The time-tested principles for a time-resistant fortune

India is seeing a steady rise in the number of family offices, which are wealth management firms that cater to a small number of UHNWIs (ultra-high-net-worth individuals) and their families. Indeed, they represent a separate investor class today. As per the Hurun List 2023, India has 260 USD billionaires; moreover, there are 1,252 Indians with a net worth of over 1,000 crores. Managing the wealth of this investor class requires an ever-growing skill set.

Family offices can have multiple objectives, including succession planning, tax planning, family wealth segregation, charity, wealth management, and estate planning. Here, I will only focus on some timeless principles that can help your family office preserve and grow wealth.

Keep values and objectives at the forefront

Every family office needs an investment charter, which is a document that captures the value system and objectives of each family in question: its risk tolerance, asset allocation, and decision-making process. Charlie Munger was famously quoted as saying, “Tell me where I am going to die and I won’t go there”. It‘s critical to know what we want to do with our money, where we want to invest it. It’s equally critical to know what we won’t do and where we won’t invest.

Creating a charter allows you to find the eye of the storm when market activities create FOMO. For instance, suppose your investment charter says that you won’t invest in high-debt companies with a debt-equity ratio higher than 2:1. Now, if high-leverage stocks were to rally for a sustained period of time, then the family portfolio might underperform to some degree, but you wouldn’t be perturbed as you’d remain true to your charter.

Take varied liquidity needs into account

Different family members can have different liquidity needs. Real estate and alternative investments through private market exposures in the form of private debt, private equity, and venture funds can lead to significant illiquidity via lock-ins over pre-defined periods. Exits can get postponed depending on underlying portfolio quality.

On the other hand, public market exposures via direct stocks/bonds are liquid. Mutual funds score even better on transparency and liquidity, as well as in terms of impact cost (the cost of purchasing and selling securities, which large financial institutions can benefit from due to economies of scale).

Ensure sufficient diversification

Diversification is like creating a symphony within your investment portfolio. Transferring family wealth from your primary business into other assets is largely driven by a need to reduce concentration risk and create multiple sources of income. Thus, building portfolios with low inter-asset correlations and asymmetric returns and risk payoffs becomes key.

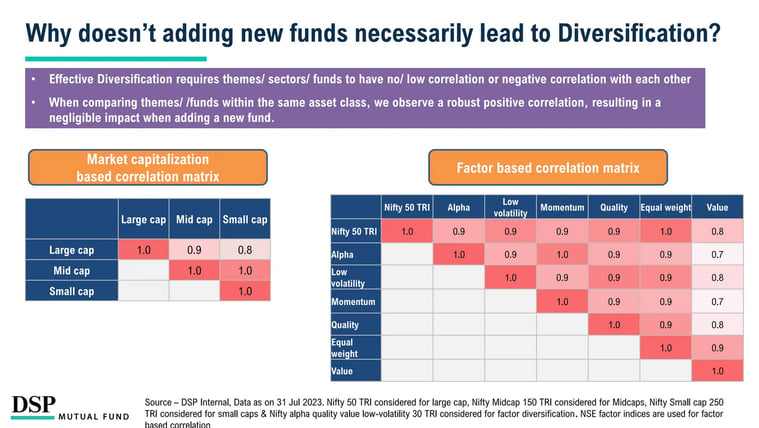

Unfortunately, simply diversifying on the basis of market cap or metrics doesn’t help much.

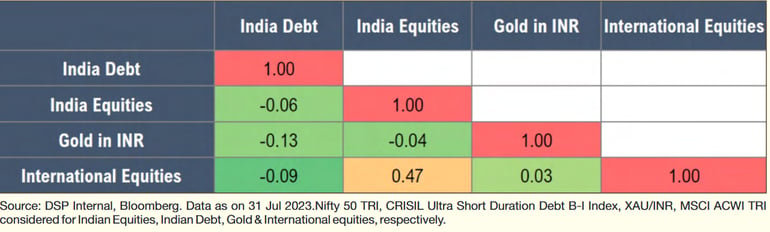

But if you introduce asset classes such as debt, gold, and international equities, you get the mostly negative correlations you’re looking for:

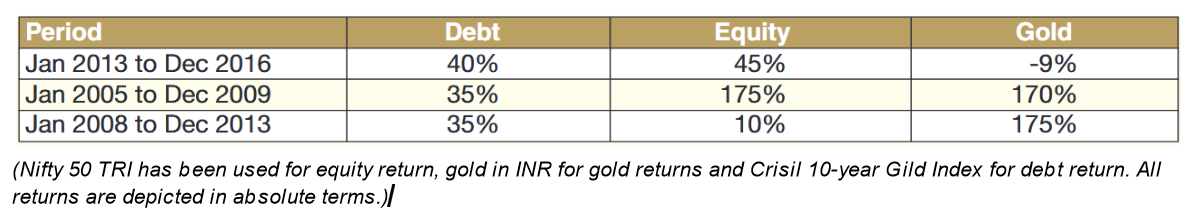

Relatively large and evolved family offices understand and execute this well. Indeed, such family offices add further asymmetry through geographical diversity and alternative investment buckets. But there are lots of smaller families, UHNWIs, budding entrepreneurs, and small- and mid-sized business owners who don’t have a defined structure to manage their wealth and rely on external advice for the same. For these groups, multi-asset allocation funds can make a big difference. Let us take some random periods and check asset class returns to validate the point:

If you don’t have the bandwidth to allocate funds across different asset classes, simply buying and holding a multi-asset allocation fund across cycles can be an efficient fix. Another uncomplicated way of achieving a conventional 60/40 growth portfolio is by simply buying an equity-bond fund that practises a buy-low-and-sell-high approach even through rebalances.

The above chart indicates 5-year rolling returns over a 15-year time period. The Nifty 50 TRI has a standard deviation of 7.25, as compared to 4.42 for a more balanced strategy. If you study the data available, the actual returns of balanced funds are mostly superior to those of Nifty 50 TRI over a 10+ year horizon with lower volatility.

Optimise your taxes

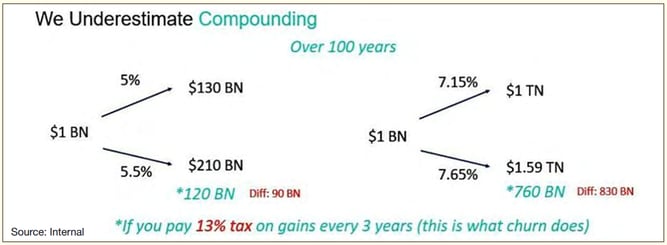

I find it rather strange when I see multi-generational wealth managers tracking quarterly and annual returns. Investors are often vulnerable to the recency and herd mentality biases. They tend to take on exposures that show better notional gains and panic-sell during short-term fluctuations. A lot of seemingly accretive churn can prove to be destructive. In the wake of compounding returns, you’ll end up compounding taxes paid as well.

Take a look at this chart: just a 13% tax over a 3-year period drastically alters the end corpus over 100 years.

The moral: As the base corpus increases, the adverse impact of churn on the final AUM figure grows dramatically.

Strive for low costs, but not lower!

Over the last decade, cost consciousness has increased in the investor community. The AUM of passive low-cost strategies grew from a humble 55,954 crores in December 2017 to a whopping 8,46,528 crores in December 2023. This increase of 1412% mirrors global trends.

Being cost conscious is great as long as you don't lose sight of the real objective, which is to generate alpha on the overall portfolio. An indexed strategy can only yield index returns minus cost and tracking error. We are witnessing greater large-cap flows into passives, but investors continue to prefer active management for small- and mid-caps. A key reason for the underperformance of active large-cap funds is that they have a low active share, and mostly end up doing closeted indexing.

Investing is probability driven. Any attempt to deviate sharply from the index can yield drastic outcomes in either direction. An investment manager with a well-documented framework that helps investors understand what they’re buying is more important than mere cost as a variable. Similarly, alternatives and PMS’s need to be evaluated along the fixed and variable cost dimensions, which is a topic that merits an article of its own. Simply put: costs must be low, but not necessarily any lower.

Value professional expertise

A common trend across unorganised setups is to have a trusted long-timer handling finances for the family as the investment decision maker. Unlisted exposures might often be identified based on word of mouth or ‘gut feel’, both of which have higher odds of going wrong than right. Investment is a specialised function, and you should aim to rely on experts for any investments in the public and private markets.

Distilling it all

Here’s a popular quote that expresses a key teaching of several great spiritual teachers:

"When you have to say something, think: Is it kind? Is it true? Is it necessary? If I propose to speak, will it improve on my silence?"

This operating principle can be fruitfully applied to the world of investing as well. Maybe you know someone who gained disproportionate wealth through a listed exposure, or by getting the commodity cycle right, or by seed funding a unicorn several years ago. And learning of such cases might tempt you to act on exotic pitches as well.

Whenever this happens, ask yourself the following:

Is this unkind to my portfolio, and catering to emotion rather than need? Is it necessary to change my current allocation? Is this true to my investment charter? Will this move be positively accretive compared to not doing anything?

About the author

Yamini Sood is Senior Vice President at DSP Asset Managers. She heads the Institutional and Family Office Business nationally. She has more than 20 years of rich experience in the financial services industry. Her professional experience evolved through advisory and sales roles in mutual funds, dealing with varied segments of institutional investors and family offices. She has a strong domain knowledge of capital markets and investor behaviour. A fanatic of personal finance, she has authored articles on this topic for Economic Times. She likes to sometimes blog or microblog her thoughts as well.Disclaimer

Leave a comment