Understanding the Magic of Arbitrage: A Simple Guide

In the vast ocean of financial investments, arbitrage has become a big fish. You might be getting a little FOMO seeing how it is trending, but we simply cannot go YOLO on it; that is for sure! Why is arbitrage getting so much attention? Let's dive in and understand the concept in simple terms.

Arbitrage Explained: It's Easier Than You Think

Arbitrage, in simple terms, is a strategy used to take advantage of the price difference of an identical item in two different markets.

For example, imagine you find a mobile phone being sold online for 50,000 rupees, but a colleague is planning to buy the same phone from a retail store for 55,000 rupees.

Seeing this discrepancy, you could buy the phone online and sell it to your colleague at a higher price, netting a risk-free profit of 5,000 rupees.

Something similar happened recently and received significant buzz in the media. This was the case of iPhone Scalping. People purchased the latest models of the iPhone in bulk from regions where they were available at a lower price or released earlier and then resold them at higher prices in regions where the devices were either more expensive or unavailable yet.

This concept also extends to financial markets, where the asset in question could be a stock, a commodity, or any other tradable security. The key is to simultaneously buy the asset at a lower price in one market and sell it at a higher price in another.

That's arbitrage for you! This concept is also applied in Mutual Funds – which results in a category called Arbitrage Mutual Funds. These funds aim to make small profits from the price difference between two different markets: the spot cash market and the futures market. The spot cash market refers to the market where stocks can be bought or sold at the current price, while the futures market allows for the purchase or sale of a stock at a predetermined future price. For instance, if stock A is trading at 200 rupees today (the spot price), but in the futures market, the same stock is predicted to trade at 201 rupees after a month, you can buy the stock now at the lower price and simultaneously agree to sell it after a month at the higher price, locking in a one-rupee profit per share. This profit is secured regardless of the stock's actual price after one month.

What's the benefit of these Arbitrage Mutual Funds? Well, these funds use arbitrage as a strategy to provide steady returns, even if small, with relatively low risk. The low risk comes from the fact that returns are attempted based on temporary price discrepancies rather than relying on market movements. When regular stock markets are volatile, these funds can be a safe harbour.

Is Arbitrage Right for You?

Arbitrage is not a one-size-fits-all solution but can be a suitable investment strategy for a particular type of investor. It's especially good for people who prefer consistent returns and less volatility compared to directly investing in the stock market. If you get anxious seeing wild ups and downs in your investments, arbitrage may be a good fit for you.

Comparing it with other forms of investments, such as equity and debt, it possibly sits somewhere in between. Equities have the potential to deliver high returns, but they come with high risk. The stock market can be a rollercoaster ride, with values surging and plummeting frequently. Debt instruments like bonds, on the other hand, are relatively safer. They offer steady returns but typically at lower rates. Arbitrage, meanwhile, takes a middle ground. It aims to offer steady returns while still providing the potential for slightly higher earnings. It's like having a foot in both worlds - seeking to balance risk and return.

So, if you're someone who wants a bit more return than debt but at less risk than equities, arbitrage could be a great addition to your investment portfolio.

Remember that while arbitrage funds have their benefits, it's crucial to consider your financial goals, risk tolerance, and investment timeline before diving in. It's always a good idea to consult with a mutual fund distributor or do your own thorough research before making investment decisions.

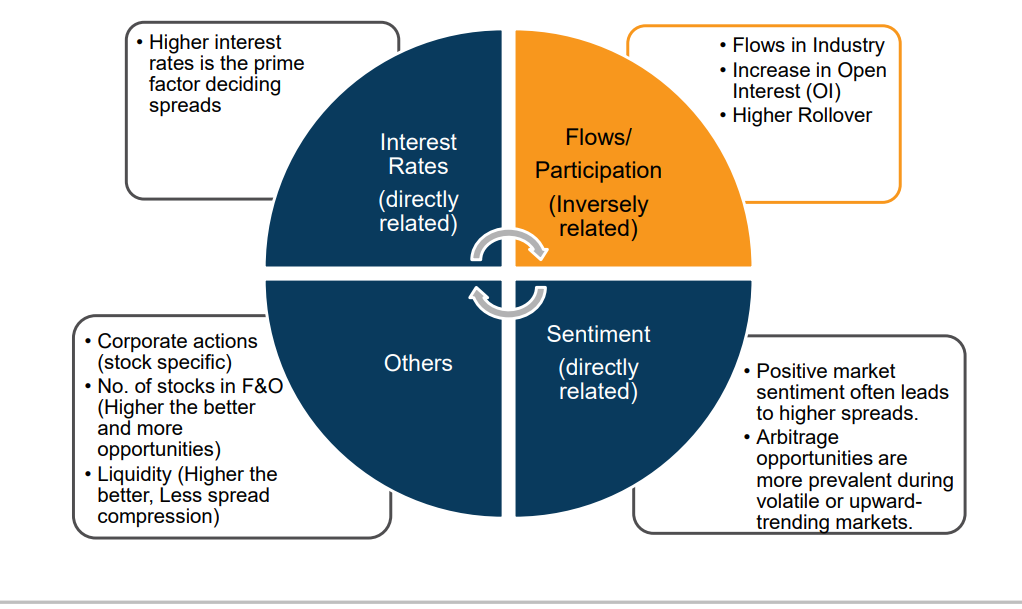

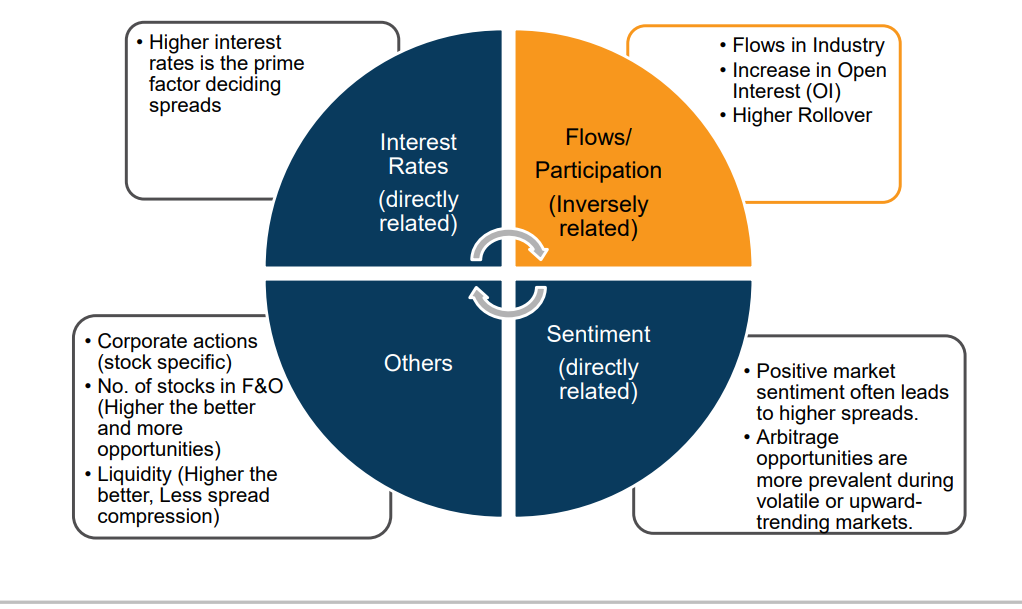

Understanding Factors Influencing Arbitrage: Key Elements

Just like how a successful road trip depends on various factors – the condition of the road, the performance of your car, and the weather – arbitrage also hinges on several elements. The 'spreads' or price differences that create arbitrage opportunities can change based on factors like interest rates, market participation, sentiment, and other influences.

Source: Internal

Interest Rates: The Fuel for Your Vehicle

Think of interest rates as the fuel prices for your car. When fuel prices (interest rates) are high, your trips (arbitrage opportunities) become costly. If fuel prices are low, you can travel more at lesser costs, making the trips more beneficial. Similarly, if interest rates are high, loans become expensive, impacting your arbitrage profits negatively. But if rates are low, it costs less to borrow, increasing your profits.

Flows / Participation: The Traffic on Your Route

This is like the traffic during your daily commute. More cars (traders) on the road lead to quicker adjustments in traffic (prices). If many people are buying and selling in a market, price differences correct quickly, making arbitrage opportunities short-lived. Think of it as a busy Mumbai street where traffic keeps flowing rapidly. On the other hand, less traffic (participation) can cause more prolonged price differences, giving more profitable arbitrage opportunities, much like driving on an open highway.

Sentiment: The Weather for Your Journey

Imagine sentiment as the weather for your road trip. When the weather (sentiment) is sunny (positive), prices might inflate, offering arbitrage opportunities. It's like when Indians are excited about an upcoming cricket match, the demand for match tickets might increase, leading to price differences in various markets. Conversely, gloomy weather (negative sentiment) could deflate prices, again providing arbitrage opportunities. It's akin to a sudden rain forecast on the day of the cricket match leading to reduced ticket prices.

Other Factors: Unexpected Roadblocks on Your Journey

These are like unforeseen obstacles on your road. A sudden policy change is similar to a new speed limit sign, changing the flow of traffic and influencing prices. A surprising event, like political turmoil or a company fraud, is like a sudden roadblock or detour, causing rapid price changes and creating arbitrage opportunities.

The Interplay of Factors: The Journey Itself

Like how your trip's success depends on a combination of factors - fuel prices, traffic, weather, and unexpected events - success in arbitrage depends on how these elements interact. For example, in India, if RBI lowers interest rates and there's positive sentiment about the stock market (like due to good monsoons leading to great agricultural output), there might be more arbitrage opportunities, even with many traders in the market. Similarly, high interest rates, negative sentiment (like due to an unexpected political event), and less market participation might lead to wider price differences, offering potential profits but with higher risk.

In essence, these factors together create the environment for arbitrage opportunities, just like different elements influence your road trip. Understanding how they work together can help you navigate the world of arbitrage better.

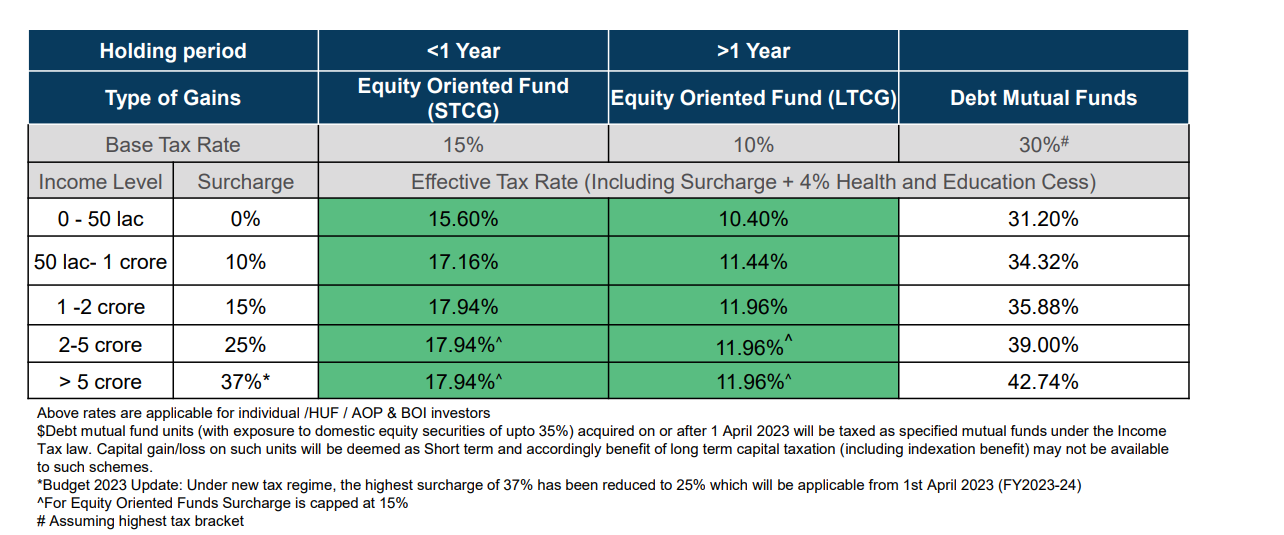

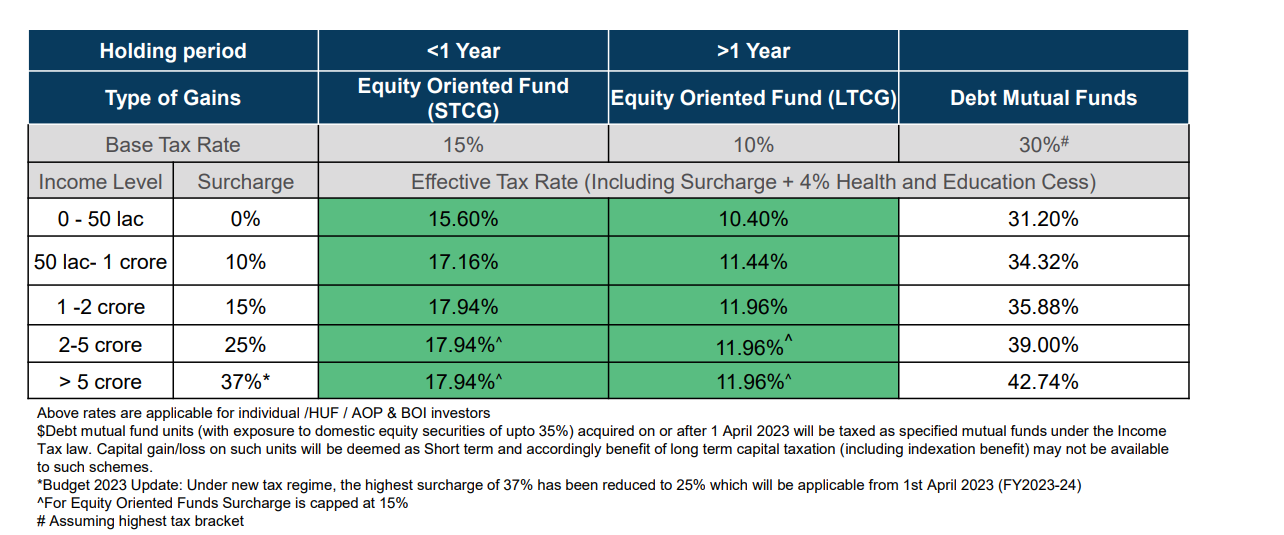

Timing: Why Arbitrage is Hot Now

Arbitrage Mutual Funds are in focus now because of market volatility. Given the global outlook has been deteriorating with time and recessionary fears grip economies across the world (The Eurozone has officially slipped into recession in 2023 as we write out this article, and fears of one in the US run high), volatility seems to reign as the theme of the season. There really is no escaping it. Traditional investment forms are generally less attractive in such times, making arbitrage funds popular. They provide steady returns through times of market turbulence. Also, recent policy changes have made Arbitrage Mutual Funds more tax-efficient than other fixed-income products. These funds use the benefits of equity taxation while giving returns like debt investments, leading to higher post-tax returns.

Arbitrage funds leverage the advantage of equity taxation while delivering returns similar to those of debt investments, thereby amplifying post-tax returns.

The table below illustrates the tax efficiency of Arbitrage funds:

Source: Internal

On another note, the number of F&O (Futures and Options) stocks increased from about 144 in 2019 to around 188 in 2023. Also, the average assets under management (AUM) of the arbitrage category was approximately Rs. 1.21 lakh crores in August 2021; it stands around Rs. 87,000 crores as of March 2023.

Imagine you're a savvy shopper who loves finding great deals. In the past, you had a limited number of stores to visit, and it was challenging to find price differences for the same item. But now, there are more stores popping up, offering a wider range of products. This means there are more places for you to look for price differences and get amazing bargains.

Similarly, the increase in the number of F&O stocks means more opportunities for traders to buy and sell financial products. Traders, like smart shoppers, can take advantage of price differences across different markets. They can buy a stock at a lower price in one market and sell it at a higher price in another, making a profit from the price difference.

Additionally, the total capital allocated to arbitrage strategies has reduced over time. This means fewer shoppers are competing for these great deals. With less competition, traders have a better chance of finding and seizing profitable opportunities. As more traders try to make money from the price differences, the prices in different markets increase, creating even more opportunities for arbitrageurs to make sizable profits.

So, in the current market scenario, with more F&O stocks and reduced capital allocated to arbitrage strategies, it's like a shopping trend where traders can easily find and capitalise on price differences. It's an attractive alternative to traditional investments, offering promising opportunities in a changing market environment.

Interested to know more about an arbitrage fund and explore in more detail?

In Conclusion: Making a Wise Choice

In the world of investments, there's no one perfect strategy. But given the current market volatility, arbitrage stands out. It might not make you rich overnight, but it's a safer choice amidst financial uncertainties.

Remember, investment decisions should be based on your financial goals, risk appetite, and investment horizon. And when it comes to arbitrage, just like in cricket, understanding the game's rules can help you make better decisions. So study well, plan wisely, and play the game of investments smartly!

Should you be considering arbitrage funds for your portfolio, leave your details here, and our experts will get in touch with you.

Disclaimer

In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house. Information gathered and used in this material is believed to be from reliable sources. The AMC however does not warrant the accuracy, reasonableness and / or completeness of any information. The above data/ statistics are given only for illustration purpose. The recipient(s) before acting on any information herein should make his/ their own investigation and seek appropriate professional advice. This is a generic update; it shall not constitute any offer to sell or solicitation of an offer to buy units of any of the Schemes of the DSP Mutual Fund. The data/ statistics are given to explain general market trends in the securities market and should not be construed as any research report/ recommendation. We have included statements/ opinions/ recommendations in this document which contain words or phrases such as “will”, “expect”, “should”, “believe” and similar expressions or variations of such expressions that are “forward looking statements”. Actual results may differ materially from those suggested by the forward looking statements due to risks or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on our services and/ or investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices etc.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

.jpg)

.png?width=1300&height=300&name=image%20(13).png)

Leave a comment