A Core and Satellite Approach For Your Portfolio Allocation

Every Friday, I have a meeting with my entire team where the only agenda is to review developments in the capital markets. We discuss the latest global macro trends, deep dive into sectors on a rotation basis, look at business cycles, review company balance sheets and analyse management discussions from quarterly calls. This enables us to keep an overall track of companies held across our portfolios.

This has become a crucial part of my routine job and one of the pillars of success in the work I do. So, for my colleagues in the Passive Investments team and me, this meeting is done with a huge passion. We collate requisite data from our market data systems like Bloomberg or Refinitiv, keep our points of discussion on hand and be prepared for this meeting in advance.

However, what if this is not a regular job for you? What if you don’t have the requisite tools and skillsets to analyse a large set of companies; from those, figure out the right companies to invest in, and then regularly monitor a portfolio of stocks? Maybe given a choice, you might have a passion for doing this, but you don’t have the time and resources to do so because you are busy with your business or job.

How can you invest your money with a limited commitment of time and market data resources?

One suggested approach could be to keep it simple and start by investing in low-cost, passively-managed Index Funds.

This seems a very simple and basic recommendation. Sure. And I am not the only one suggesting this. One of the best stock pickers in the world, Warren Buffett, has made a similar suggestion for his wife who is not an investment expert – do not try to pick up individual stocks. To keep it simple for his wife, in his will, he has made an asset allocation for her with 90% into Index Funds and 10% into US Government bonds.

Moving back to India, over the past few years, we have seen an increased interest in index funds, and this trend is likely to continue. Index funds are slightly different from ETFs as they don’t require a Demat account and a stockbroking account. Hence, first-time investors who want to access the equity markets, could more easily start with index funds, both with a lump sum investment or also set up a monthly SIP.

For a sophisticated institutional investor like a family office or an exempt PF Trust, index funds could be used for taking a tactical view by investing in a transparent and low-cost index fund. Besides these points, the attractiveness for an individual investor could be to gain equity allocation by way of an easy to understand and well-diversified portfolio of the index fund.

As an individual investor, it would be prudent to follow a 3 step approach, with inputs from your trusted financial advisor where required:

- Identify and document specific financial goals like a new car, children’s education, retirement, etc.

- Create an asset allocation and timeline for each goal

- Invest regularly with an aim to achieve your goals

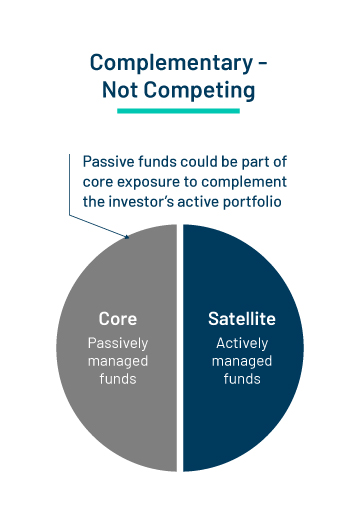

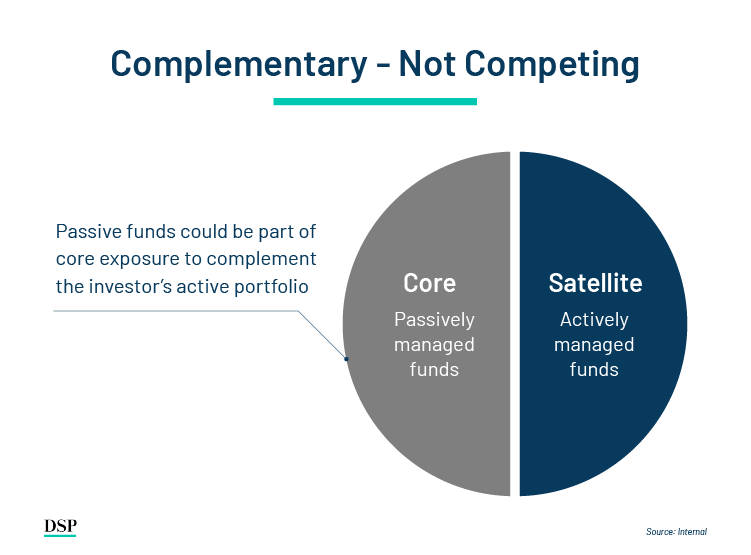

For step 3, financial advisors often suggest that the best approach for an investor looking to build a long-term portfolio would be to use index funds as a complementary strategy for gaining the requisite equity allocation by following a core and satellite approach:

Core Allocation

- Aims to provide market-based returns.

- No fund manager style bias (e.g. growth/value) as different styles perform in different market periods.

- Can be useful especially in the large-cap segment.

Satellite Allocation

- Can have the potential to generate alpha.

- Different types of funds with different fund management styles can be included (e.g. small-cap, mid-cap, value etc.)

- Short term tactical allocation for seeking better returns can be done.

For the Core allocation in the large-cap segment, use index funds that provide equity market participation at a low cost, without any fund manager bias. The Core could be a combination of index funds on Nifty 50 and Nifty Next 50. This provides exposure to the large-cap universe comprising good companies, which are leaders in their sectors and have seen multiple business cycles. So your Core allocation now has a diversified and transparent portfolio of such companies via just two low-cost index funds.

For the Satellite allocation in the mid-and small-cap segment, use active funds managed with a robust process and investment framework, which provide the potential to generate outperformance over the benchmark. The Satellite could also include other investment classes for diversification such as gold, sector funds, international funds, etc., some of which might be for a relatively shorter period of time for tactical market views. So your Satellite allocation has a differentiated allocation, often needing a bit more analysis and research before investing.

The most important financial goals are usually common – for most of us, they are aligned to the happiness of the family, a better life for children, starting or expanding a business/profession. Some of us often get preoccupied with the wrong priorities - like increasing returns at all costs or finding the next star fund manager. Instead, a better approach could be to keep it simple by investing in a low-cost index fund giving exposure to the broader market, with an aim to achieve your goals with a reasonable degree of certainty.

About the author

Anil Ghelani, CFA is the Head of Passive Investments & Products at DSP Asset Managers. Besides this role, he has also been associated as a volunteer with CFA Society India since 2007 and is currently Vice Chairman of the Board. The mantra he follows when it comes to writing - "Simplicity is the ultimate sophistication - Da Vinci".Disclaimer

This note is for information purposes only. In this material DSPAsset Managers Pvt Ltd (the AMC) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author or the AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. Any sector(s)/ stock(s)/ issuer(s) mentioned do not constitute any recommendation and the AMC may or may not have any future position in these. All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them.

For product labelling/ more information on DSP Nifty 50 Index Fund, click here.

In case you make any investment decision after reading this post, please consult with your trusted MFD/RIA first. Request you to please select MFD/RIA code while conducting your transaction.

.jpg)

Leave a comment