What's Netra telling us: May 2023

The May edition of Netra is here, offering us some insights into global economic and financial trends and how India is positioned. Read on to know more about what to expect in the coming months!

The American rollercoaster: Uncertainty and market volatility on the anvil

The mature US economy has been a driving force for global markets, and any signs of market volatility in the country has a ripple effect on financial markets worldwide. We now sit on the edge of a precipice. The stimuli is two-pronged.

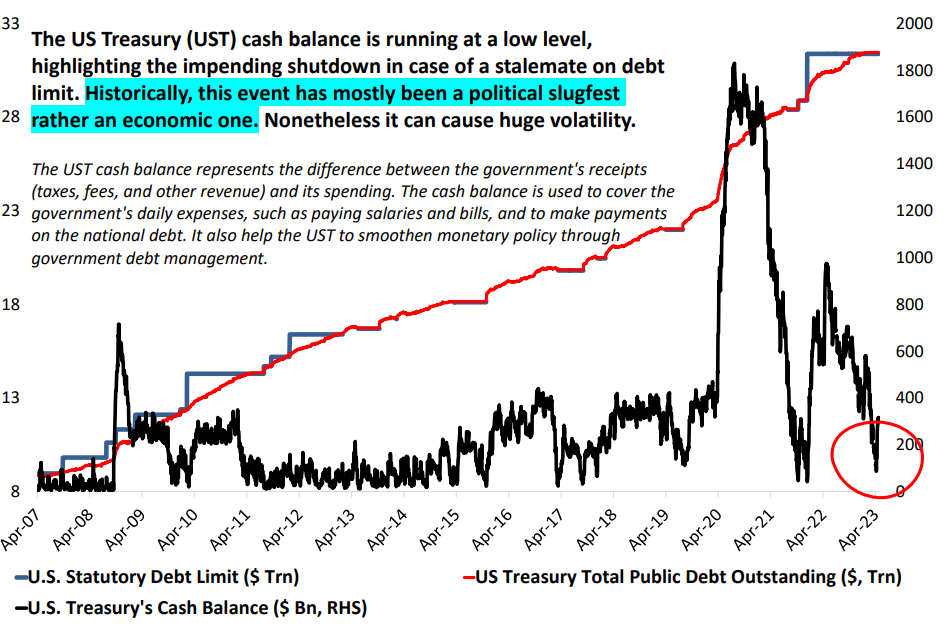

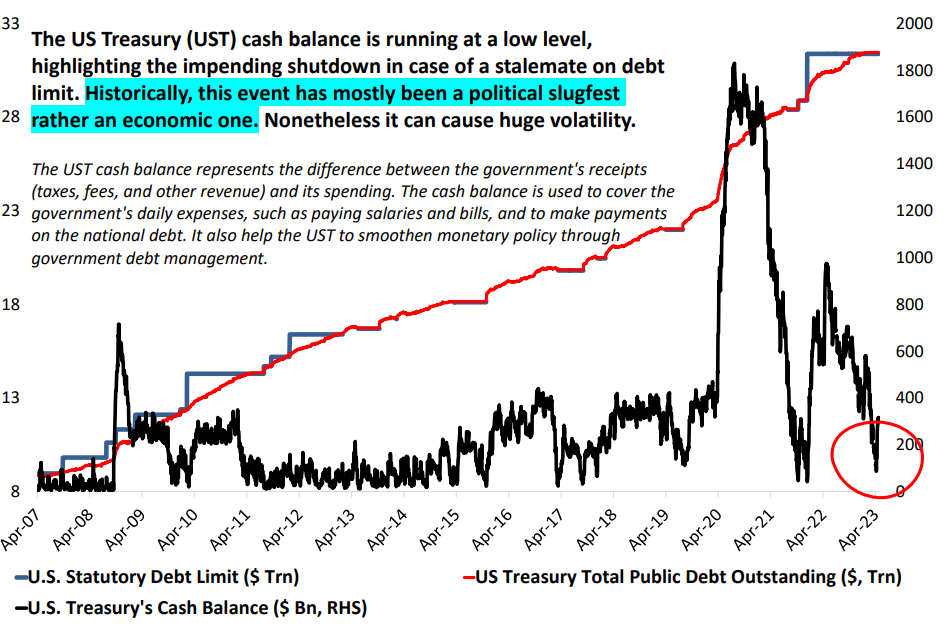

US debt ceiling is about to be breached

The US Debt Ceiling refers to a legal limit on the amount of money the US government can borrow to finance its operations and meet its obligations. This limit may be breached by June or August 2023, as per the estimates from the treasury department and the Congressional Budget Office.

Before you panic, here's a trivia: The US debt ceiling is set by the Congress, and has been raised or suspended over 100 times since its introduction in 1917!

So what happens? Basically, when the debt limit is reached, the Treasury Department is tasked with taking measures to avoid a default - either reducing spending or shutting down the government.

Past data shows the Treasury's forewarnings about debt ceiling breaches are often politically inclined (with ensuing mudsling!). The Fed then swings into action at the last moment with rate changes.

However, it does not take away the fact that apart from the political slugfest, the possibility of no resolution and the potential consequences of such a failure can lead to significant market fluctuations in the coming month.

Source: DSP, Bloomberg Data, Data as of April 2023.

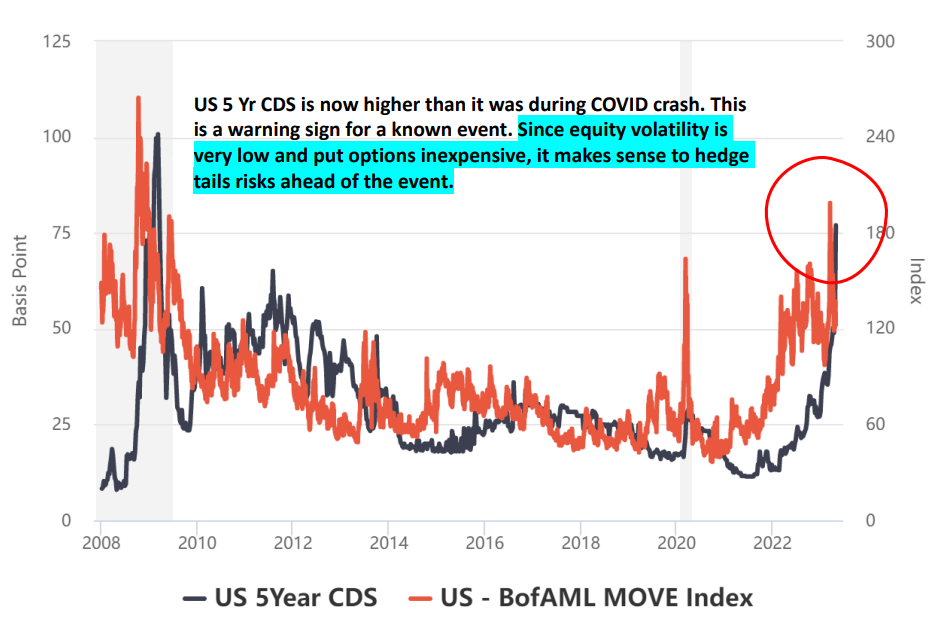

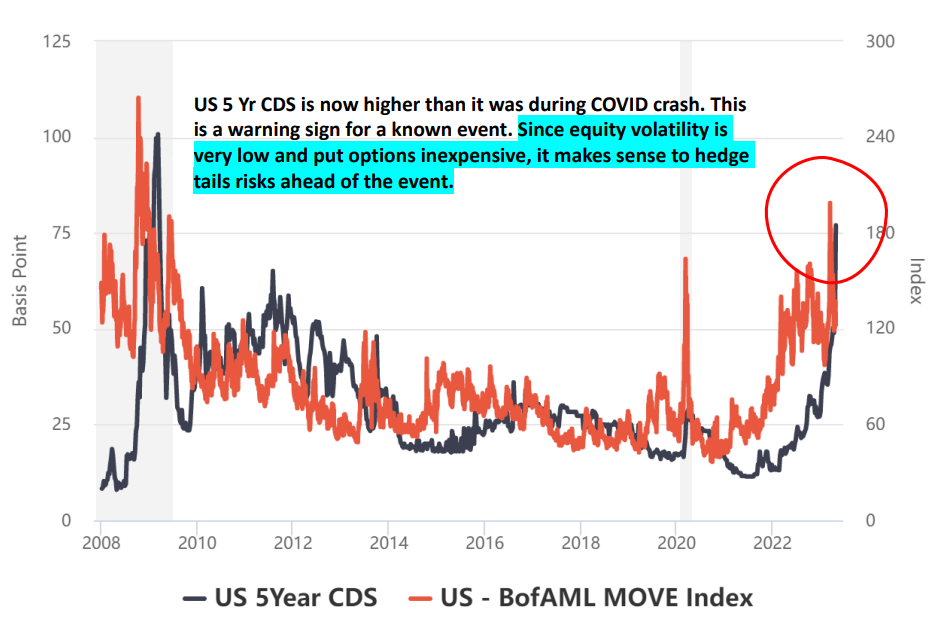

The rising CDS prices

Economic uncertainty like these often send investors into a tizzy over the risk of the government defaulting (despite knowing at the back of our minds that there is no way the strongest economy in the world can default. However, that’s how greed and fear work the markets, isn’t it?). The Treasury Department offers a financial instrument called the US Credit Default Swap (CDS) which gives its investors a pay-in and protects them against the risk of default. Naturally, rising prices of CDS indicate that more people are expecting a default to happen.

Now, the 5-year US CDS prices have reached levels not seen in 15 years!

As seen from the chart below, the volatility indicator of the bond market, called the MOVE index, is also higher than it was during the covid-led crash. That indicates investors being wary of the uncertainty. Reading it together with the CDS data, it seems investors are buffering their portfolios with bonds, bracing for volatility in equity ahead. If the Congress doesn't agree on a debt limit soon, more volatility may be expected.

Source: Macromicro.me, DSP, Data as on April 2023

Calm before the storm: India’s low VIX hinting at a raging bull in the market?

Indian economy and corporate earnings remain robust. Many large cap companies have outperformed market estimates which has kept the market sentiment upbeat. It has indeed been a smooth run for the Indian stock market over the past few weeks in this earnings season.

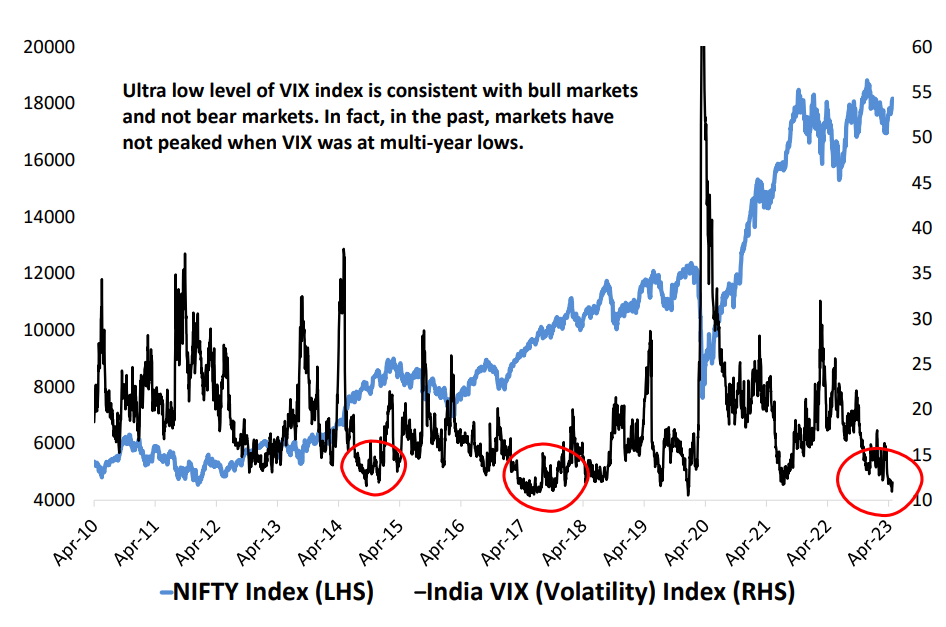

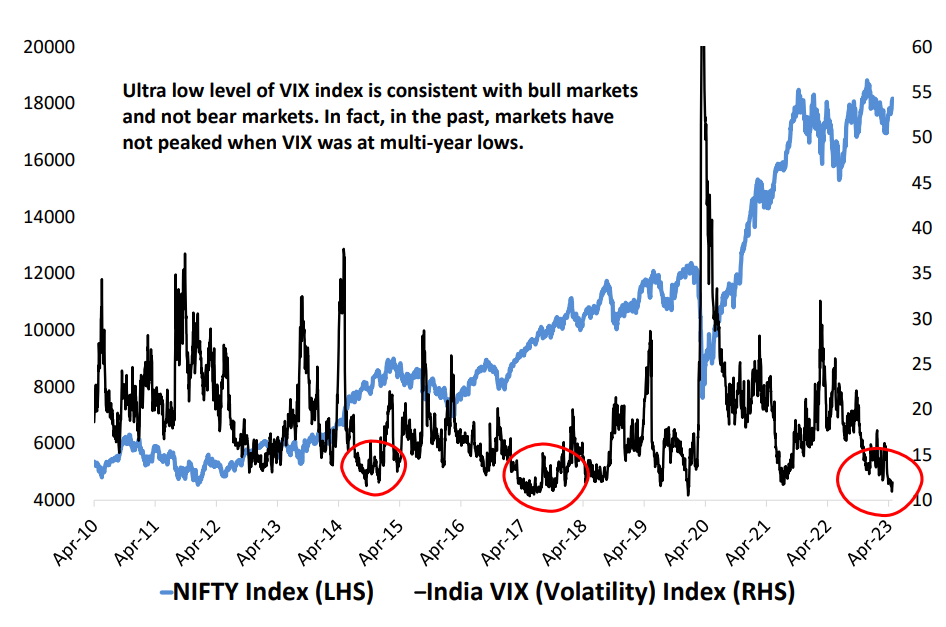

While many believe that the market has become quite complacent, data points otherwise. Firstly, the India Volatility Index (VIX) has recorded the lowest readings recently, as seen from the chart below. Such ultra-low VIX is generally a good indicator of an ensuing bull market. Before you rush off to buy all the stocks you can, you may want to read into the second point. Secondly, the market is primed for volatility ahead. What’s happening in the US financial systems will have its impact on the Indian markets.

Note that the option premium is at a multi-year low. Therefore, put options may be explored as a hedge.

So what should you be doing? It may just be prudent to keep your investments in stocks stable but also protect yourself with affordable measures against the upcoming turbulence.

Source: DSP, Bloomberg, Data as on April 2023

Golden glow in the horizon

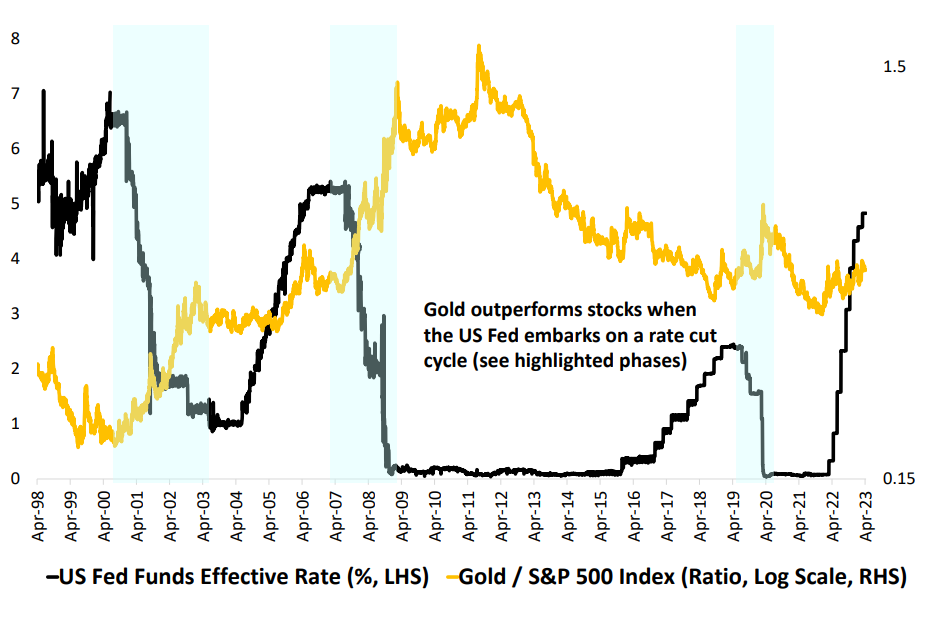

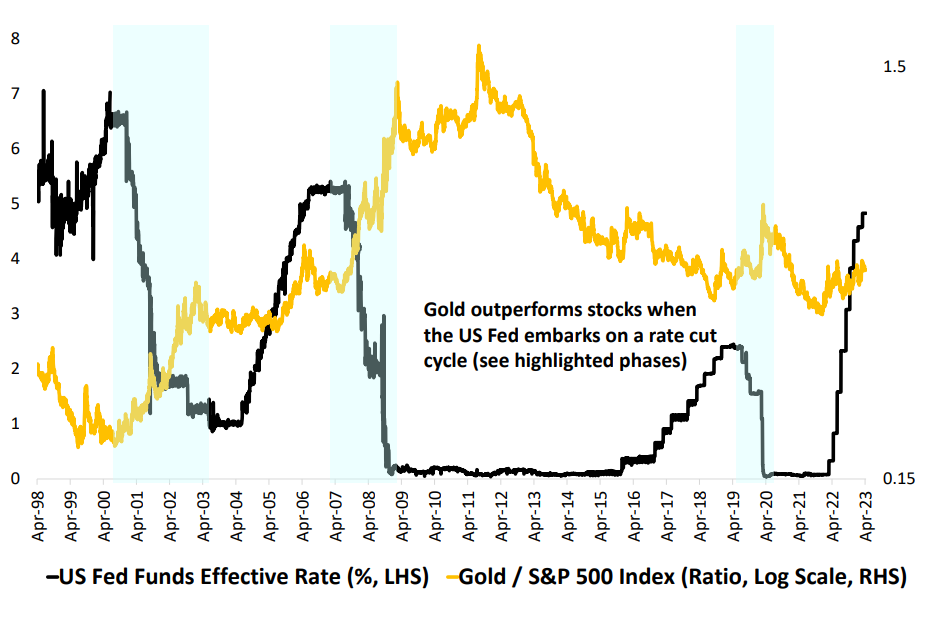

Connecting the dots, should the US Federal Reserve lower interest rates, investors will tend to flock to Gold. This is because lower interest rates reduce the opportunity cost of holding non-yielding assets such as Gold. Also, gold is a great hedge against market volatility and a safe haven during economic uncertainty. And with that, the price of the precious metal will tend to rise.

It is highly likely that gold breaks towards a new lifetime high.

That could then mean we're in a new bull market for gold, and prices could go up towards $2500.

Source: DSP, Bloomberg, Data as on April 2023

India unfazed: Maintaining stability amidst global economic turbulence

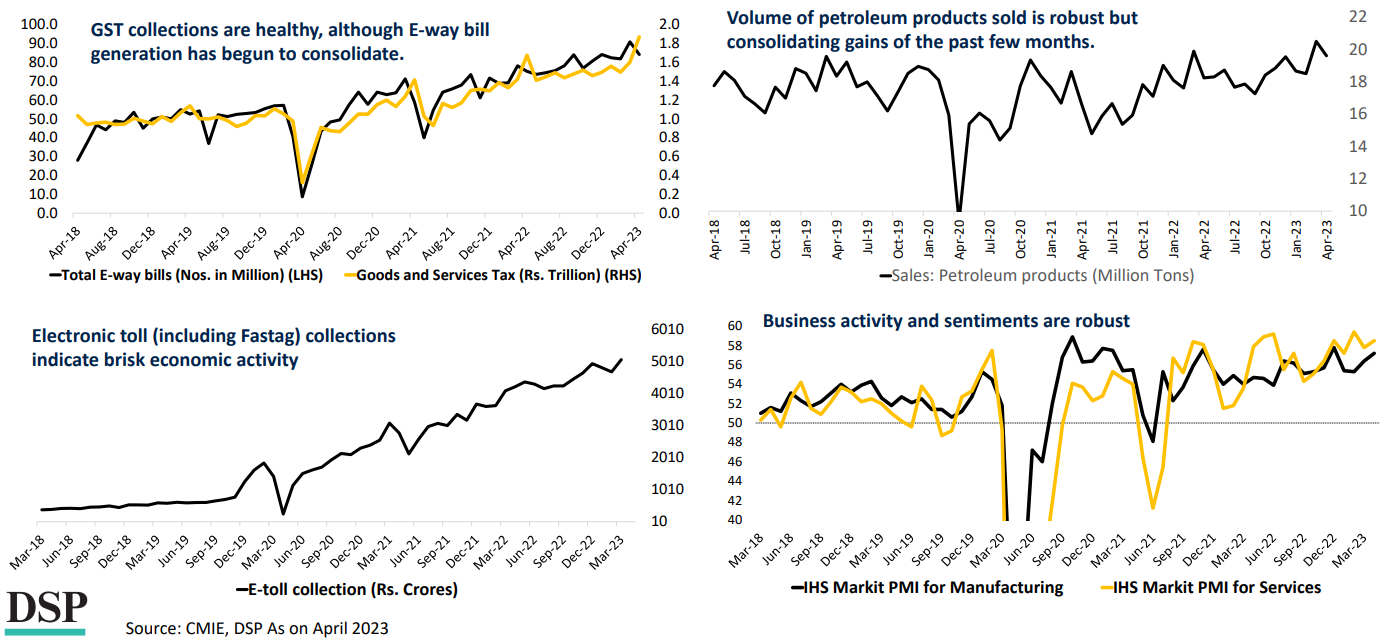

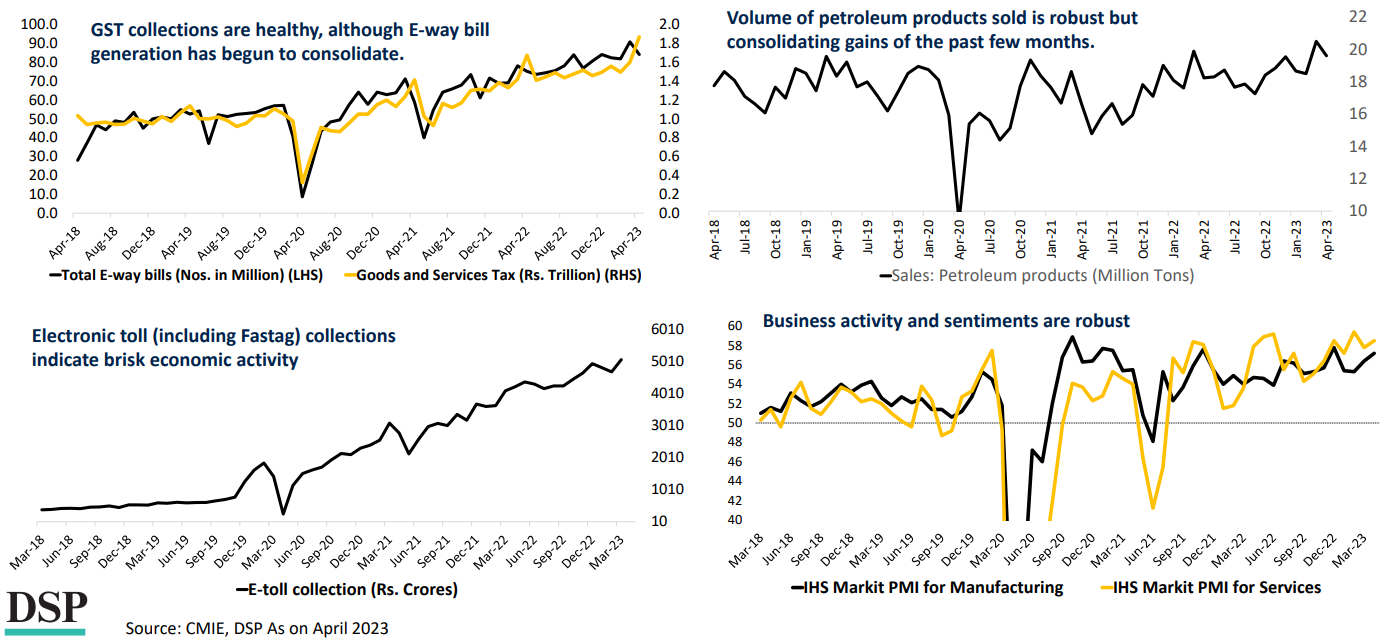

While the global data seems grim and the market conditions shaky, Indian economic conditions seem reasonably stable. Some indicators include healthy GST collections, robust sale volume of petroleum products, promising electronic toll collections, and robust business activity and sentiments.

Despite interest rate hikes to multi-year highs, most countries are still grappling with inflation, striving to bring it within the target bands. Not India. India stands out with softening inflation. The downward trajectory of inflation is evident from the inflation nowcast models and the RBI’s pause of the rate hike cycle.

India's current monetary policy is well-suited to support a growth recovery, and the tapering of current account worries would help India's external position as well. This is a ray of hope for Indian investors as it points to the possibility of better investment outcomes in the Indian markets.

Source: DSP, Bloomberg; Data as of April 2023

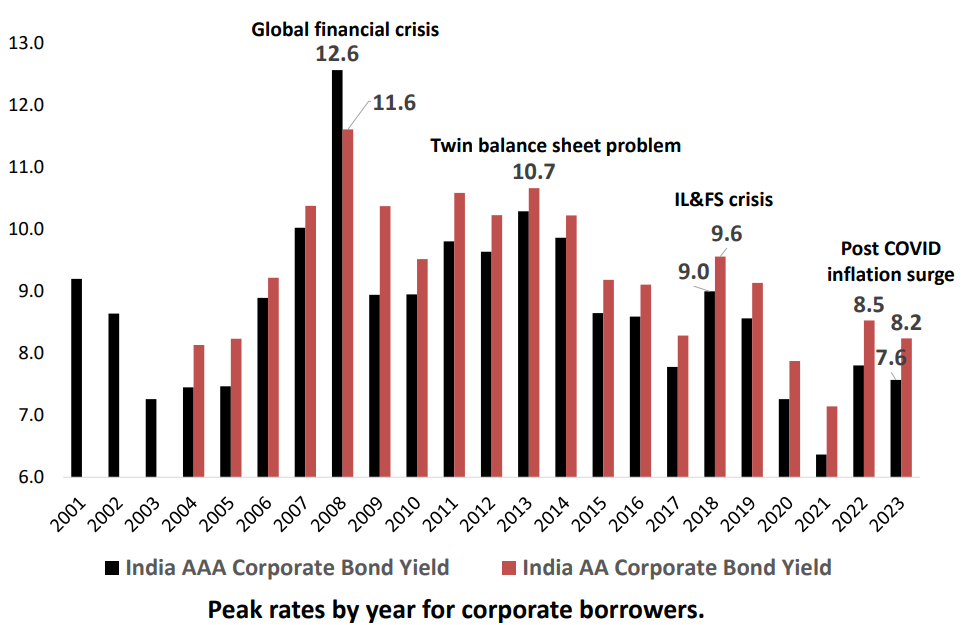

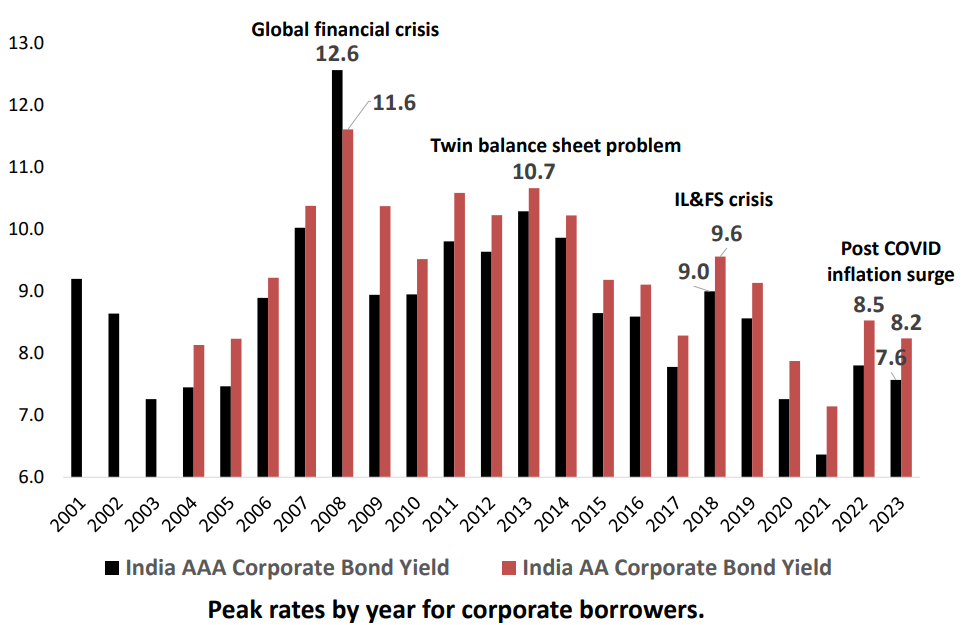

What you see in the chart above is that Indian corporate borrowers have actually enjoyed lower peak rates at the peak of rate hike cycles in India. This is proof that Indian monetary policy condition is ‘least tight’ during episodes of crisis and inflation upsurges, and we have relatively better monetary policy management than most other countries.

A 100 bps lowering in borrowing costs helps GDP growth by 80 bps over a 5-year period.

Bottom line

The looming uncertainty caused by the US debt ceiling and the rising US CDS prices could lead to significant market fluctuations in the coming months. However, amidst global turbulence, India seems to be maintaining stability, with signs of softening inflation and a well-suited monetary policy to support growth recovery. The India volatility index remains low and the possibility of a new bull market for gold also offers some positive investment outcomes. Staying updated with these trends and protecting oneself against upcoming turbulence is essential.

While the Indian markets look stable, it is wise to exercise caution and make informed investment decisions, not emotional ones. A systematic investment plan can protect you from impulsive and emotional investment decisions.

Check your emotional temperature every time or adopt a systematic approach to investing? The choice is yours.

— DSP Mutual Fund (@dspmf) May 5, 2023

Download #DSPNetra: https://t.co/goGdXr9tWB pic.twitter.com/pK75aRT65O

Download the report: dspim.co/NetMay23

Disclaimer

In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house. Information gathered and used in this material is believed to be from reliable sources. The AMC however does not warrant the accuracy, reasonableness and / or completeness of any information. The above data/ statistics are given only for illustration purpose. The recipient(s) before acting on any information herein should make his/ their own investigation and seek appropriate professional advice. This is a generic update; it shall not constitute any offer to sell or solicitation of an offer to buy units of any of the Schemes of the DSP Mutual Fund. The data/ statistics are given to explain general market trends in the securities market and should not be construed as any research report/ recommendation. We have included statements/ opinions/ recommendations in this document which contain words or phrases such as “will”, “expect”, “should”, “believe” and similar expressions or variations of such expressions that are “forward looking statements”. Actual results may differ materially from those suggested by the forward looking statements due to risks or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on our services and/ or investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices etc.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Leave a comment