ELSS funds: still good under the new tax regime?

If you’re anything like me, you might have fond memories of when you first learned of Equity Linked Savings Scheme (ELSS) funds and the tax deductions associated with them.

Maybe it felt like you’d discovered a cheat code for life, one that could save you significant amounts of moolah (yay, more vacations / clothes / exotic coffees etc!). Maybe an ELSS fund was what first gave you the confidence to enter the equity markets and embark on a long and fruitful investing journey. Or maybe you enjoyed being seen as a financial guru when you told all your friends about ELSS funds way back when you were 21.

So it might have felt disappointing that the new income tax regime, introduced in 2020, did away with one of the key attractions of ELSS funds: their tax-saving benefits.

But does this really mean that ELSS funds are now passé, and that you need to look beyond them towards greener pastures?

Definitely not. Here’s why.

ELSS funds: a quick low-down

If you’re new to ELSS funds, fret not: here’s the elevator pitch for these (former?) bad boys.

ELSS funds are tax-saving mutual funds that invest primarily in stocks (equity and equity-related securities). They enable investors to avail themselves of a deduction of up to ₹1.5 lakh from their total annual taxable income under Section 80C of the Income Tax Act, 1961, under the old tax regime.

An ELSS fund is an equity fund that can reduce your income tax liability. Under Section 80C of the Income Tax Act, you can claim a deduction of up to ₹1.5 lakh per annum (financial year) on your ELSS investments if you opt to pay tax under the old tax regime.

Simply put, under the old tax regime, you get a tax break for investing in such funds.

But that’s not the only reason why most people love ELSS funds. These funds are also liked because:

- Being diversified equity mutual funds1, they also offer the benefit of potential wealth creation.

- Their lock-in period of 3 years is among the lowest across all tax-saving instruments.

- There are ZERO charges (entry or exit fees) when you buy or sell.

Thus, if you’re choosing to remain with the old regime, retaining your existing ELSS investments or making fresh ELSS investments still makes perfect sense.

ELSS funds under the new tax regime

Now, the new tax regime doesn’t offer any investment-oriented tax benefits. It does away with *most* deductions and exemptions, except a few such as the “standard” deduction of ₹50,000 for salaried employees.

Nevertheless, because the new tax regime has different tax slabs and tax rates than the old one, it might turn out that you’d save more tax under the new tax regime, depending on your income range. This is generally true if you’re in the early part of your career. Of course, do consult your CA to determine if this is indeed the case.

So, should you get rid of existing ELSS funds and maybe not invest in ELSS funds again, if you opt for the new tax regime?

The straight answer: of course not! Even with the new tax regime, there are at least two clear, good reasons to not turn away from this category of funds altogether.

1. The lock-in period could save you from yourself

As mentioned above, ELSS funds have a lock-in period of three years. You might find this lock-in period to be annoying and high-handed: who are they to stop me from doing as I please with my money?!

But it’s all a matter of perspective. Seen another way, the lock-in period might, in fact, keep you from losing money.

How? Well, when the market gods get angry and stock prices are in the doldrums, it’s very hard for most retail investors to simply sit tight and wait until the promise held out by their portfolio gets fulfilled. Instead, investors start to panic, lose faith in their investment thesis, and end up selling their fund units at a relatively low price, or even at a loss!

In such situations, a lock-in period can prevent you from acting on your emotions and can keep you disciplined even if your lizard brain is screaming it wants to get out.

Which is why we often suggest that when investing in equity funds, one should make a mental affirmation to stay locked-in for at least 10 years, even when there’s no official lock in period!

2. ELSS funds can also be good wealth creators, period!

Whether you choose the old tax regime for the available tax benefits or not, ELSS funds can also be a great way to create wealth over the long term, even if you opt for the new tax regime.

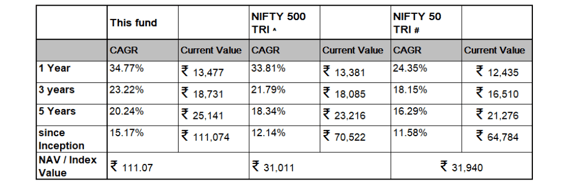

Consider this: Had you'd invested ₹1 lakh in DSP ELSS Tax Saver Fund on its inception date of Jan 18, 2007, your investment would've grown by over 11X by Jan 31, 2024!2

According to Sourabh Jain, Founder of financial consultancy firm Magnum Finvest Services:

“ELSS is a powerful alternative when one looks at the tax benefits and return potential of other instruments such as PPF, especially for investors who have a higher risk appetite.”

The bottom line

In sum, what we’re saying is this: don’t throw the baby out with the bath water! Sure, try to get ELSS tax benefits if you can, but don’t break up with ELSS funds just because you have to switch to the new tax regime. The potential wealth in store and the self-protection engine of a lock-in period could make a big difference as well.

The need for such a holistic approach is echoed by Manish Hingar, the founder of Fintoo, a tax and investment planning platform:

“It's important for ELSS fund investors to consider their overall financial situation, tax liabilities, and investment goals before making a decision on their investments.”

Like with anything when it comes to investing, no short term, emotional reactions. No jumping in and out of funds without critical reasoning. That’s all we really ask of investors.

So now that you know all this, go ahead and recapture the satisfaction of being considered a financial guru by your friends and family (or experience this sweet, sweet feeling for the first time) by talking to them about ELSS funds. Better still, share this blog with them :)

Next steps?

Speak with our experts by filling this form. Our team will get in touch and guide you. And if you’re investing with an MF Distributor already, you can speak to them directly too.

For more information on our ELSS tax saver offering, click on the link below.

1 ELSS Schemes are required to comply with the applicable regulatory guidelines including “Equity Linked Savings Scheme, 2005” rules for making investment in various securities/instruments.2 Returns mentioned are for DSP ELSS Tax Saver Fund (Regular plan – Growth option) as on Jan 31, 2024. Historical Returns (As per SEBI format) as of January 31, 2024 with investment of ₹10,000

^ Fund Benchmark # Standard Benchmark

Rohit Singhania is managing the scheme since July 2015.

Charanjit Singh is managing the scheme since May 2023

Date of allotment: Jan 18, 2007.

Period for which fund's performance has been provided is computed based on last day of the month-end preceding the date of advertisement

Different plans shall have a different expense structure. The performance details provided herein are of Regular Plan, Growth Option.

Since inception returns have been calculated from the date of allotment till January 31, 2024

For viewing performance of other funds managed by the Fund managers, click here.

|

DSP ELSS Tax Saver Fund (Erstwhile known as DSP Tax Saver Fund)$$ |

|

|

An open ended equity linked following a value investment strategy |

|

|

Product Suitability |

|

|

This product is suitable for investors who are seeking*

* Investors should consult their financial advisers if in doubt about whether the Scheme is suitable for them. |

|

|

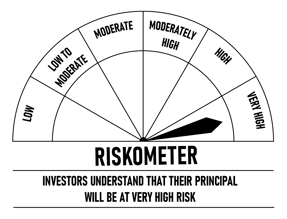

SCHEME RISKOMETER |

BENCHMARK RISKOMETER |

|

|

|

Disclaimer

This material is for information purposes only. The recipient of this material should consult an investment /tax advisor before making an investment decision. In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house and is believed to be from reliable sources. The statements contained herein may include statements of future expectations and other forward looking statements that are based on prevailing market conditions / various other factors and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. The recipient(s) before acting on any information herein should make his/their own investigation and seek appropriate professional advice. The investment approach / framework/ strategy mentioned herein are currently followed by the scheme and the same may change in future depending on market conditions and other factors.

The AMC nor any person connected does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Data provided is as on February 12, 2024 (unless otherwise specified and are subject to change without notice). Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. There is no assurance of any returns/capital protection/capital guarantee to the investors in the above mentioned scheme. The comparison with PPF, Bank Fixed Deposit (and other traditional saving instruments) has been given for the purpose of general information only. Investments in mutual funds should not be construed as a promise, guarantee on or a forecast of any minimum returns. Unlike traditional saving instruments, there is no capital protection guarantee or assurance of any return in mutual fund investment. Traditional savings instruments are comparatively low risk products and are backed by the Government (except 5-year recurring deposits). Investment in mutual funds carries high risk as compared to the traditional saving instruments and any investment decision needs to be taken only after consulting a tax consultant or financial advisor.

For complete details on investment objective, investment strategy, asset allocation, scheme specific risk factors and more details, please read the Scheme Information Document, and Key Information Memorandum of the scheme available on ISC of AMC and also available on www.dspim.com. All opinions/ figures/ charts/ graphs are as on date of publishing and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Leave a comment