Tax Implications of Investing in Mutual Funds

The possibility of stellar returns has made mutual fund investments attractive for investors over the last few decades. But you don’t get to walk away with all the returns you earn on paper- you need to pay tax on the profits you book whenever you sell some of your holdings.

In this blog, we will give you a quick breakdown of the tax applicable to profits earned on different types of MF investments. Understanding tax implications is crucial because it allows you to make more informed decisions as you go on your investment journey.

Taxation on Equity Mutual Funds

Mutual funds yield returns either in the form of Capital Gains or Dividends, and both of these attract taxes.

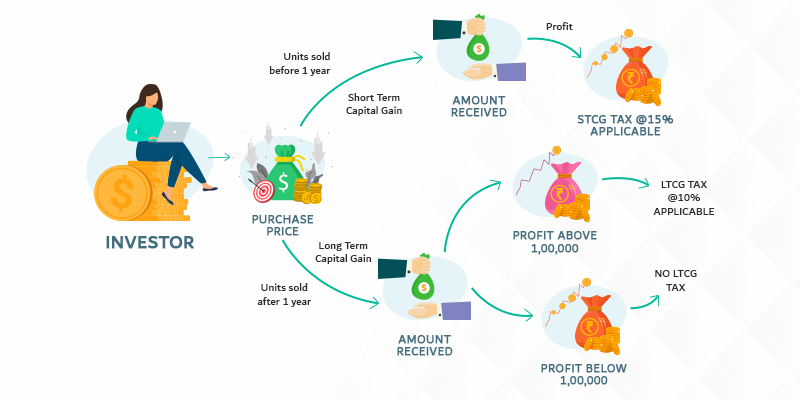

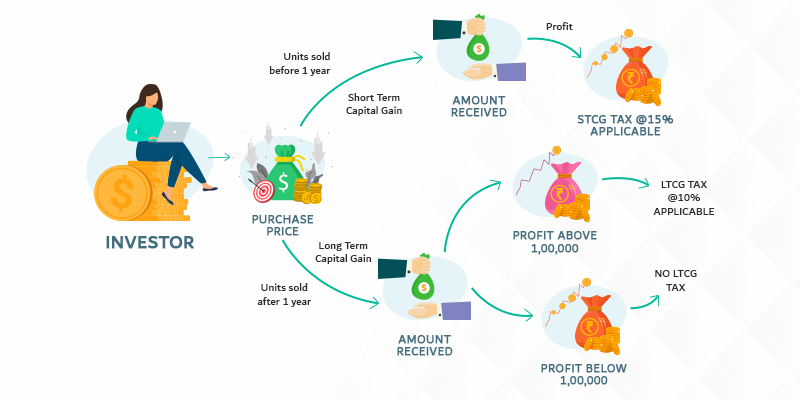

1. Capital Gains Tax

Capital gains refer to the profit earned when the units are sold and are taxable.

Your holding period for the units you’re selling determines the tax applicable to your capital gains. If you stay invested in an equity mutual fund for over a year, your gains will attract Long Term Capital Gains tax, whereas selling within a year will require you to pay Short Term Capital Gains Tax.

a. Long-Term Capital Gains Tax (LTCG):

You pay a flat 10% on the profits you earn when you sell an equity MF investment if the total profit earned in the financial year is over Rs 1 lakh. Unrealized capital gains do not attract tax.

For example- let’s say Mr. Shah invested in a high-performing mutual fund for the past few years. He invested Rs 75,000, which has now grown to Rs 1,20,000. If he decides to redeem his investment, he will be subject to a 10% long-term capital gains tax on his earned profit.

Mr. Shah’s capital gains: Rs 1,20,000 - Rs 75,000 = Rs 45,000.

Tax payable is 10% of Rs 45,000, which is Rs 4,500.

b. Short-term Capital Gains Tax (STCG):

Short-term capital gains attract a 15% tax. This tax is applied only to profits generated from selling equity MF units held for less than one year.

Suppose Mr. Shah sold units of another equity MF within six months of investing and earned a profit of Rs 40,000. He will then have to pay Rs 6,000 with additional cess as tax.

Note: Unlike long-term capital gains, short-term capital gains below Rs 1 lakh are taxable too.

2. Tax on Dividends

First off, since April 2021, the term ‘Dividends’ was replaced with ‘IDCW’ (Income Distribution cum Capital Withdrawal) based on a regulator instruction (SEBI).

IDCW payouts from mutual funds vary based on the option chosen once you’ve decided upon the scheme- ‘Growth’ or ‘IDCW’.

Investments in the Growth option do not earn IDCW payments. This happens only in case you’ve chosen one of the IDCW option/s. The IDCW amount, when paid out, is added to your income and attracts tax based on your income tax slab.

We recommend the Growth option to most investors since it can offer better post-tax returns to those in higher tax brackets. Unless you need a regular income stream from your investments, you don’t need to go for the IDCW option/s.

3. Securities Transaction Tax (STT)

Beyond tax on capital gains, when you buy or sell stocks or mutual fund units on a recognized stock exchange, a securities transaction tax or STT tax applies. It is 0.001% in the case of mutual funds and 0.1% in the case of delivery transactions.

Taxation on Debt Mutual Funds

There are no LTCG (long-term) tax indexation benefits available on debt mutual funds anymore* if their domestic equity allocation is less than or equal to 35% of their total corpus. The taxation of gains earned from such investments is based on STCG taxation.

However, if they allocate over 35% in domestic equities, they will not lose LTCG tax indexation benefits. Capital gains on debt mutual funds purchased after 1st April 2022 will be added to your income and taxed according to the income tax slab applicable to you.

Note that if your investment in a debt mutual fund was done before Apr 1st, 2023, the earlier tax rules would remain applicable, and if your units are held for over 36 months at the time you redeem, you will still earn indexation benefits.

We wrote a blog recently with a more detailed breakdown of all debt taxation regime changes. You can read it here:

Taxation on other Mutual Funds

Equity Linked Saving Schemes (ELSS): ELSS, or tax saver funds, are a popular choice to help save tax each Financial Year. These are equity mutual funds, hence subject to similar taxation rules. However, investments in this specific type of scheme can earn you further tax benefits- Investments of up to Rs 1.5 lakh can be claimed as a tax deduction under Section 80C of the Indian Income Tax Act.

Balanced/ hybrid/ asset allocation funds: These funds invest in two or more asset classes - typically equity and debt. Hybrid funds with more than 65% allocation to domestic equity in their portfolio are taxed similarly to Equity funds, others are taxed like debt funds. According to the tax regime instituted post Apr 1, 2023, gains on debt fund investments with domestic equity allocation less than or equal to 35% are treated as short-term capital gains and taxed according to the income tax slab. This creates another category of hybrid funds with an equity allocation of less than 65% but more than 35%. If held for over three years, profits earned on these funds are subject to 20% tax, and investors can enjoy indexation benefits.

Gold Mutual Funds: Investments in gold through mutual funds or Exchange Traded Funds (ETFs) are taxed similarly to debt funds.

International MFs and Fund of Funds: Gains from funds that invest internationally are generally taxed like debt funds. Again, according to the Apr 2023 tax regime update, international funds with less than 35% exposure to domestic equity will be taxed according to the income tax slab. In contrast, those with over 35% exposure will be treated as equity mutual funds.

SIP Taxation: When investing via Systematic Investment Plans (SIP), each SIP instalment is treated as a separate investment. If you redeem your investment after making SIP payments for 12 months, not all of your gains will be exempt from tax. Only the gains earned on the initial SIP instalment, which has completed one year, will be tax-free, and so on. Gains from the subsequent SIP instalments will be subject to short-term capital gains tax.

Conclusion

In essence, most mutual funds are taxed based on the inherent feature of being either equity-bent or more debt-oriented. So, awareness of the tax implications associated with mutual fund investments is essential. Understanding the various taxes and the factors determining them allows you to make informed decisions and set expectations appropriately.

Do you want to know what kind of mutual funds could be right for you and how to start building a sound portfolio? Drop your details here, and we’ll get in touch with you!

*Prior to 1st April 2023, debt taxation was based on the holding period. Any profit upon selling debt MF units within 36 months of purchase was treated as a short-term capital gain and units held for more than 36 months attracted tax based on long-term capital gains, with an indexation benefit (cost price adjustment for inflation)

Disclaimer

In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house. Information gathered and used in this material is believed to be from reliable sources. The AMC however does not warrant the accuracy, reasonableness and / or completeness of any information. The above data/ statistics are given only for illustration purpose. The recipient(s) before acting on any information herein should make his/ their own investigation and seek appropriate professional advice. This is a generic update; it shall not constitute any offer to sell or solicitation of an offer to buy units of any of the Schemes of the DSP Mutual Fund. The data/ statistics are given to explain general market trends in the securities market and should not be construed as any research report/ recommendation. We have included statements/ opinions/ recommendations in this document which contain words or phrases such as “will”, “expect”, “should”, “believe” and similar expressions or variations of such expressions that are “forward looking statements”. Actual results may differ materially from those suggested by the forward looking statements due to risks or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on our services and/ or investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices etc.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

.jpg)

Leave a comment