Accelerated innovation fuelling portfolio growth

The biggest New Year parties in 2021-22 took place in the Metaverse. There was Paris Hilton hosting a party in the Roblox Metaverse while Decentraland’s Metafest 2022 Global Party, hosted by the real estate firm Jamestown and the Digital Currency Group (DCG), recreated the iconic New York Times Square ball drop. With the virtual world slowly inching its way to becoming as important as the physical world, you now really know that ‘nothing is impossible. Innovative ideas and solutions are pushing the boundaries of our imagination and spanning their wings to increasingly embrace large swathes of people across the world.

The narrowing of innovation cycles

As expectations, capabilities, and resources evolved, each generation cultivated its own tribe of innovative thinkers and progressively shrunk the innovation cycle. For example, while the leap from horse drawn carriages to gas-powered automobiles spanned almost a century, it took us less than 50 years to go from flying 7 miles per hour across a field to 7 miles per second into space all due to combustion engines and the rocket. From that perspective, the history of innovation cycles is telling. The first wave of innovation, characterised by the introduction of water power, textiles, and iron lasted almost 60 years followed by the second, third, and fourth waves which lasted 55 years, 50 years, and 40 years, respectively. We are currently in the 5th wave of innovation and possibly at the cusp of the sixth wave.

In the backdrop of such a landscape, we must reposition our portfolios and gear up for the future by embracing innovation. Investing in companies that are at the helm of innovation is a great start. Inarguably, innovative solutions can potentially elevate our ecosystems and engender great value. However, as investors, you can benefit from this accelerated pace of innovation not just through tangible products and services but also by investing in companies that lead innovation. More importantly, if you are investing for the future then you must invest in the future. This means eschewing some of the old economy themes in favour of futuristic themes that can help you play innovation investing and create a robust portfolio of the future.

Why invest in innovative companies?

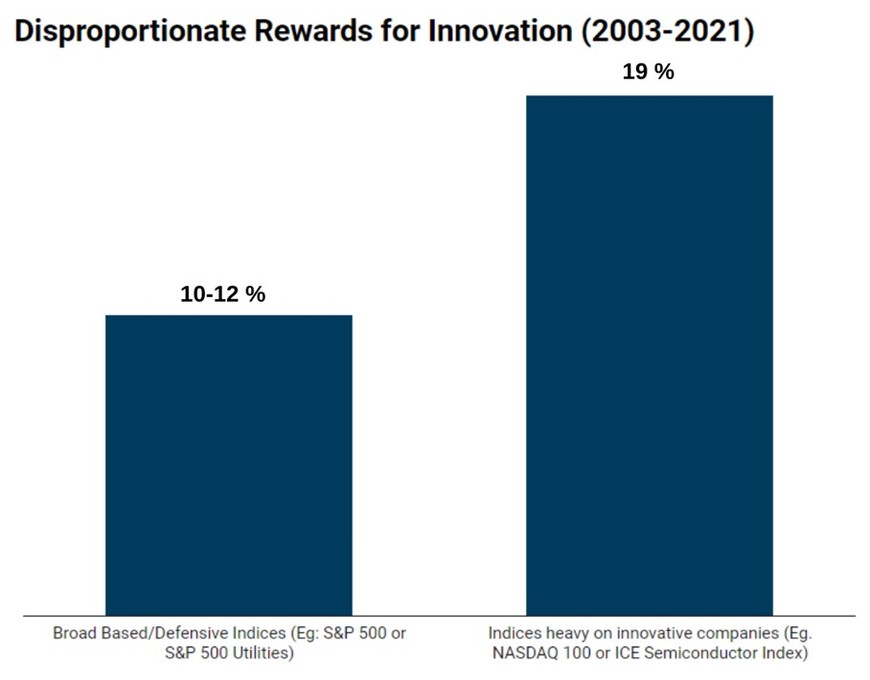

Innovative companies are rewarded disproportionately over the long-term: There is increasing evidence of a performance gap between innovation winners and companies that simply muddle along.

Based on data charted from 2003 to 2021, it has been observed that broad-based and defensive indices like the S&P 500 Index or the S&P 500 Utilities Index delivered returns in the range of 10% to 12%. Correspondingly, indices with high exposure to innovative companies like the NASDAQ 100 Stock Index or the ISHARES Semiconductor ETF have delivered approximately 19% returns. As the pace of innovation accelerates and the solutions offered orchestrate exponential growth in their respective industries, this outperformance by innovative companies is set to increase further.

Technology is gaining critical mass in terms of earnings: The accelerated pace of digital transformation, in part precipitated by the COVID-19 pandemic, has put technology companies on a fast track to growth and enabled them to gain critical mass in terms of earnings. Industries across the board are embracing digital solutions in an attempt to stay relevant and thrive in the new normal. Technology companies that are at the forefront of innovation are well-positioned to capitalise upon the growing demand for innovative tech solutions and improve their top-line as well as bottom-line. Over the last two decades many such companies have witnessed consistent growth in ROE, exemplified by the fact that technology sector ROE has grown from 14% in 2004 to approximately 21% in 2012 and further to 34% in 2021.

Innovation led companies can potentially leapfrog several layers of growth: Many ideas and innovations have humble beginnings and much like the impoverished artists of the 18th and 19th centuries, their true value is discovered only after a period of time. However, once the true value is discovered, or in the case of innovative companies, once the solutions gain critical mass, the growth delivered can be exponential. As a result, innovation companies can witness large moves whenever they deliver and their inclusion in the portfolio can act as a catalyst for portfolio growth.

An opportunity to earn ‘innovation premium’: The world today is in the midst of unprecedented innovation which is all set to accelerate even further as human beings test the boundaries of the ‘implausible’. New and emerging themes like metaverse, genome editing, Web 3.0, etc., are bringing with them the promise of great value creation and change. Investing in companies at the forefront of innovation will not only help you participate in these emerging themes but also enable you to capture the value or reward for creativity.

Right from the invention of the wheel to the development of the Mars Rover, innovative ideas and technologies have shaped civilisations and changed the contours of life on earth. Today, we are standing at the cusp of unimaginable opportunities that can enable us to chart the future course of civilisation while also growing our investment portfolio.

Does this space excite you? Do you feel that investing in disruptive ideas like the Metaverse, Genome Editing, Artificial Intelligence and Web 3.0 can add value to your portfolio?

A lot of such cutting-edge work in these mind-bending innovative technologies is happening internationally and while they may not be easily accessible to Indian investors just yet, DSP has launched a new product that will give you the ability to gain access to these spaces.

About the author

Sahil Kapoor - Vice President & Head - Products & Market Strategist at DSP Asset Managers. In his own words, his writing is his "Gurudakshina" - his humble repayment to Mr. Market.Disclaimer

This note is for information purposes only. In this material DSP Asset Managers Pvt Ltd (the AMC) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author or the AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. Any sector(s)/ stock(s)/ issuer(s) mentioned do not constitute any recommendation and the AMC may or may not have any future position in these. All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them.

Leave a comment