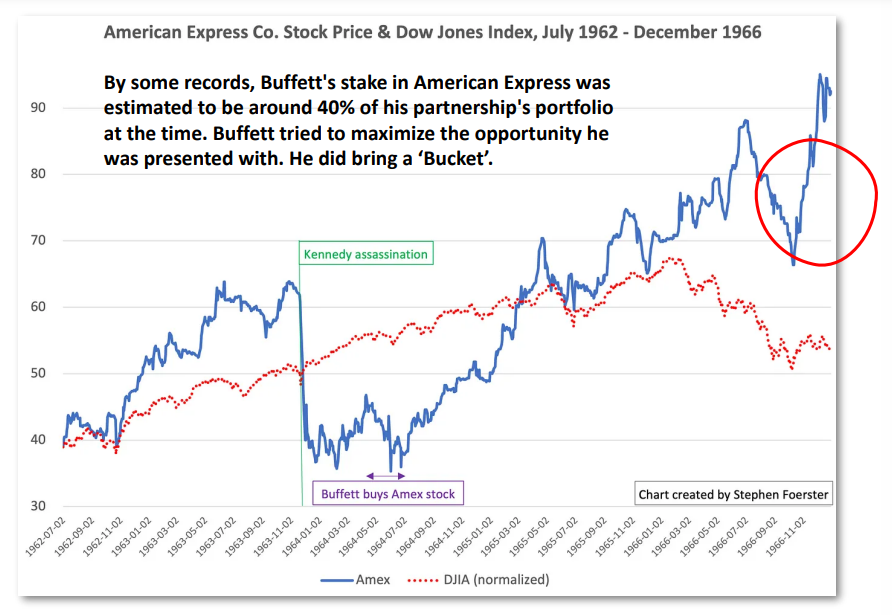

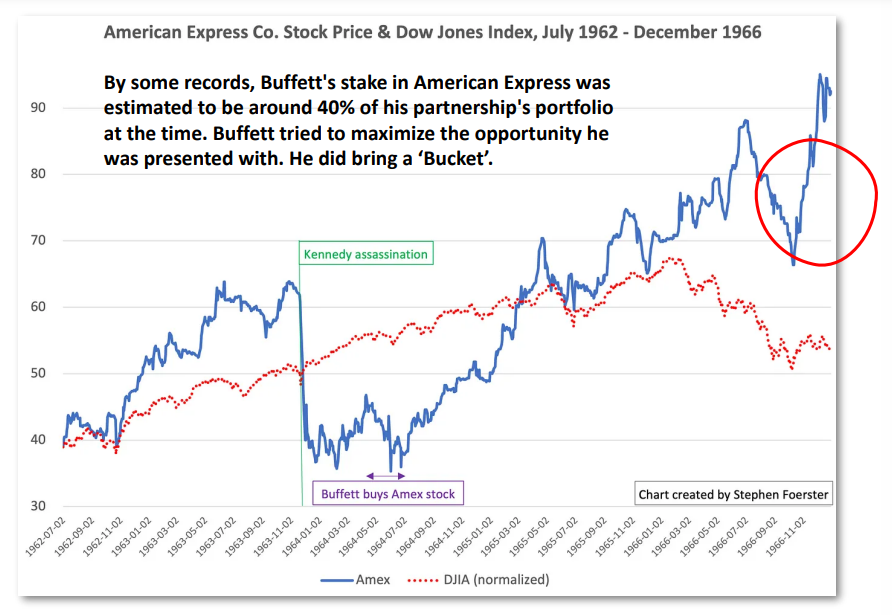

Warren Buffett's investment in American Express during the Salad Oil Scandal exemplifies the principle of seizing opportunities amidst temporary setbacks. Despite the company's stock plummeting from $65 to $37 due to losses incurred by funding De Angelis' Allied Crude, Buffett recognised the downturn as transitory and purchased a 5% stake for $20 million. By capitalising on market inefficiencies and acknowledging the long-term potential of high-quality businesses during challenging times, astute investors can position themselves for significant returns.

“Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.” - Warren Buffett

Source: DSP, Mark I. Weinstein, Stephen Foerster

Success Through Strategic Investing

Late.Rakesh Jhunjhunwala, also known as "The Big Bull," achieved immense wealth by adhering to two fundamental principles: avoiding overpayment and acquiring high-quality businesses.

Jhunjhunwala's success stems from remaining invested in select high-quality businesses throughout market cycles and not paying excessively for any investments. Rather than second-guessing market movements, he emphasises the importance of avoiding excessive prices and focusing on resilient companies capable of weathering market fluctuations. Jhunjhunwala's approach highlights the power of strategic investing in generating substantial wealth over time. It also bears testimony to the power of long-term commitment to long-term players.

Navigating Market Volatility

The European debt crisis is a cautionary tale, reminding us that market euphoria can mask underlying vulnerabilities. Just as a bull market can create a false sense of brilliance, it's essential to remain vigilant and recognise the risks lurking beneath the surface.

The European debt crisis also serves as a stark reminder of the risks associated with market-induced uncertainty and how investors can safeguard their wealth during such challenging times. When the European debt crisis struck, several countries faced severe economic turmoil, causing stock markets to plunge and investor confidence to waver. However, investors who adopted a long-term perspective and maintained a diversified portfolio were better positioned to weather the storm.

Maintaining calm when negativity looms

The Recession Buy Indicator (RBI) highlights the value of contrarian thinking. By embracing positivity amidst widespread negativism, investors may be able to identify opportune moments to enter the market. Discover the wisdom of buying when the news is overwhelmingly bad, as history has shown that such periods often precede the stock market's subsequent recovery.

Investing can be a minefield, often caused by our own actions. Self-awareness and discipline are crucial to staying afloat in these unpredictable waters. Avoid chasing performance, following investment fads, or making impulsive decisions. Instead, focus on long-term goals, avoid overpaying, and stay the course.

Embracing Consistency and Reward

In the vast sea of investment options, many investors tirelessly seek that one exceptional stock that will bring them unprecedented success. Jack Bogle had a timeless piece of advice here:

"Don't look for a needle in the haystack, just buy the haystack”

Jack Bogle's words are a powerful reminder of the merits of adopting a broader investment approach by embracing the entire index (He speaks of index funds. To know about these funds, click here). This perspective encourages investors to focus on the collective performance of a diversified portfolio rather than relying on the success of a single stock.

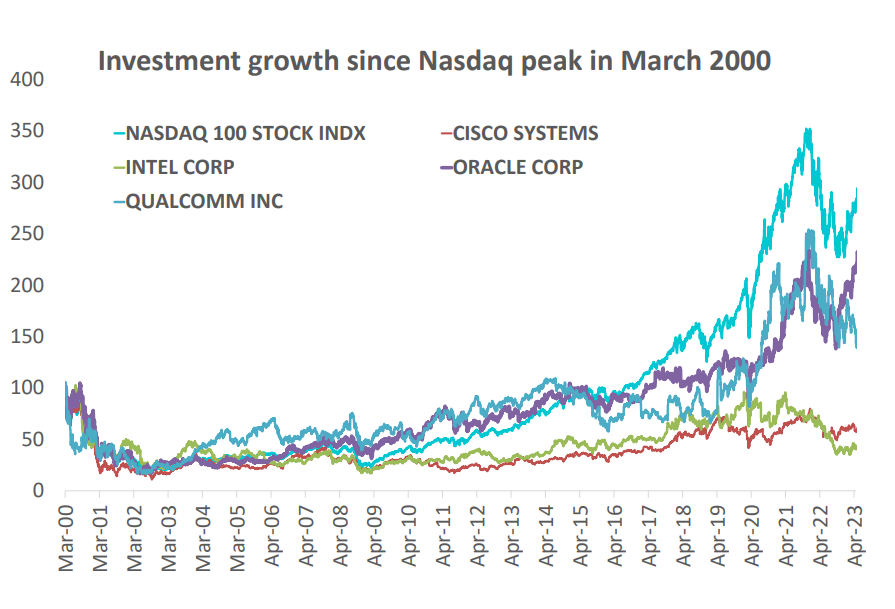

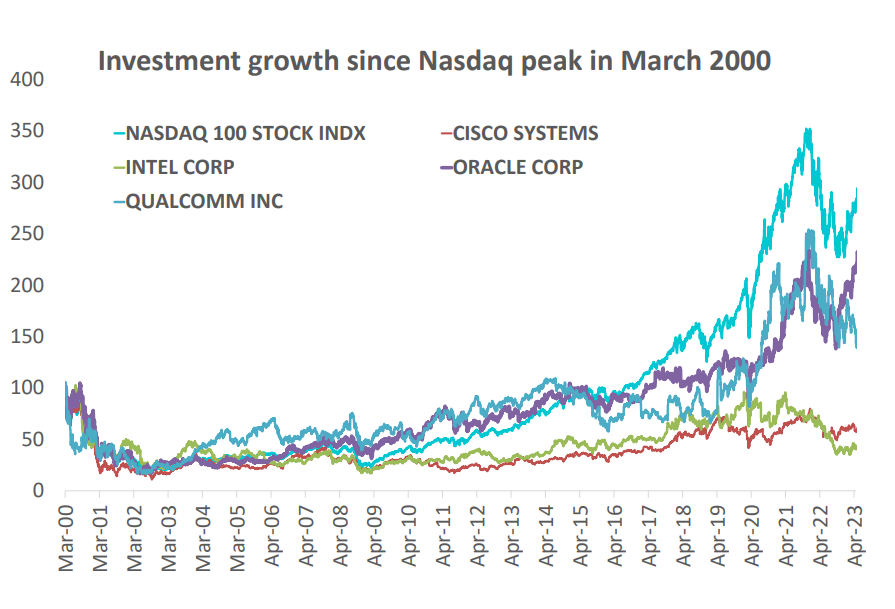

To understand the impact of the "haystack" approach, let's consider the performance of leading companies within the Nasdaq 100 index. Out of the top 10 companies in the index in 2000, four have underperformed, and five are no longer part of the index. This data highlights the volatility and uncertainty associated with individual stock selection. By investing solely in these specific companies, investors may have missed out on better returns achievable by investing in the entire index.

Source: Parth Shah, DSP, Bloomberg, Data as on May 2023

Source: Parth Shah, DSP, Bloomberg, Data as on May 2023

By heeding Bogle's advice and embracing the "haystack" of the index, investors position themselves for more consistent and rewarding investment outcomes. The diversification offered by investing in the entire index helps mitigate the risks associated with individual stock performance. It allows investors to capture the overall market growth, benefiting from the combined strength of multiple companies rather than relying on the success of a few.

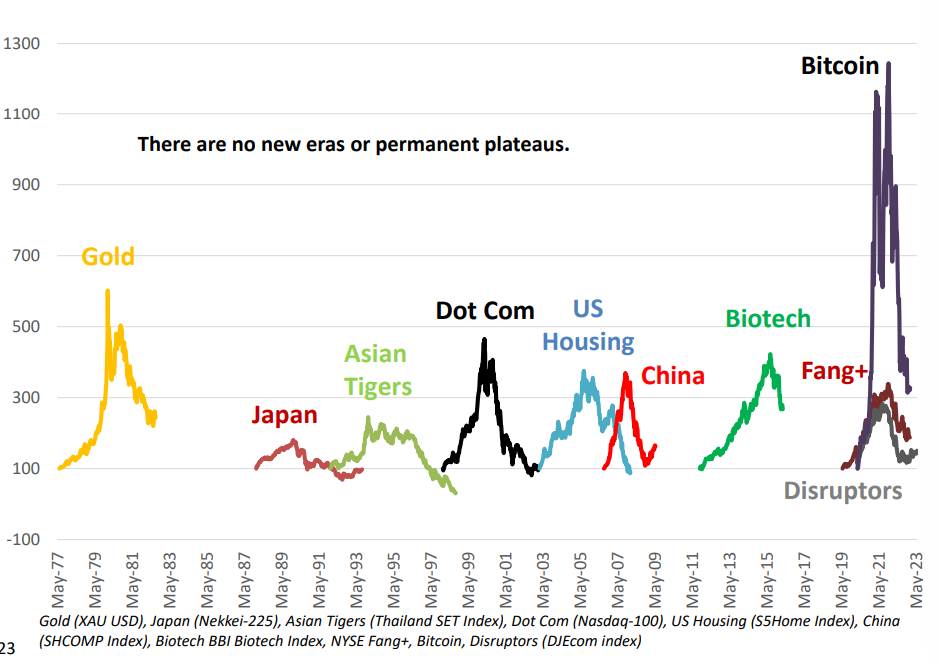

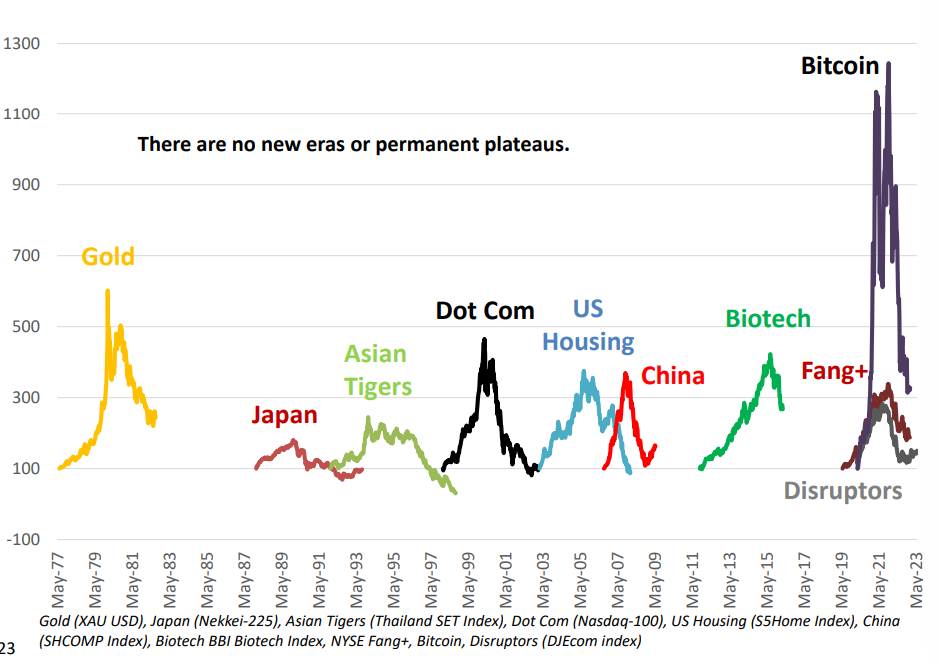

History Repeats

Financial bubbles and busts may seem unique each time, but they follow familiar patterns. Understand the influence of human psychology, economic conditions, and systemic factors that contribute to these cycles. Trust the experts, but also ask critical questions and remain cautious when claims of "different" times arise.

Source: DSP, Bloomberg, Data as on May 2023

The Bottom Line

Successful investing requires knowledge, discipline, and a long-term perspective. Investors can navigate uncertainties and build wealth over time by learning from past experiences, understanding market dynamics, and adopting proven strategies. Remember, the journey to financial success begins with a commitment to continuous learning and making informed investment decisions.

Download the report: Click here

Disclaimer

In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house. Information gathered and used in this material is believed to be from reliable sources. The AMC however does not warrant the accuracy, reasonableness and / or completeness of any information. The above data/ statistics are given only for illustration purpose. The recipient(s) before acting on any information herein should make his/ their own investigation and seek appropriate professional advice. This is a generic update; it shall not constitute any offer to sell or solicitation of an offer to buy units of any of the Schemes of the DSP Mutual Fund. The data/ statistics are given to explain general market trends in the securities market and should not be construed as any research report/ recommendation. We have included statements/ opinions/ recommendations in this document which contain words or phrases such as “will”, “expect”, “should”, “believe” and similar expressions or variations of such expressions that are “forward looking statements”. Actual results may differ materially from those suggested by the forward looking statements due to risks or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on our services and/ or investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices etc.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Leave a comment