Low volatility strategies have underperformed recently: Time to exit?

For those who don’t know, ‘factor investing’ is an investing strategy in which one selects assets based on a certain set of factors or attributes, as long as they meet the pre-decided criteria. The five most common ‘factors’ used by most investors are value, size, momentum, quality and volatility. In this blog, we will discuss about the volatility factor. Note: This will be a bit technical :)

----------

Low volatility factor investing simply refers to a portfolio construction technique that creates a portfolio of stocks that exhibit lower volatility with respect to the broader market.

The low volatility anomaly refers to the empirical evidence that seems to suggest that low volatility securities tend to generate higher risk-adjusted returns over the long term than can be explained by the CAPM (Capital Asset Pricing Model), which itself suggests that investors should be rewarded for taking higher risk.

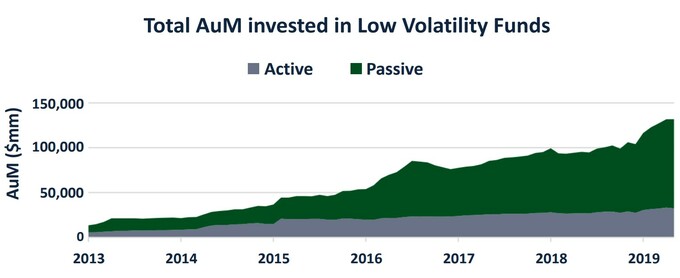

The defensive characteristics of low volatility portfolios along with evidence of long-term outperformance have contributed significantly to the rise in popularity of this strategy over the last decade or so. As per EPFR data, strategies that are explicitly designed as ‘low volatility’ have over $130 bn in AUM across 200 funds around the globe. The strong inflows over time in low volatility strategies were driven in part by outperformance of such strategies versus the broader markets.

Source: EPFR

Click to view in higher quality

Understanding the Low Volatility factor

The defensive characteristics of low volatility strategies make them uniquely attractive for investors looking to contain drawdowns during market turmoil. Loss aversion often leads to investors reducing equity exposure in portfolios at inopportune moments. Low volatility strategies, by trying to minimize drawdowns, help investors remain invested in equities during periods of market turbulence.

Higher risk-adjusted returns in the past relative to broader equity indices allow investors to free up risk budgets and seek other strategies allowing for potentially higher portfolio returns for the same risk budget. This feature enhances the attractiveness of the strategy to asset allocators. In India, these portfolios tend to be significantly overweight on defensive sectors such as Consumer Staples, IT and Healthcare. Given the defensive positioning, low volatility strategies typically underperform during sharp market upmoves as they explicitly choose stocks having characteristics such as low beta and low standard deviation of returns.

Recent underperformance and link with interest rate movements

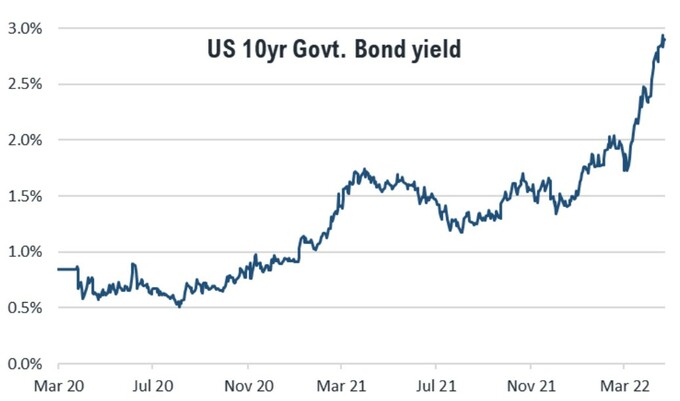

While the recent underperformance of low volatility strategies has been challenging, the significant macro headwinds facing the strategy cannot be understated. We have made an attempt to contextualize the underperformance with the extreme drawdowns that we have witnessed in long-duration fixed-income instruments.

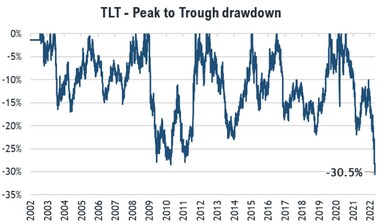

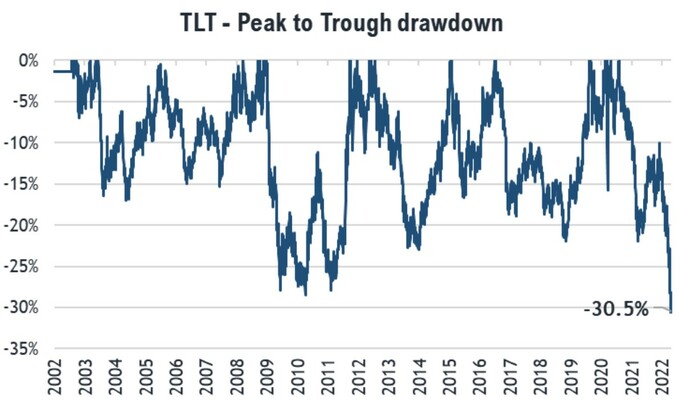

The chart below is the ‘peak-to-trough’ return drawdown for an ETF that mimics the behavior of US treasury bonds with 20+ yrs maturity. The current selloff in longer-dated US treasury bonds has resulted in the biggest peak-to-trough drawdown in the history of this ETF which goes back 20 years.

Source: Bloomberg

Click to view in higher quality

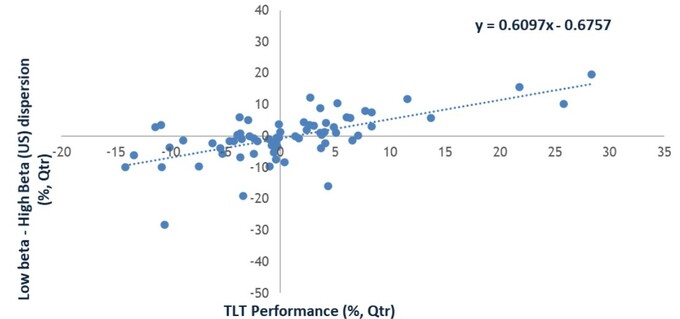

We tried to analyze the impact of long-term interest rates on the low volatility/low beta factor premium. For the analysis, we regressed the quarterly performance of the Dow Jones Market Neutral Anti Beta index (as a proxy for the low volatility factor premium) versus the TLT ETF (a proxy for the behavior of the Long Term Treasury Bond).

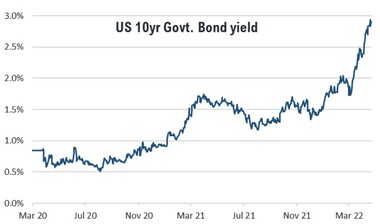

We found that there is a very strong positive correlation between the two series. In other words, falling longer-term yields cause positive effects on low volatility strategies. Conversely, when long-term yields rise, they have a negative impact on the performance of low volatility strategies. Since Aug 2020, the pace of rise in long-term bond yields in the US has been one of the sharpest since 1980s. As a result, the erosion in the low volatility factor premium has been quite staggering.

Source: Bloomberg

Click to view in higher quality

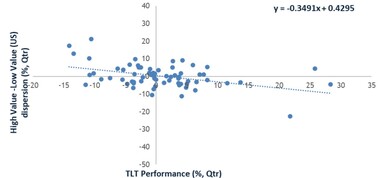

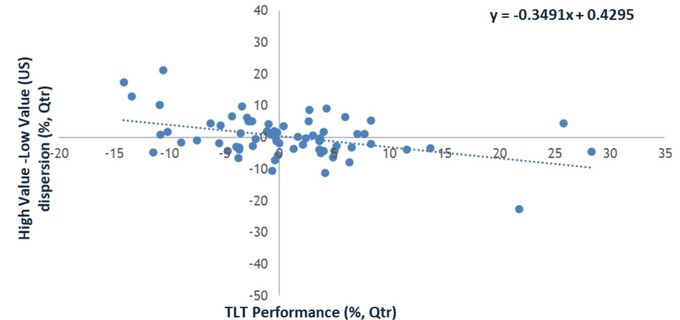

Since low volatility strategies are typically defensive in nature, we tried to analyze if the reverse observation is true for the Value premium which tends to show pro-cyclical behavior. To test this, we used the Dow Jones Market Neutral Value index (as a proxy for the Value premium) and regressed the quarterly performance of the TLT with it.

On expected lines, we found a very strong negative correlation between the two data series. This confirms our hypothesis of rising longer-end interest rates as being negative for low volatility strategies and a positive for value strategies. Indeed, the comeback of value-style post-2020 crash seems to corroborate this analysis.

Source: Bloomberg

Click to view in higher quality

Source: Bloomberg

Click to view in higher quality

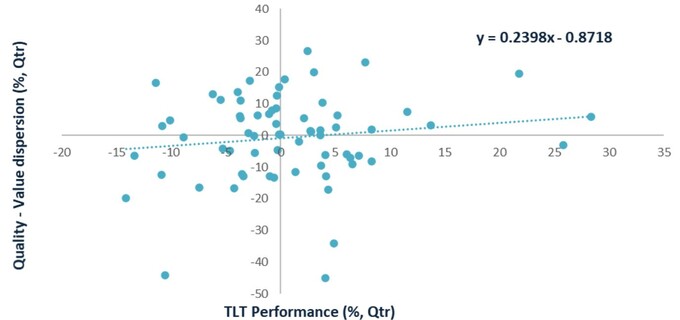

We went further with the analysis to see if the same phenomenon extends to Indian equities as well. For this purpose, we regressed the quarterly performance dispersion between Nifty Quality Low Volatility 30 index and Nifty 500 Value 50 index with the TLT.

Here too we see a strong positive relationship, indicating that a large part of the recent underperformance of low volatility strategies versus value-oriented strategies has come on account of rising long-term interest rates.

Source: Bloomberg

Click to view in higher quality

The analysis demonstrates that the recent unprecedented sharp rise in long-term US interest rates (based on expectations of rate hikes) has indeed acted as a significant headwind to low volatility strategies.

Consequently, a situation where rates stabilize could mark a turning point and bring about a reversal in the fortunes of low volatility strategies. Given the inherently defensive characteristics of such strategies, an investor would benefit by continuing to stay invested, especially when the sharp anticipated rate hikes bring about the inevitable economic downturn, where such strategies usually thrive.

They say that the night is darkest before dawn. This may possibly be the darkest hour for low volatility strategy investors. Hence, it would be prudent for investors to stick with the strategy so they are in a position to reap the benefits when the macro environment turns favorable again.

About the author

Prateek Nigudkar is part of the Quantitative Investment Team at DSP Asset Managers. He is the designated Fund Manager for DSP Quant Fund and DSP Value Fund. He is a motorsport enthusiast and a Formula 1 buff. Having done a fair bit of Go-Karting over the years, he hopes to participate more in competitive Karting championships over the next few years!Disclaimer

This note is for information purposes only. In this material DSPAsset Managers Pvt Ltd (the AMC) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author or the AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. Any sector(s)/ stock(s)/ issuer(s) mentioned do not constitute any recommendation and the AMC may or may not have any future position in these. All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them.

Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

Leave a comment