Why you should keep an eye on Small and Mid-cap stocks in 2023

At DSP, we produce a quarterly guide called Navigator which aims to bring together key market-related insights together for the benefit of the investors.

In the December 2022 edition of Navigator, we put forward an intriguing thesis that could represent a great opportunity for investors.

We believe 2023 could be the year of small and mid-cap stocks rather than large-cap stocks. Let’s take a deep dive into the reasoning behind this thesis.

Large cap valuations ran up over the last few months

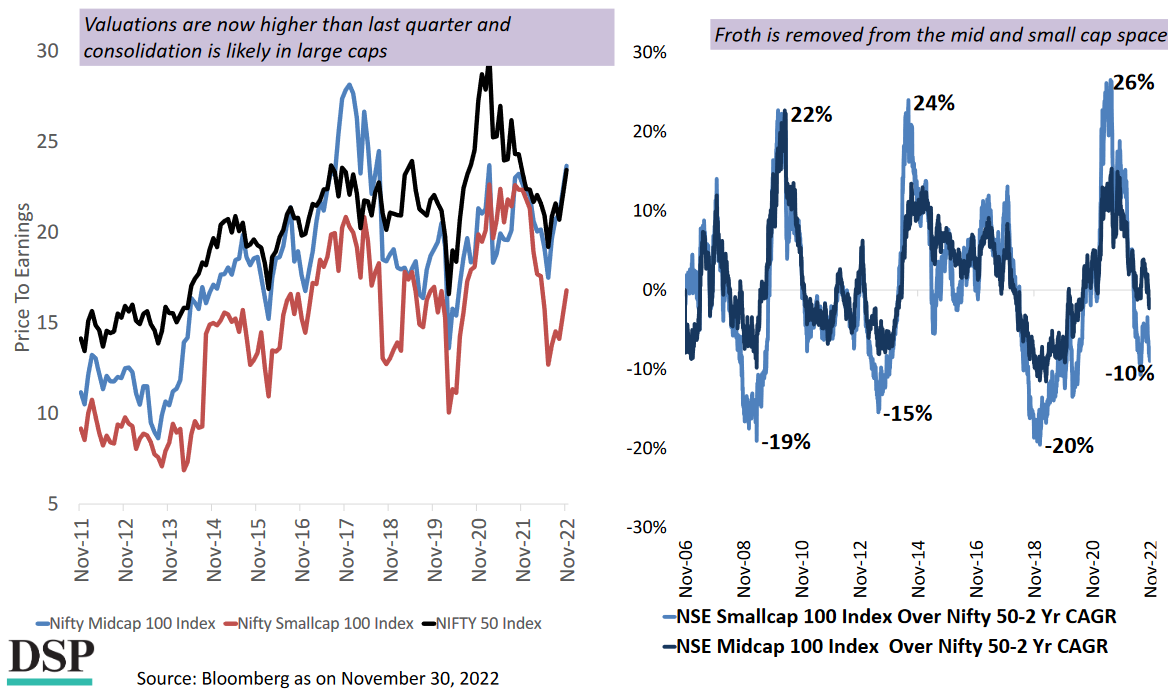

In the September 2022 edition of Navigator, we noted that overall equity valuations had gone from cheap to medium-priced and were somewhat higher than their long-term averages. However, we also argued that they were not so high as to justify any changes in investors' asset allocations. Therefore, we recommended that investors with moderate risk appetites maintain an equity allocation of around 50%. We also suggested that it might be a good idea to look at specific sectors that still had relatively lower valuations.

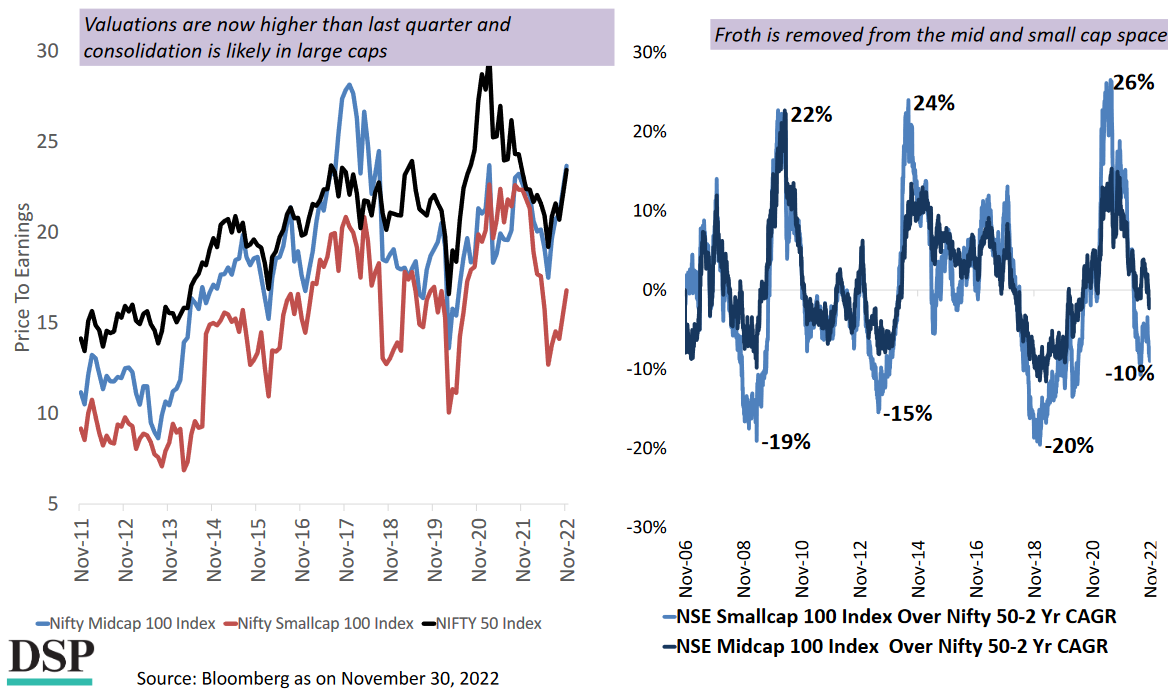

By December 2022, it was clear that the rise in valuations had continued at a fast pace, and some differentiation based on market cap had become evident: while large cap valuations had become quite high and were likely to consolidate further, small and mid-cap (SMID) stocks were lagging behind. We believe that this is a sign that SMID stocks may perform well soon, as market rallies are often led by large caps and followed by mid and small caps with some delay.

SMID performance reflects the real economy

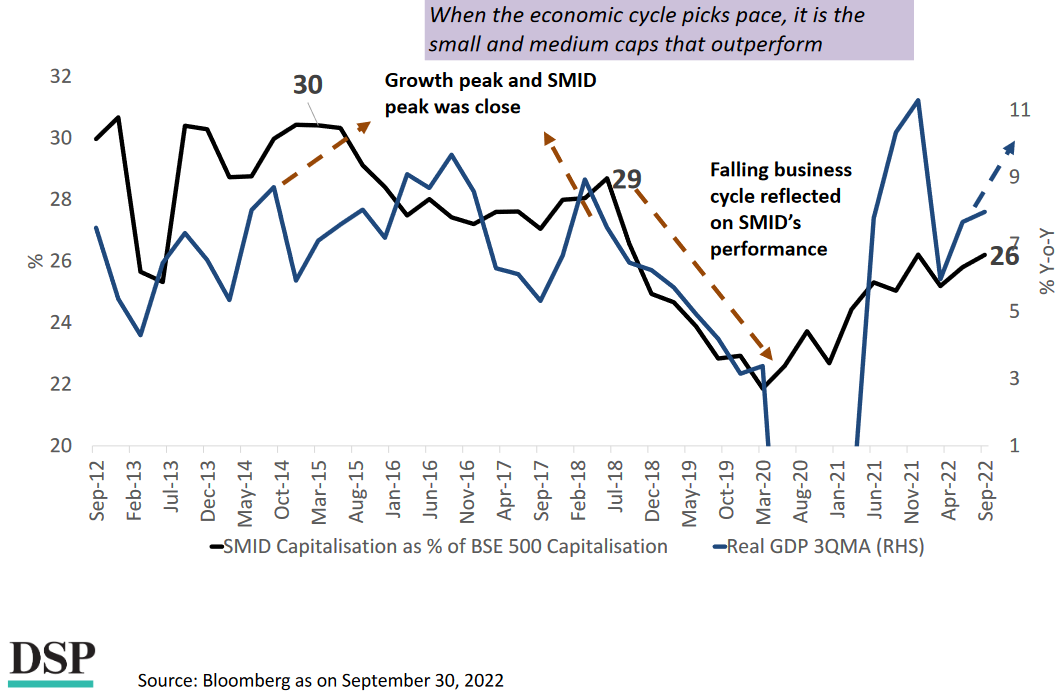

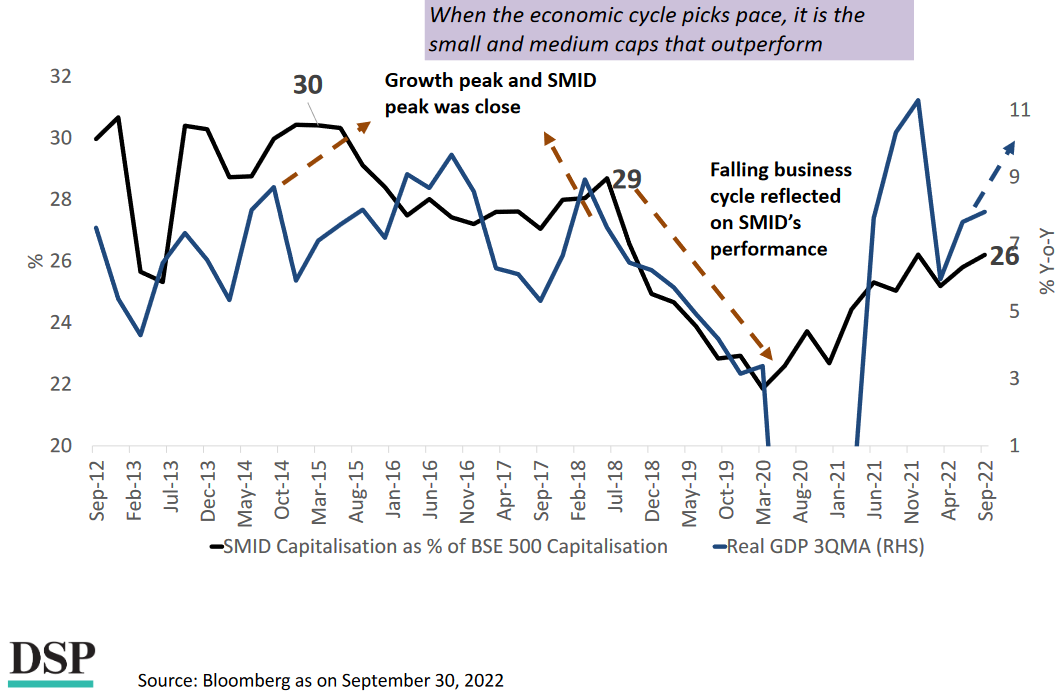

The Indian market’s recovery in the wake of the 2020 crash caused by the Covid-19 pandemic has been uneven and has mostly been led by large-cap stocks. However, we believe that this trend is likely to change soon.

This is because historically, the performance of SMID stocks has correlated better with the real economy. Thus, when the economic cycle picks up pace, it is usually SMID stocks that see the most impressive outperformance. Coupled with the fact that the real economy in India is expected to be strong in the near future due to resilient domestic indicators, there is further support for the hypothesis that SMID stocks are likely to see growth in the near or medium term.

Of course, if there is a global slowdown, the Indian economy could suffer as well, leading to the assumption of near-term economic growth not holding. However, we believe this risk can be mitigated by choosing the right stocks (or a dependable fund that does so), ones that can withstand such a downturn without an outsized impact.

EM Performance Is Good For Domestic SMID Outperformance

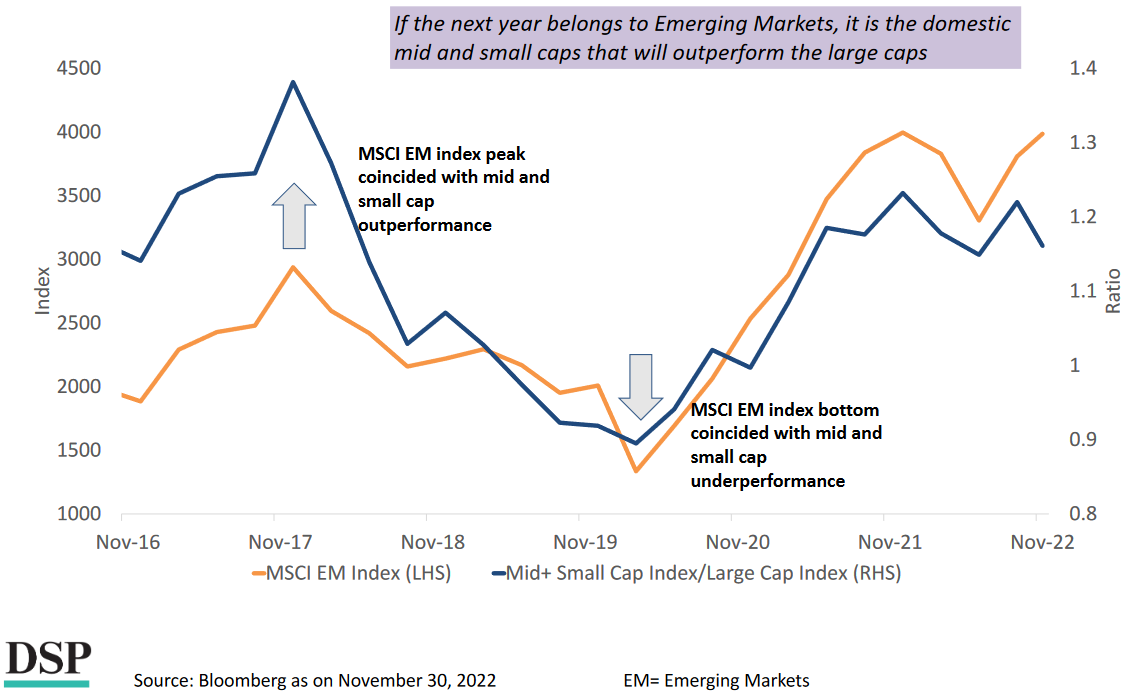

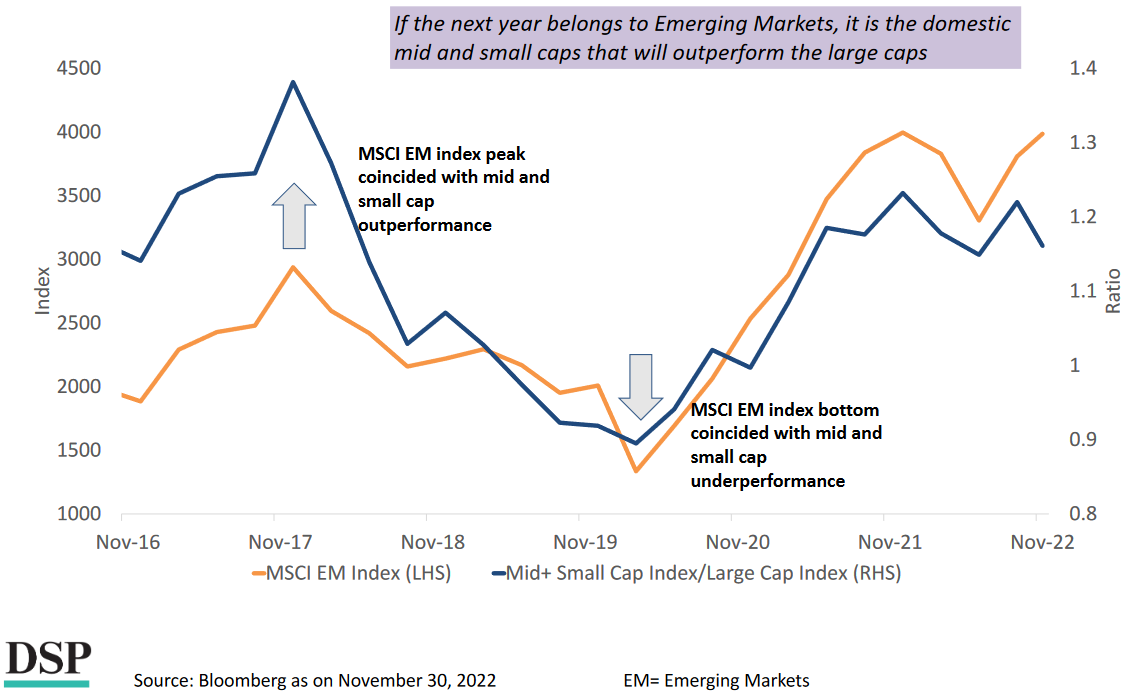

There are some interesting correlations between the MSCI EM Index (which tracks 24 Emerging Markets, or EMs) and the performance of Indian SMID stocks. In particular, the MSCI EM Index peak in late 2017 coincided with SMID outperformance, and the bottoming out of the index in early 2020 coincided with SMID underperformance.

This also suggests that if Emerging Markets do well in 2023, then there’s a good chance that Indian SMID stocks will perform better than large caps.

But are there reasons to believe that Emerging Markets will perform well in 2023?

Yes, there is one important reason: the US Dollar is likely to weaken. This could happen for several reasons:

- It is quite possible that by mid-2023, the US Federal Reserve will have put an end to its ongoing Quantitative Tightening (QT), which reduces liquidity in financial markets.

- A narrowing yield differential between the US and the rest of the developed world would also put downward pressure on the US Dollar, as more investors may then use US Dollars to buy bonds and other securities in other countries.

- A global economic slowdown cannot be ruled out: several factors could precipitate it. Such a slowdown would drag the US Dollar down.

Thus, if the US Dollar does weaken, and Emerging Markets do perform well as a result, then it’s likely that Indian SMID stocks will put up an impressive performance.

The bottom line: an excellent opportunity for Indian investors

Given all of these considerations, it appears to us that there’s a good chance we will see Indian SMID stocks deliver handsome returns in 2023 (and beyond, perhaps). As a result, we believe that while investors with a moderate risk appetite should continue to allocate 50% of their portfolio to equity, it might also be a good idea for them to increase their tactical allocation to SMID stocks.

Sold on this thesis? To bolster your portfolio in this space, you may consider our specialist small-cap or mid-cap funds. However, note that investing in this space is risky and you should consider it only if you’re willing to stay invested for a decade or more. Otherwise, seek advice from a professional expert before taking any investment decisions!

Disclaimer

This note is for information purposes only. In this material DSP Investment Managers Pvt Ltd (the AMC) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author or the AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. Any sector(s)/ stock(s)/ issuer(s) mentioned do not constitute any recommendation and the AMC may or may not have any future position in these. All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them.

Leave a comment