What’s Netra telling us: April 2023

We’re back with the April 2023 instalment of the Netra- our monthly report highlighting the country's latest economic and financial trends.

In this Netra edition, we focus on the road to growth (literally), what’s fueling our economy, the banking sector and the crisis it is going through, and the healthcare sector and its prospects. Let’s dive right in!

Roads: A Highway to Robust Economic Growth

It’s not the destination; it is the journey that matters.

A strong road and transport network play a direct role in boosting development and economic activity in the country. By linking remote villages to towns, towns to cities, and cities with each other, India has created innumerable opportunities for traders, households and businesses to thrive.

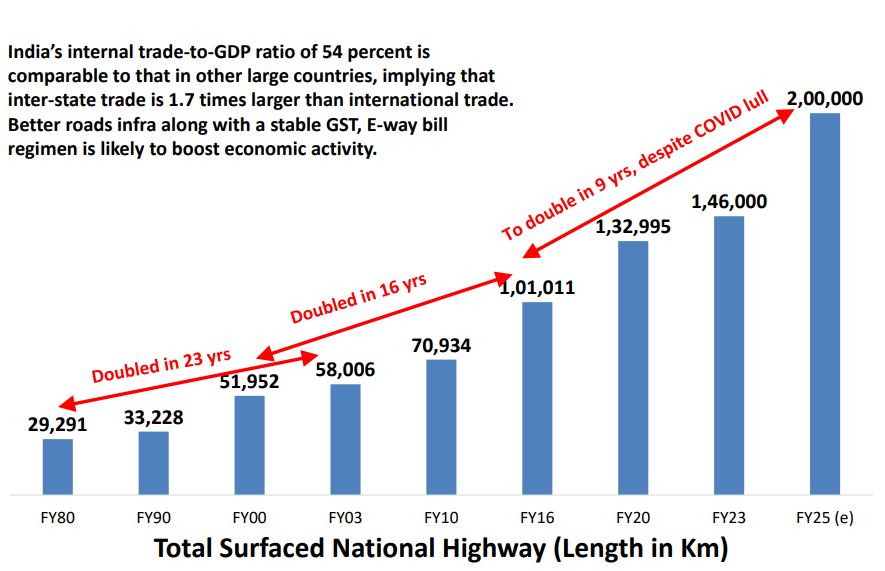

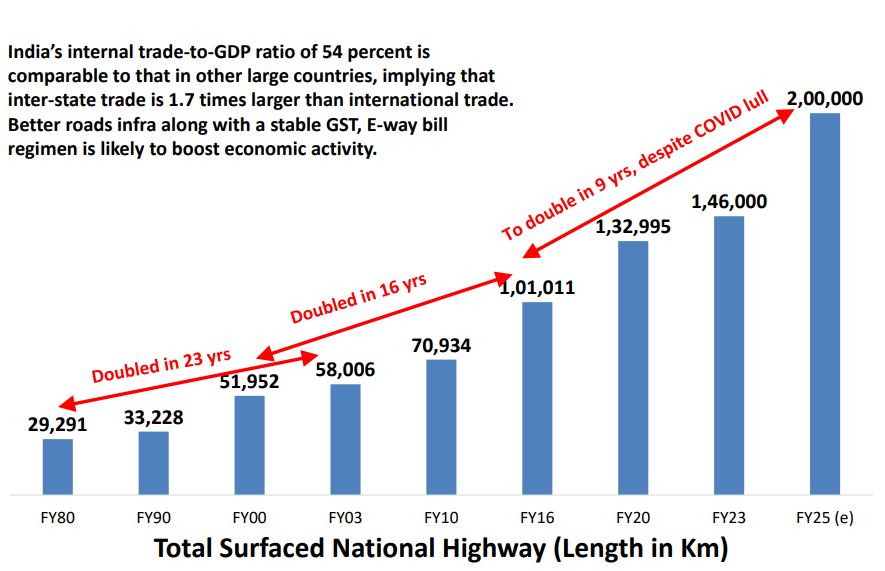

From just 29,291 km in 1980, India doubled its road network to 58,003 km in 2003. We then doubled this infrastructure again to 1.01 lakh km by 2016. Presently, India might be on her way to double this again to 2 lakh km by FY25 - this is despite the Covid-19-induced slowdown!

India’s internal trade-to-GDP ratio is 54%, comparable with other large countries. The figure can also be interpreted as the inter-state trade in India being much larger (nearly 1.7 times) than its international trade. This is the dream, however, further boosting road infrastructure can definitely help skyrocket this metric, giving the Indian economy the edge with self-sufficiency that it desires, apart from a seat at the table with other developed countries in the world.

Source: DSP, CMIE, Govt Docs; Data as on March 2023

Focusing on Sustainable Energy

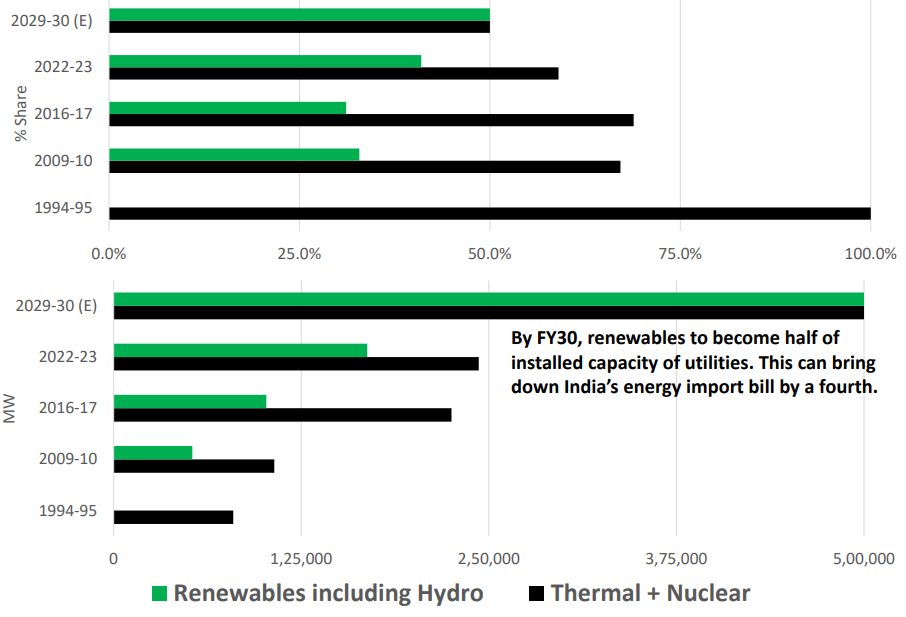

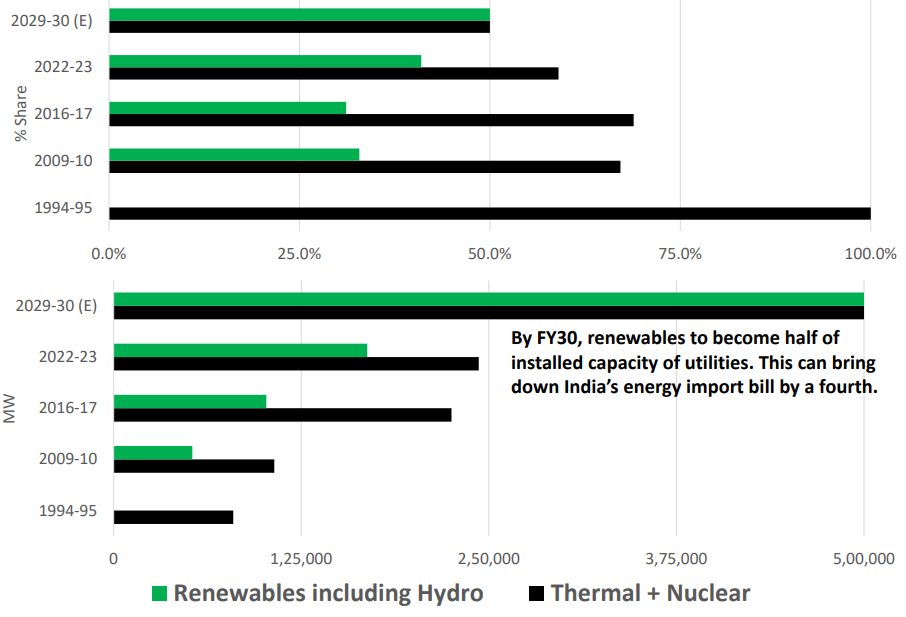

India has been heavily reliant on the import of oil and gas. This bleeds the exchequer by nearly $150 billion in gross energy imports every year, gaping open the fiscal deficit.

India’s mission for sustainable growth and net-zero commitment through the promotion of green fuel may go a long way in easing India’s energy security woes and reducing dependence on oil imports.

Between FY10 and FY17, India’s thermal energy capacity (from fossil fuels) grew by 11% CAGR while the installed renewable capacity grew at 10% CAGR. This might have been worrisome, had it not been for the promising future. Over the last 6 years, the renewable energy capacity has grown at a 9% CAGR, while thermal energy capacity grew at just 1% CAGR.

This indicates positive momentum - clean and green energy alternatives are being widely adopted. Although this move is just the beginning, it opens up numerous avenues for investment in transmission and distribution.

Source: DSP, CMIE; Data as of March 2023

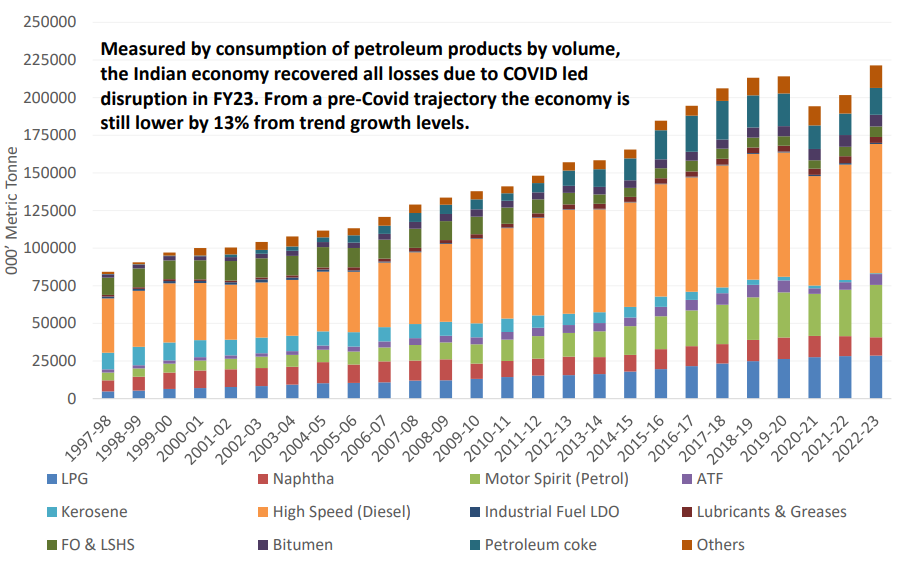

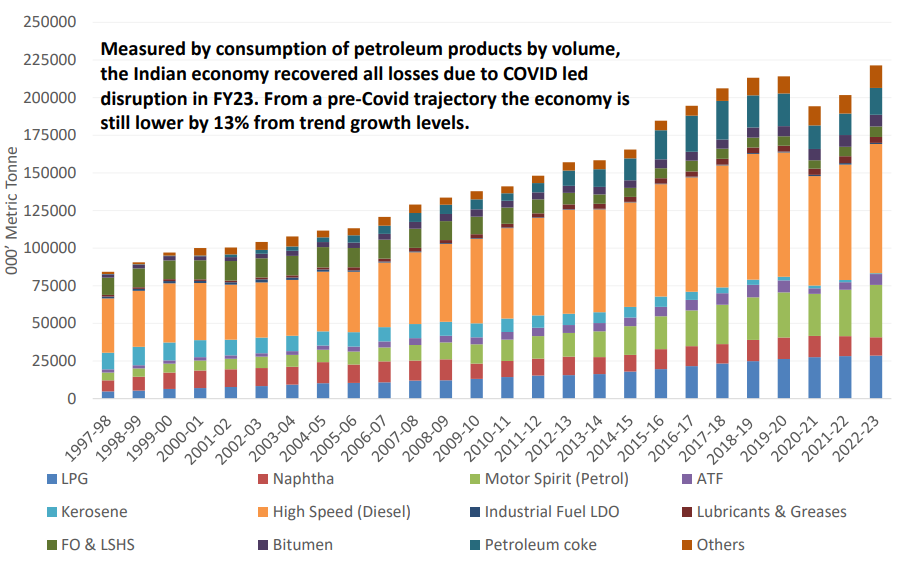

Energy Consumption Overview: Economy Has Recouped Covid-19 Losses

Assessing the quantum of energy consumption is a window to seeing how well the economy is doing. It has taken us 3 years to recoup the Covid-led losses.

However, economic growth measured by the quantity of petroleum products consumed (with pre-covid growth trajectory as the base) is still lower by 13% against the trend growth, if Covid had not happened.

This implies two facts:

- The Indian economy is still in an early growth phase and is not tipping over anytime soon.

- Energy consumption will likely increase over the next few quarters

Source: DSP, CMIE; Data as on March 2023

While these spell happy times ahead, global headwinds have been blowing strong. With large banks running aground, is there a contagion in the near future?

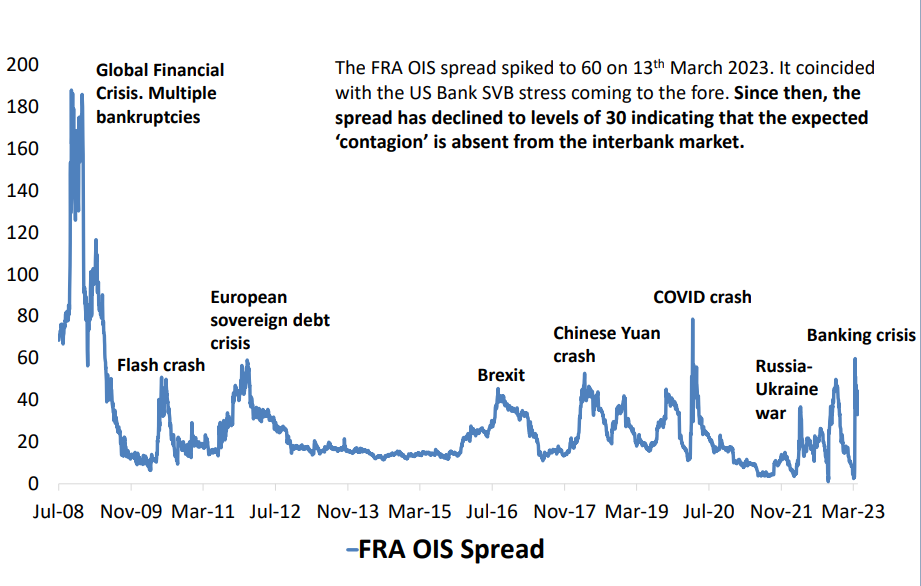

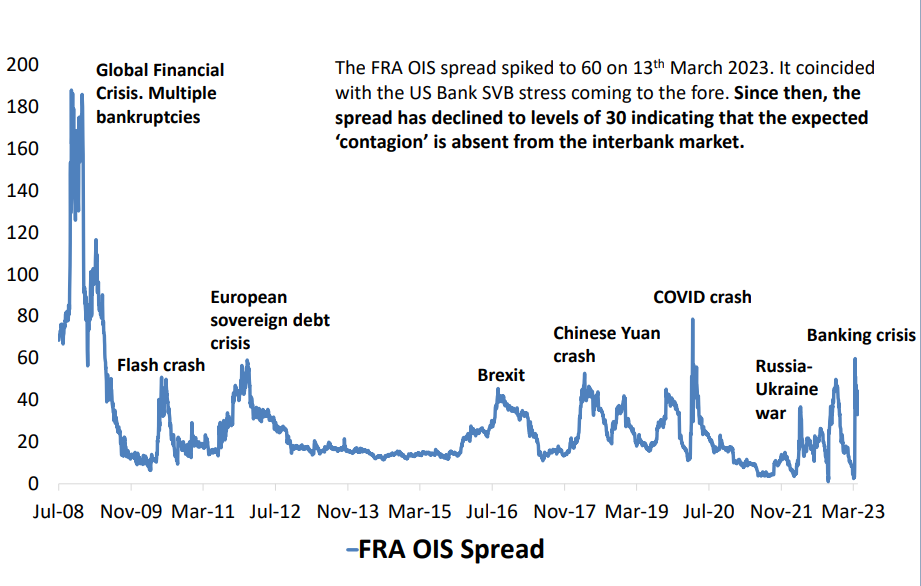

Measures of Risk: Interbank Market doesn’t Indicate a Contagion, for now

A FRA-OIS spread is a proxy for banking sector risk. The FRA-OIS spread helps measure the gap between U.S. three-month forward rate and the OIS rate.

The FRA-OIS spread has seen a spike whenever there has been a crisis in the banking sector- from the 2008 crisis to the European sovereign debt crisis, from the Covid crash to the Russia-Ukraine war breaking out.

From levels of 60 on March 13, 2023 coinciding with news about the SVB collapse, the FRA-OIS spread has now declined to 30, as seen from the chart below. This is good news.

Source: DSP, Bloomberg Data; Data as on March 2023

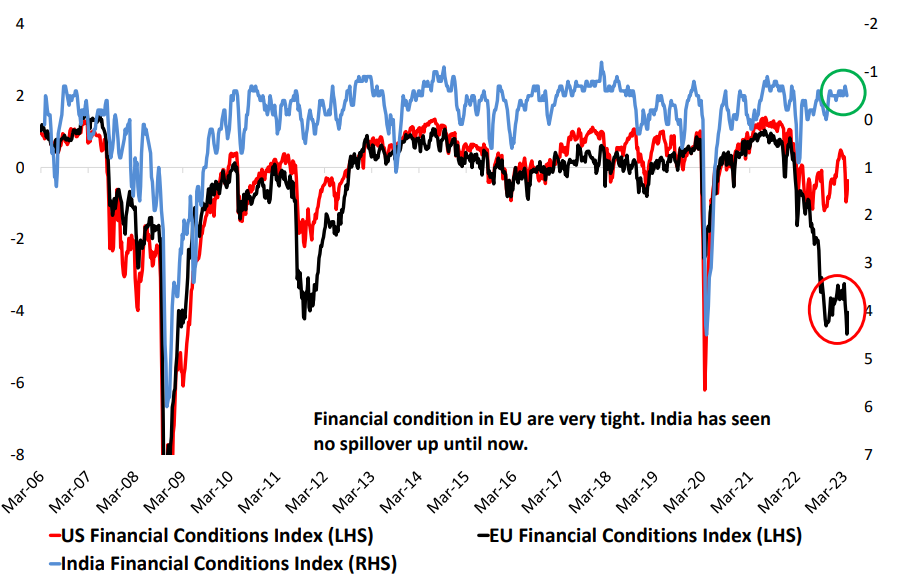

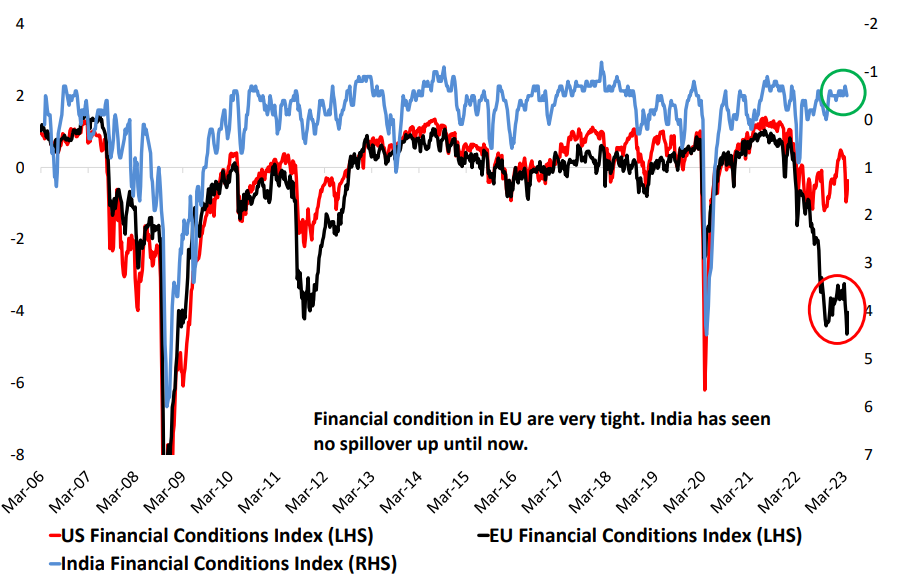

Measures of Risk: Financial Conditions aren’t in Sync like in the Past

While the financial conditions index for the U.S. and the U.K. indicate a crisis, the Indian financial conditions index looks much calmer, as can be seen from the chart below. Historically, these indices have coincided, for example, during the 2008 crisis and the Covid crash.

The India financial conditions index currently portrays resilience.

Source: DSP, Bloomberg Data; Data as on March 2023

Check out this tweet about our findings from the VMF indicator, an in-house indicator that measures the combined volatility in stocks, bonds and currency markets. You may also read about it in the Netra report.

Our in-house indicator has recovered from massive overbought conditions. In the past, such readings coincided with stock price bottoms.

— DSP Mutual Fund (@dspmf) April 5, 2023

Download #DSPNetra: https://t.co/8uptymbISR pic.twitter.com/s1aRjRnUnw

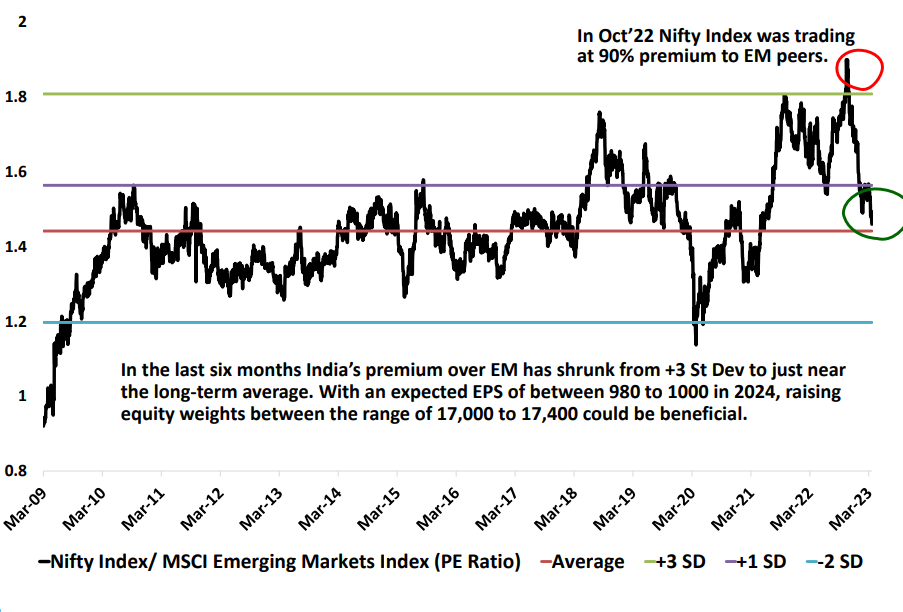

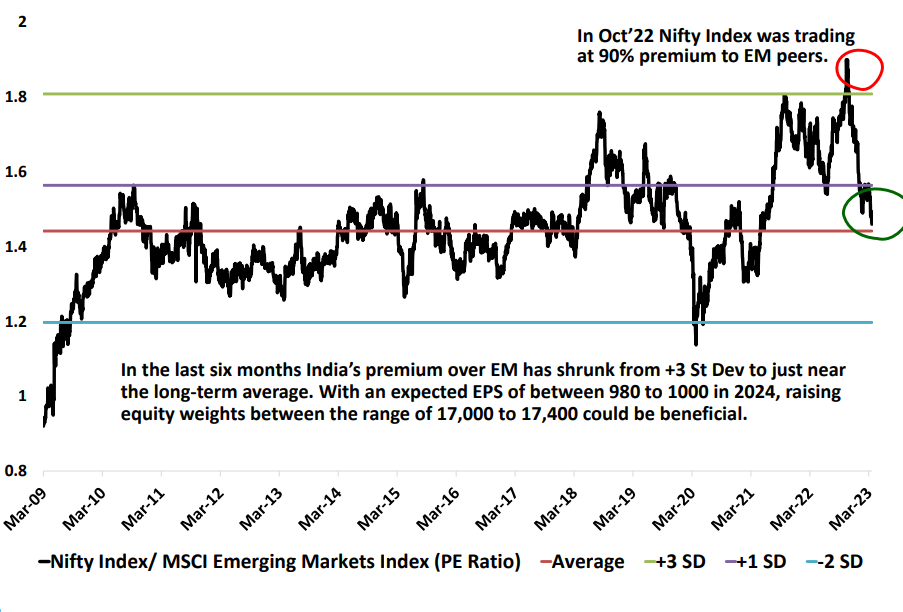

India’s Premium over EMs Washed Off

Six months ago, India traded at a 90% premium compared to its emerging market (EM) peers. The gap has now narrowed led by a ~10% correction in Indian stocks and a simultaneous rally in EM peers. Nifty is trading at its long-term average valuations against emerging markets. This may be interpreted as potential for better foreign inflows into India since headwinds from active foreign investors on account of market expensiveness is no longer valid.

Source: Bloomberg Data; as of March 2023

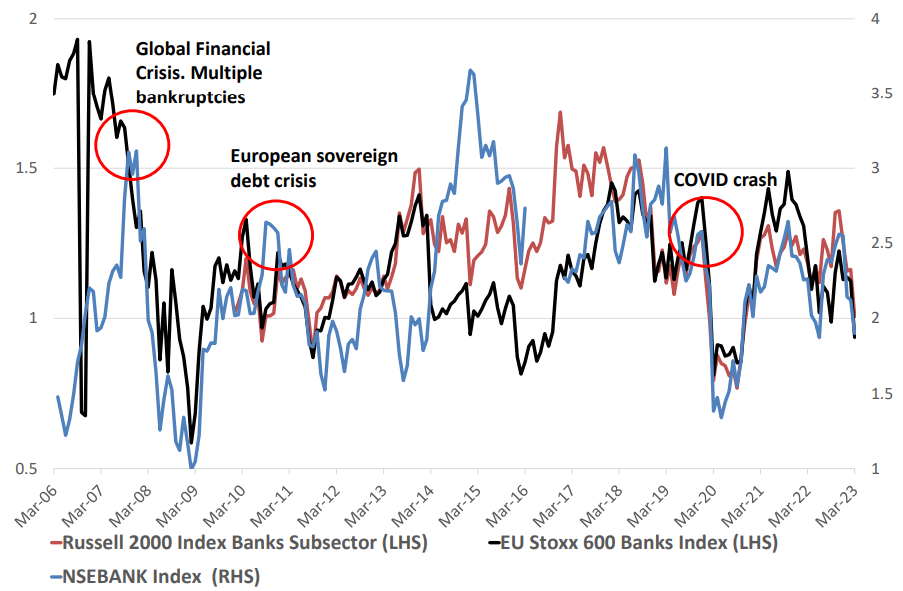

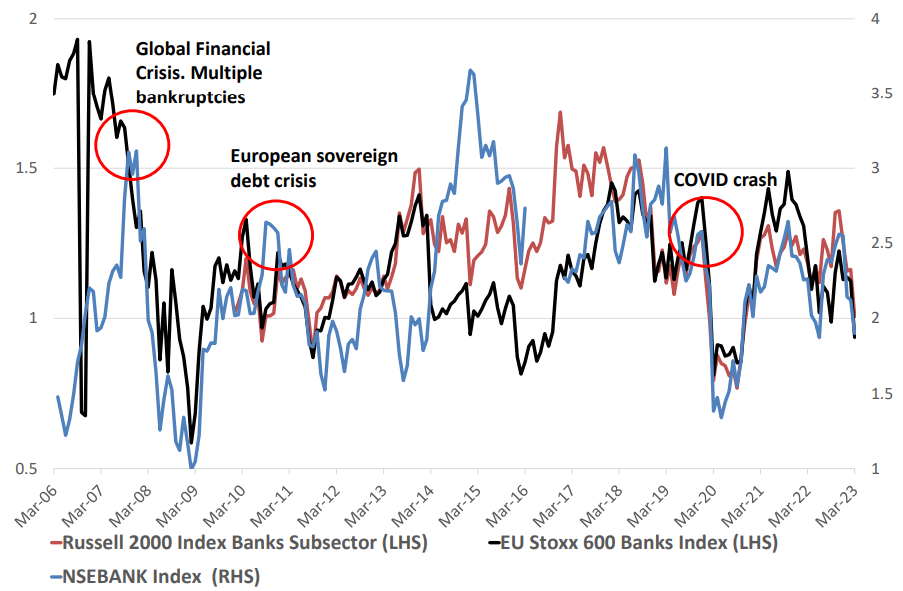

Banking Sector Valuation is Lower than Most Previous Crises

Market-wide panic generally happens when there are hefty equity valuations. Historically, troubles in the financial sector have been tailwind by higher valuations. However, most banks today have better asset quality and higher provisioning compared to previous crises. Many banks in India today are trading at valuations higher than the Covid lows, but are still lower than they have been in the past 7 years. Cross-reading this with the robust credit growth we see, and steady earnings from Indian banks, it is quite possible that banks are in for a bull run.

Source: DSP, Bloomberg; Data as on March 2023

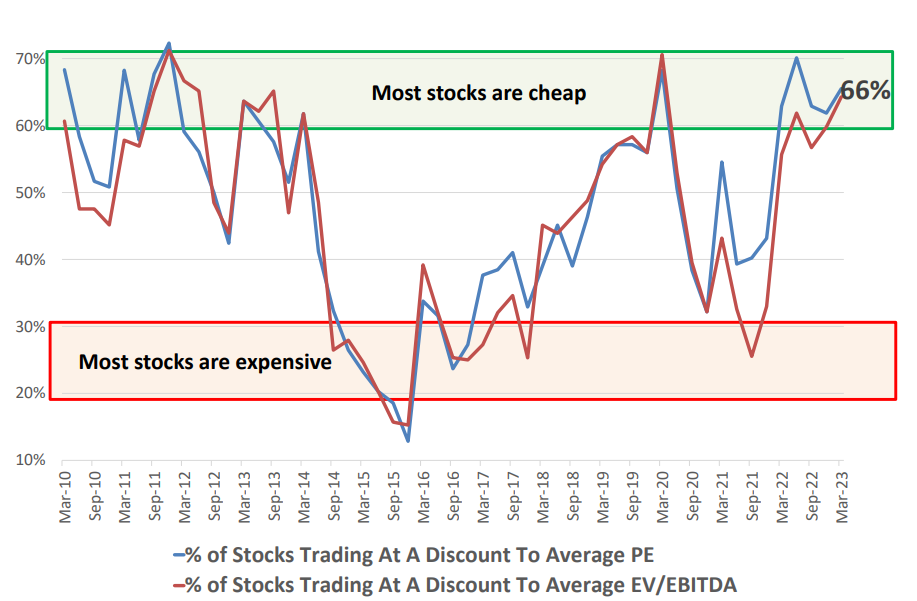

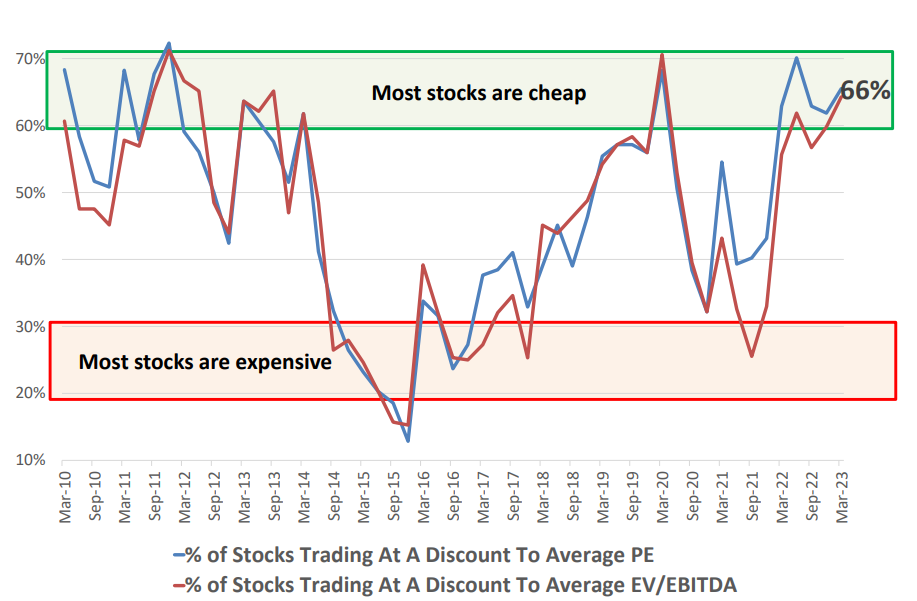

Healthcare: Margin of Safety Due to Attractive Valuations

An extensive study of more than 94 healthcare segment players have revealed that more stocks in the sector are cheaper now than their own past. A 2/3rd of the healthcare sector is trading below their 13-year P/E average while almost a similar number of stocks are trading at historically low EV/EBITDA figures. As seen from the chart below, there have been very few times when healthcare valuations have been this attractive.

Source: DSP, Bloomberg; Data as of March 2023

Bottom Line

With the Covid-induced lull wearing off and attractive valuations now seen across various sectors, the Indian economy is set to recover at full speed. Despite the uncertainties in developed markets such as the U.K. and the U.S., India's growth story is back on its strong foot. In fact, data suggests that India might be looking to step into a brand new era of slingshot growth, led by higher inter-state trade and FPI.

Disclaimer

In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house. Information gathered and used in this material is believed to be from reliable sources. The AMC however does not warrant the accuracy, reasonableness and / or completeness of any information. The above data/ statistics are given only for illustration purpose. The recipient(s) before acting on any information herein should make his/ their own investigation and seek appropriate professional advice. This is a generic update; it shall not constitute any offer to sell or solicitation of an offer to buy units of any of the Schemes of the DSP Mutual Fund. The data/ statistics are given to explain general market trends in the securities market and should not be construed as any research report/ recommendation. We have included statements/ opinions/ recommendations in this document which contain words or phrases such as “will”, “expect”, “should”, “believe” and similar expressions or variations of such expressions that are “forward looking statements”. Actual results may differ materially from those suggested by the forward looking statements due to risks or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on our services and/ or investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices etc.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Leave a comment