Innovative companies are reimagining the world. Are you missing out?

“I’m Orkut. You may not know me, but 13 years ago, I started a social network called orkut.com while I was working as an engineer at Google.” I found the words ‘you may not know me’ both strange as well as telling. I mean, who would not know ‘Orkut’, one of the most visited websites in India and Brazil in 2008? However, it turns out, many people today have no idea about Orkut and how it assumed great value in our lives for a brief period in time. Such is the disruptive power of creative innovation. What is relevant today might not stay relevant tomorrow. A quick glance at the leaders over the last three decades exemplifies how disruption can change leadership within sectors.

A classic example is the BlackBerry*, perhaps the world’s first widely adopted premium smart phone, branded as the darling of businesses and corporates. At its peak in 2010, Blackberry* had an almost 50% share of the US market and approximately 20% of the global smartphone market share. At the time, it sold over 50 million devices a year and boasted a stock price of over USD 230. In just under 4 years, its market share dropped to around 6%, eventually falling to almost zero. Its stock price mirrored the drop in market share and subsequently dropped to high single digits. Correspondingly, the new kid on the smartphone block, Apple’s iPhone, steadily climbed the charts, improving its market share from a mere 5% in 2008 to over 50% currently.

Click to view in higher quality

Is there someone coming to devour the iPhone and usurp its dominant position? You never know! And that’s where lies the biggest challenge of innovation investing. The ability to mine winning companies and having the conviction to stick with them over the long-term.

The DSP Global Innovation Fund of Fund recognises this hurdle in innovation investing and aims to surmount it through a holistic approach that entails:

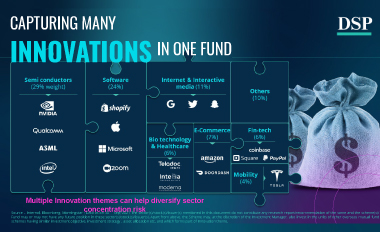

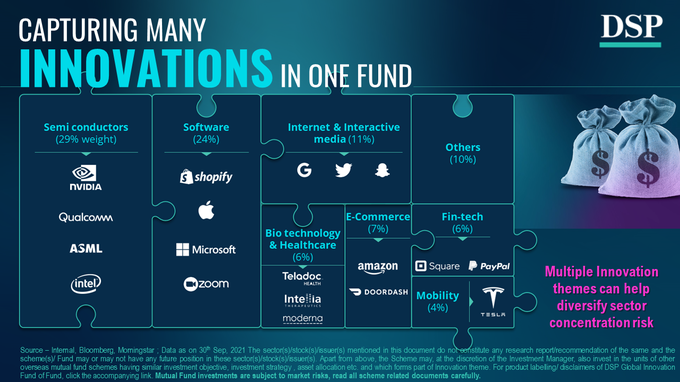

Diversifying across sectors so that no single theme overpowers the portfolio: Innovation investing can often fall within the long tail of investing, occasionally following the power law. This means that more often than not, the larger returns are delivered by a small set of investments. This makes diversification even more important. The DSP Global Innovation Fund of Fund aims to achieve optimal thematic diversification by capturing several innovative themes and providing exposure to sectors which are at the forefront of R&D spending. Some of the key themes in which the fund intends to invest include semi-conductors, software, internet & interactive media, fintech, biotechnology & healthcare, e-commerce, and mobility.

Click to view in higher quality

The concentration risk is also mitigated by limiting single stock exposure. This ensures an added layer of diversification, without compromising on the return potential of the portfolio. Further, we are cognisant of the shapeshifting landscape of innovation investing and intend to be agile enough to identify emerging themes and alter portfolio exposure accordingly.

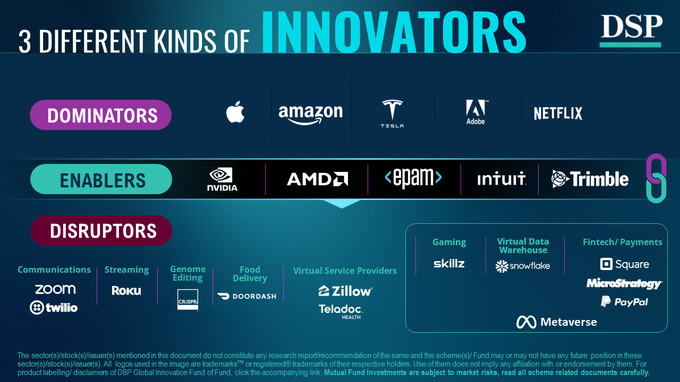

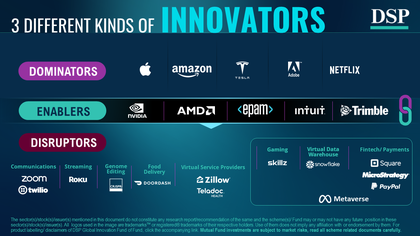

Diversifying across dominators, enablers, and new disruptors so that the portfolio has appropriate risk weight: The basic tenet of building a robust long-term portfolio is to strike an optimal balance between alpha generation and downside protection. In other words, to enhance the risk-adjusted returns of the investment portfolio. To achieve this, the fund aims to invest in a mix of dominators, enablers, and new disruptors such that the dominators can provide portfolio stability, the new disruptors can give a fillip to long-term returns, and the enablers can bring both portfolio stability as well as growth.

Click to view in higher quality

For example, an investment in early stage innovators like Tesla can potentially provide high returns while exposure to well-established innovators like Google or Apple can provide stability in an unfavourable environment.

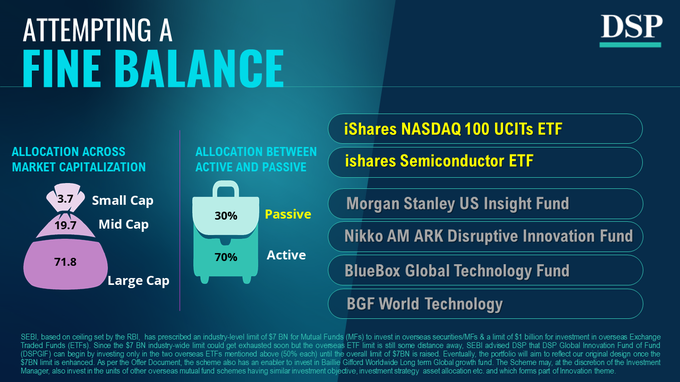

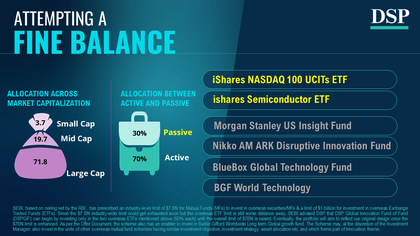

Diversifying across managers and investing in active and passive funds to remove manager risk: One of the longest standing debates in the investment industry is the active vs passive investing debate. Each approach has its own pros and cons, and we say that a mixed strategy that can harness the benefits of each approach could be optimal.

Click to view in higher quality

Around 70% of the DSP Global Innovation Fund of Fund portfolio will be allocated to active managers while approximately 30% will be allocated to passive fund managers, thereby ensuring an optimal balance between rules-based investing and fund manager investing. In order to further harness the market capitalisation based capabilities of companies, the fund will also seek to diversify across large-cap, mid-cap, and small-cap stocks.

Interested in DSP Global Innovation Fund of Fund? Click on the button below. But before that, do read the following paragraph.

SEBI has set an industry-level limit of $7 BN for Mutual Funds (MFs) to invest in overseas securities & MFs & a limit of $1 billion for investment in overseas Exchange Traded Funds (ETFs). While the overseas ETF limit is still some distance away, the $7 BN limit for investments in overseas securities/MFs could get exhausted soon. Hence, on 23rd Jan 2022, SEBI advised us that DSP Global Innovation Fund of Fund (DSPGIF) should invest only in overseas ETFs until the overall limit of $7BN is raised. Therefore, DSPGIF will begin by investing in two passive funds, iShares PHLX Semiconductor ETF & iShares NASDAQ 100 UCITS ETF as advised by SEBI. Once the overseas investment limit for the Indian MF industry ($7BN) is increased, this fund will also start investing in unique active strategies like BlueBox Global Technology Fund, Nikko AM ARK Disruptive Innovation Fund, Morgan Stanley US Insight Fund & BGF World Technology Fund. Please note this change, before you invest.

The DSP Global Innovation Fund of Fund is a one-of-a-kind design which most funds ignore. It lends itself well to innovation investing by ensuring that the true benefits of innovative ideas can accrue to investors while establishing robust risk and downside protection metrics.

To download the product presentation (and to view disclaimers), click here.

Disclaimer

For product labelling/ disclaimers of DSP Global Innovation Fund of Fund, click this link.

There is no guarantee of returns/ income generation in the Scheme. Further, there is no assurance of any capital protection/ capital guarantee to the investors in the Scheme.

* Source - BlackRock analysis on Thomson Reuters 20 Largest Tech Companies by Market Cap (US$ Bn)

This note is for information purposes only. In this material DSP Asset Managers Pvt Ltd (the AMC) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author or the AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. Any sector(s)/ stock(s)/ issuer(s) mentioned do not constitute any recommendation and the AMC may or may not have any future position in these. All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them.

Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Leave a comment