The Unmistakable “Why” Behind Multi-Asset Investing

Imagine your financial future as an exquisite tapestry, every thread representing a unique investment opportunity. Now, picture yourself holding the power to weave those threads into a masterpiece that not only endures the test of time but also gleams with ever-increasing opulence. Welcome to the realm of asset allocation, where financial dreams evolve into vibrant mosaics of success.

Asset allocation involves strategically dividing your investments among different asset classes like stocks, bonds, real estate, and commodities. The goal is to optimize your portfolio's risk and return while aligning with your financial objectives.

While the desire to maximize returns is common, focusing solely on equities can lead to pitfalls.

The pitfalls of solely focusing on equity

Solely concentrating on equities is risky due to their volatile nature and susceptibility to significant drawdowns during market downturns. What can go wrong?

- Market Volatility and Drawdowns: Stock markets are inherently volatile, with prices responding to economic, political or otherwise unforeseen events. This can lead to substantial losses due to sudden crashes, like what happened during the 2008 Global Financial Crisis or the aftermath of Covid-19.

- Lack of Diversification: Over-reliance on equities by its very definition means that you will miss out on the benefits of diversification- spreading risk to earn stability even if one asset class falters.

- Emotional Stress: Exclusive focus on equities can lead to severe emotional stress, causing impulsive decisions driven by fear and greed. Not to cause alarm, but stock market crashes and losses due to (often uninformed) over-indulgence in the stock markets has also been linked to higher rates of deaths by suicide. On the flip side, asset allocation strategies will not outperform the equity market in times of secular bull runs or sudden rises, but they offer a much calmer, balanced journey, aiding investors even through good as well as bad times.

The power of asset allocation

Asset allocation is where the real power lies. By strategically diversifying your investments across different asset classes, you can achieve a more balanced and resilient portfolio.

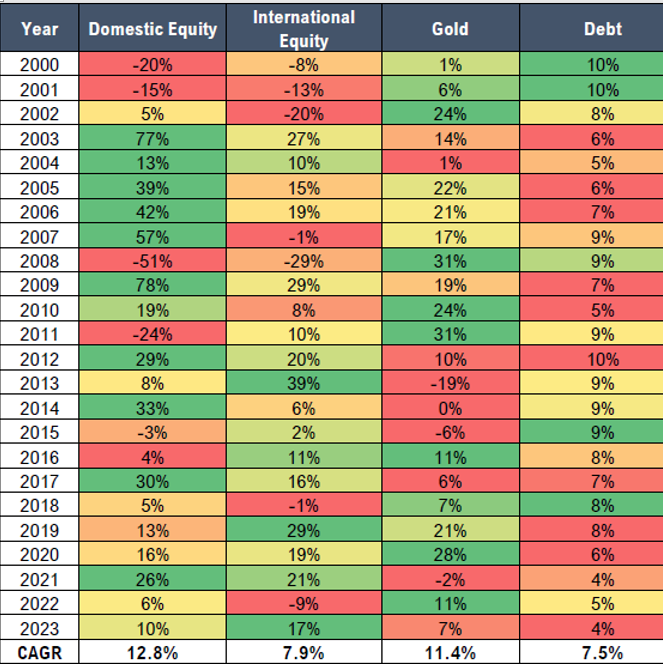

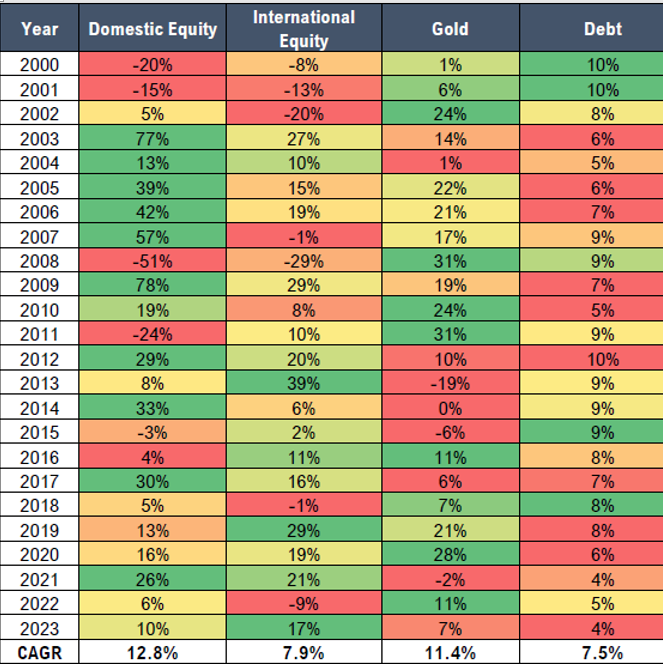

But why is this necessary? Look at the table below, which covers the performance of 4 different asset classes in each calendar year from 2000 to 2023.

Data as on 31 Jul 2023. Source: DSP Internal. Nifty 50 TRI, CRISIL Ultra Short Duration Debt B-I Index, XAU/INR, MSCI ACWI TRI considered for Indian Equities, Indian Debt, Gold & International equities respectively.

The simple story here is that no single asset class outperforms every time. The rankings change, and each of them can both outperform or underperform.

This is the ‘gold medal’ tally of outperformance in each calendar year over the past 23-24 years.

|

Asset Class |

Times Outperformed |

|

Domestic Equity |

10 |

|

International Equity |

3 |

|

Gold |

7 |

|

Debt |

4 |

Source: DSP Internal

While Indian equities lead the table, no single asset class outperforms all the time. Asset class performance varies significantly, and inconsistently: in 2000-2002, debt thrived while equities struggled; from 2003-2007, equities excelled; during the 2008 crisis, equities plummeted, while gold thrived.

Therefore, a mix of different asset classes is likely to help you navigate volatility better so you get a smoother investment journey and importantly, peace of mind.

Which asset class has given most returns over the last ~23 years to Indian investors?

— DSP Mutual Fund (@dspmf) September 4, 2023

𝗦𝗶𝗺𝗽𝗹𝗲: 𝗜𝗻𝗱𝗶𝗮𝗻 𝗘𝗾𝘂𝗶𝘁𝗶𝗲𝘀⚡

However, to earn those returns, you should have actually REMAINED INVESTED through all the ups & downs- including the Dot Com bubble bust in 2000,… pic.twitter.com/CJyDeKuxpr

Data over the past two decades clearly demonstrates the strength of this argument, as seen in the tweet above.

How can you do this?

Well, one simple way of doing this is to ‘trust an expert’, for instance, your Mutual Funds Distributor. They might be running exactly the process mentioned above, in their own unique way.

An easier way, especially for those who do not currently work with an expert MFD or an advisor, is to simply choose a Multi Asset Allocation based mutual fund scheme, that delivers this powerplay conveniently and effectively.

Click below to explore one such strategy and begin your journey towards multi asset investing today!

Disclaimer

In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house. Information gathered and used in this material is believed to be from reliable sources. While utmost care has been exercised while preparing this document, the AMC nor any person connected does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The recipient(s) before acting on any information herein should make his/their own investigation and seek appropriate professional advice. The statements contained herein may include statements of future expectations and other forward looking statements that are based on prevailing market conditions / various other factors and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. The sector(s)/stock(s)/issuer(s) mentioned in this presentation do not constitute any research report/recommendation of the same and the schemes of DSP mutual fund may or may not have any future position in these sector(s)/stock(s)/issuer(s). All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them. These figures pertain to performance of the index/Model and do not in any manner indicate the returns/performance of the Scheme. It is not possible to invest directly in an index.All data source is Internal unless specifically mentioned, and is up to Jul 31, 2023

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments.

Leave a comment