Investing in Index Funds - Beginner’s Guide

You might have grown up hearing dinner table discussions on how the Sensex has reached new highs, or NIFTY has corrected. If that ever left you feeling a little lost, you’ve come to the right place.

An index in the beginning of a book is a list of topics covered within. A stock market index is somewhat similar: it is essentially a group of securities defining a market segment. This segmentation can be on the basis of the market capitalization (like large-cap, small-cap, etc.), sector-based (like IT, banks, etc.), geography (like emerging markets, Asia-Pacific, etc.), or asset class (like commodities, gold, etc.). This classification becomes representative of the larger universe of stocks and is used as a yardstick to assess the performance of the segment and the market in general.

For example, the NIFTY 50 is the broad index for the National Stock Exchange, which represents the free-float market-cap-weighted average of 50 of the largest Indian companies listed on the NSE.

Similarly, a set of 30 of the largest companies which are also the most actively traded stocks listed on the Bombay Stock Exchange, comprises the main index of the BSE called the Sensex. Some other popular indices include BSE Smallcap, NIFTY Next 50, NIFTY 50 Equal Weight, NIFTY Midcap 150 Quality 50, NIFTY Pharma, etc.

These indices help you compare the current price levels with the past performance and assess the overall direction the market is taking. For example, the Sensex had a base value of 100 in 1979. Look at where it is today - well on its way above the 50k mark! That is a good 500-fold return in about 40 years. Similarly, the NIFTY with its base at 1000 in 1995 has grown 14x in 25 years.

You cannot directly invest in the index as they are only mathematical constructs!

Therefore, index funds.

What are Index Funds?

Index funds are mutual funds that invest in a set of stocks, bonds or asset classes, imitating the portfolio of a market index. They are the simplest, easiest, no-fuss investments to build wealth over time. For example, an index fund that mirrors the NIFTY 50 will invest in the exact same composition of stocks in the exact same weightage, comprising the index.

Instead of picking out stocks individually, index funds present a unique opportunity to indirectly buy the whole market. By investing in an index fund, you are building yourself a diversified portfolio of quality assets that earns as much returns as the market itself. Individual stocks may rise and fall, but indexes tend to rise over time. You are therefore minimizing your risks when you invest in an index fund.

What one needs to note, importantly, is that Index funds only imitate the chosen index, not attempt to surpass it. From an investor standpoint, this is akin to scoring the passing marks in an exam - will do, but is not enough. Investors who are keen on benchmark-beating growth, therefore, don’t find index funds as appealing as the potential returns from other equity funds, which have the potential to outperform as well as underperform the market. However, for investors aiming to invest in equity markets, index funds may be the easiest way to build wealth. Over the past few years, inflows into index funds have more than tripled.

Index funds are passive investments. To know the difference between passive and active funds, watch our video below:

Experts have claimed that for investors who do not have the time to study the markets, trends, or companies, the safest bet is actually index funds, with a great risk-reward ratio, and the option to invest via SIP.

"A low-cost index fund is the most sensible equity investment for the great majority of investors," Warren Buffett told John C Bogle in his book ‘The Little Book of Common Sense Investing’. "By periodically investing in an index fund, the know-nothing investor can actually out-perform most investment professionals."

How do index funds work?

Suppose an index fund tracks a benchmark like the NIFTY 50, the fund manager picks out the same 50 stocks that comprise the NIFTY 50 to make up the composition of the fund. She then allocates money to the different stocks in the same percentage as they feature in the index. She passively monitors the performance of the fund and buys and sells stocks in accordance with the changes in the underlying index. Indices in India are usually rebalanced bi-annually to keep in line with the changing economic trends of the market segments they represent. For e.g. new stocks come in and existing stocks go out of the Nifty 50 Index in March and September every year to reflect the changes in market capitalization of the companies, if any.

Any increase or decrease in the NAV (Net Asset Value, or the unit price of the fund) will be in line with the rise or fall in the chosen index. In case of our example, the NIFTY 50. Now, if your index fund comprises the same stocks as the index it tracks, with the same weightage for composition, your returns would be the same, right?

Wrong!

Here comes the twist. Index funds mirror the index, but when it comes to returns, it does not reflect the performance exactly by the same percentage. There is a minor deviation in the performance of index funds against the index they track, known as the “tracking error”. This could be due to various factors such as liquidity provisions, index constituent changes, corporate actions, etc. The fund manager is tasked with the duty of bringing down the tracking error as much as possible.

Let us explore index funds with the example of the DSP NIFTY 50 index fund.

The DSP NIFTY 50 fund tracks the NIFTY 50 index. The composition of the fund is the same as the Nifty 50, that is, it consists of 50 top performers from the stocks listed on the National Stock Exchange. The weightage or the proportion of each stock within the fund is also similar to that of the underlying index.

Here is how a monthly SIP of Rs 1000 in the DSP NIFTY 50 Index Fund invested at the inception of the fund has performed:

Disclaimer1

As you can see from the chart, your investment in the DSP Nifty 50 Index Fund as a pocket-friendly monthly SIP of Rs 1000 at the inception of the fund on 22 February, 2019, would have earned you returns of 26.6% as of 30 June, 2021. Note that SIP returns are calculated using XIRR. In absolute terms, the Rs 29,000 you would’ve invested till 30 June would’ve grown to Rs 39,327. The returns from the index fund are in line with the returns of the Nifty 50 index.

What is the investment objective of Index Funds?

Unlike actively managed funds that constantly strive to outperform the underlying index, the objective of index funds is simply to meet the performance of the index.

In some ways, you are actually winning by accepting defeat - According to the latest SPIVA® report, over the past ten years to 31st December 2020, 68.42% of actively managed large-cap funds underperformed the benchmark index they tracked - the S&P BSE 100. Actively managed mid-and small-cap funds underperformed the S&P BSE 400 MidSmallCap Index by 35.71% in the same time frame. The underperformance of the category funds is wider in the 5-year term to 31st December, 2020, at 87.95% and 54.35%, respectively.

| Fund Category | Index | 1 year (%) | 3 year (%) | 5 year (%) | 10 year (%) |

| Indian Equity Large-Cap | S&P BSE 100 | 80.65 | 88.14 | 87.95 | 68.42 |

| Indian ELSS | S&P BSE 200 | 65.12 | 90.91 | 85.71 | 51.43 |

| Indian Equity Mid-/Small-Cap | S&P BSE 400 MidSmallCap Index | 66.67 | 34.88 | 54.35 | 35.71 |

| Indian Government Bond | S&P BSE India Government Bond Index | 50 | 74.36 | 76.74 | 86 |

| Indian Composite Bond | S&P BSE India Bond Index | 90.67 | 96.53 | 97.22 | 96.15 |

Isn’t meeting market gains a surer bet than trying to beat the market? That is what index funds are designed to do.

However, the human mind rarely settles for ‘enough’ - if actively managed funds have the potential to yield higher-than-benchmark returns, then why settle for benchmark returns?

That said, one cannot away the potential of index funds to grow your wealth over time. While actively managed funds have a higher degree of risk involved, index funds provide a sense of assurance that indices generally do well over longer durations and therefore your money may also be growing alongside.

To know the risk-reward of making passive investments, such as in Index funds, and how it differs from active investments, watch our video:

How do I pick which index fund to invest in?

Logically speaking, two funds tracking the same index should offer the same returns. And they do. So how does one differentiate, and how does one choose which fund to invest in? This is facilitated by what is called the expense ratio.

As the name suggests, it is an expense, and it goes without saying that the lower the expense ratio, relatively larger the yield is on the investment.

Let us take a quick look at Expense Ratio.

What is Expense Ratio?

It is the annual fund operating expenses of a scheme, including administration, management, communication-related expenses etc. which is mentioned upfront in the offer document. Expense ratio is expressed as a percentage of the fund’s daily net assets.

Typically, the expense ratio of index funds is lower than actively managed funds because the engagement of the fund manager is mostly limited to picking the composition of the fund as per the benchmark index, and of course, minimizing the tracking error as we already discussed. Index funds are passively-managed funds.

This means, as an investor, you may be getting a larger portion of your returns back in your kitty as the cutback towards expense ratio is lower.

Types of Index Funds

There are many types of index funds in matured markets such as the US. Most popular ones in India are:

| Type of Index Fund | Index mirrored | Opportunity | Example |

| Broad Market Index Funds | Nifty, Sensex | Captures entire market | DSP NIFTY 50, Sensex 30 |

| International Index Funds | Foreign indices like S&P 500, MSCI EAFE Index | Captures potential of foreign markets; minimizes risk from such exposure | NASDAQ 100 ETF |

| Market Capitalization Index Funds | BSE SmallCap Index, Nifty MIDCAP 100, etc. | Exposure to specific growth potential based on market capitalization | |

| Bond Market Index Fund | Government Securities Index, Corporate Bond Index, etc. | Captures opportunities from bond market movements | DSP Liquid ETF3, G-Sec index funds, BHARAT Bond Index |

| Sectoral Index Funds | BSE IT, Nifty Bank, etc. | Captures the potential of the chosen sector | ETF Nifty Bank Funds, ETF Gold Funds |

| Factor-based/Smart Beta Index Funds | Smart Beta Index | Captures specific characteristics of the market such as momentum, quality, low risk, etc. | Nifty 50 Value 20 index fund (NV20), Nifty 100 Quality 30, DSP Quant Fund4, DSP Equal Nifty 50 Fund5 |

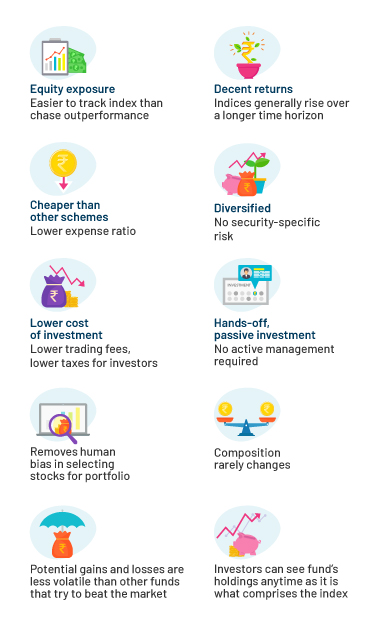

What are the benefits of investing in Index Funds?

Equity exposure: In case of equity index funds.

Diversified: Given an index fund is composed of a range of securities (across m.cap or sectors, as per the benchmark index), there is enough diversification to buffer your portfolio from serious losses.

Removes human bias: Unlike in actively managed funds, the fund manager does not select or assign weightage to the securities in an index fund. The composition of an index fund is exactly the same as the market index it tracks.

Who should invest in Index Funds?

Investment decisions solely depend upon risk profiles and investment goals. Overall, index funds are a perfect option for:

- Investors with low-risk appetite seeking equity exposure.

- Investors with a long-term investment horizon.

- Someone who wants to invest in equities but does not want to track performance.

Index funds are very hands-off, meaning you can sit back and relax unlike with other kinds of equity investments that require you to be on-the-toes, constantly monitoring performance to try to outperform the index. You already know that the index fund would offer returns linked to the performance of the particular index it tracks.

Who should not invest in Index Funds?

Avoid locking your money in index funds if:

- You are an investor seeking outperformance vis-a-vis the index

- If you have a short-term view and require funds in the short-term.

- If your risk profile indicates that an aggressive approach to investing is more suited to you.

To find out more about risk profiling and to assess where you stand on the risk-o-meter, check out this article.

Things to note before investing in Index Funds

1. Decide where to buy

Index funds are easiest to buy directly from Mutual Fund houses, such as DSP Mutual Fund. Investors may also subscribe to the units from brokerages or mutual fund distributors/agents.

2. Pick an Index

Figure out which index captures your attention and suits your portfolio requirement. There are various types of indices to choose from, such as MCap indices, foreign exposure, sectoral indices, indices that capture market opportunities like emerging markets index, commodities focused-indices, etc. Read about the idea behind the index’s construction and how it can add diversification value to your core portfolio while reducing your overall portfolio cost.

3. Assess risk capacity - of the index (fund) as of self

Each index comes with it’s own set of risks. Apart from the fact that index funds limit your equity exposure to the components of a particular index only, thereby denying you other opportunities, they are also fraught with risks such as lack of downside protection. Suppose you have invested in a sectoral index fund and that sector is gripped by the bears…. It is therefore advisable to follow a core-satellite approach and have a mix of index and actively managed funds in your portfolio.

4. Minimum error, maximum gains

To maximize the returns from your investment in index funds, shortlist funds with minimum tracking error. This information is often furnished as a percentage in the fund listing webpage or the offer document. However, tracking error should only be examined over a longer fund history as it tends to smoothen out over time.

5. Fund size does not matter

While selecting a passive equity fund such as an index fund for the long-term, it might be useful to review the qualitative aspects and not worry about the fund’s size. As long as your chosen underlying market is large, liquid and transparent, your scheme, irrespective of the quantum of assets under management, will perform in line with the benchmark index.

6. Check costs involved

Before signing on the dotted lines to subscribe to the fund, ensure to check the cost of investment. The cost of investment is an expense that is reduced from your actual investment amount, thereby affecting your returns. Find out the minimum investment, the taxes involved, and the expense ratio of the index fund you choose to invest in.

7. Investment Horizon

Because index funds mirror a market index, you know it is going to be an uphill journey, but they will take their time to wriggle through bouts of market volatility. It is, therefore, preferable to have a long-term investment horizon for index fund investments. Historical data says it may take 6-7 years for an index to return 10-12% on an annualized basis.

8. Take note of taxes

When you sell or redeem units of index funds, the profit you make is called capital gains. Depending on your holding period, that is, the duration for which you were invested in the fund, your gains are subject to tax.

Capital gains made during holding periods of upto one year, called short-term capital gains, are taxed at a rate of 15%.

When your holding period is more than one year, the profit you make is called long-term capital gains. If this amount is more than Rs 1 lakh in one financial year, you will be subject to LTCG tax on the profit at a rate of 10% without the benefit of indexation.

| Holding Period | Short Term Capital Gains Tax | Long Term Capital Gains Tax |

| Less than or equal to 1 year | 15% | NA |

| More than 1 year | NA | <Rs 1 Lakh = NIL > Rs 1 Lakh = 10% |

To more about how taxes affect your mutual fund returns and how different types of mutual funds are taxed, read our article on taxation of mutual funds.

Conclusion

Index funds are the easiest way to get exposure to the entire market through a single product and generate wealth over the long term. These funds aim to generate the broad market by mirroring particular indices, and therefore, the risk-return is similar to the market.

Index funds are passively managed and generally experience lesser volatility than their actively -managed counterparts or diversified funds that typically adopt an aggressive investing style.

Note that while the markets may fluctuate in the short term, or even in the medium term, past record shows that over the long term, the trend of the Sensex and Nifty may most possibly be upward. Hence, any time is a good time to invest in index funds, as long as you have the patience and resilience to remain invested over a long time!

Index funds may be the arc that can carry you safely across the choppy waters of the market. Speak with your financial advisor to assess the suitability of these funds to your investment portfolio.

Amended as on Apr 1, 2023: Please note that as per amendments in Finance Bill 2023, from April 1, 2023, profits made on investments in debt mutual funds are now taxed as short-term capital gains if these funds invest <=35% in equities. This means, debt mutual funds are now taxed as per the income tax rates as per an individual’s income.

Also note that with effect from Apr 1, 2020, Dividend Distribution Tax (DDT) was abolished, and mutual fund dividends were made taxable in the hands of investors. Dividend income is now considered as ‘income from other sources’ and investors need to pay tax on it as per their individual tax slabs.

This video was originally created at a time when tax rules were different. Please treat this note as the latest updated tax information.

Disclaimer

This note is for information purposes only. In this material DSP Asset Managers Pvt Ltd (the AMC) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author or the AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. Any sector(s)/ stock(s)/ issuer(s) mentioned do not constitute any recommendation and the AMC may or may not have any future position in these. All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them.

[1] Source: Internal, Plan/Option: Direct plan growth option. Data since inception as of June 30, 2021

For product labelling/ more information on DSP Nifty 50 Index Fund, click here.

[2] For product labelling/ more information on DSP NIFTY Next 50 Index Fund, click here.

[3] For product labelling/ more information on DSP Liquid ETF, click here.

[4] For product labelling/ more information on DSP Quant Fund, click here.

[5] For product labelling/ more information on DSP Equal Nifty 50 Fund, click here.

Past performance may or may not sustain in future and should not be used as a basis for comparison with other investments.

In case you make any investment decision after reading this post, please consult with your trusted MFD/RIA first. Request you to please select MFD/RIA code while conducting your transaction.

Leave a comment