How 'rolling down' can help you feel better 😊

Equities are generally regarded as risky investments. With them, there’s a chance you might end up getting a return that diverges greatly from what you expected. Both positively and negatively. While equity-based mutual funds can apply various kinds of strategies to try and mitigate such risk, at the end of the day, they too can produce unexpectedly divergent returns.

And why do most people like equities? Because of the potential of returns.

Now, debt investments lose out to equities when it comes to retail investors, due to them being thought of as offering something somewhere between the ‘excitement of equity’ and the ‘guarantee of Fixed Deposits (FDs)’.

Now, what if I told you that there’s a certain kind of debt strategy that helps you earn close to a ‘fixed’ return rate, but one that’s potentially better than that of most FDs?

The underdogs among (debt) funds

I can sense that your ears just perked up- strange title for a specific kind of debt funds, isn’t it?

But first, let’s address what debt funds are. These funds invest in various kinds of debt instruments, including bonds, commercial papers (CPs), certificates of deposit (CDs), and treasury bills (T-bills). Debt funds that invest in short-term (i.e. 1 year or lower) debt instruments are often referred to as money market funds.

Debt instruments typically have two components: the principal and the interest. When you buy a debt instrument, you are entitled to a periodic interest payment at a pre-decided rate, and will also receive the principal when the instrument matures. Thus, debt instruments are considered to be a more predictable, stable way to generate regular income (than equity investments).

The wrench in the works

The problem with this rosy picture, however, is something called interest rate risk. Let’s say I buy a bond with a maturity of five years and an interest rate of 7%. Two years down the line, my bond has become the equivalent of a new three-year bond. Now, if interest rates have risen in the meantime, then someone aiming to buy a bond at that point could pick up a freshly issued three-year bond offering perhaps a higher interest rate of say 9%.

In other words, the (originally 5-year but now) three-year bond I hold is offering me a lower rate of interest than a new three-year bond. Which means that the former is less valuable than the latter. This affects me negatively in two ways:

- If I was planning to sell my bond for a profit in the secondary market, then that may not be possible any more as its price will have dipped and buyers may be difficult to find, and

- If I had initially bought a two-year bond instead of a five-year bond, then I could’ve picked up a three-year bond right after that first bond’s maturity, and I would’ve been earning a better cumulative interest rate right now.

Of course, if interest rates had declined instead, then I would’ve been in a much better position. But there’s no guarantee which way interest rates will go, which means that although debt instruments can offer you a ‘fixed income’, there’s always some interest rate risk attached to them, which affects its effective return rate over time.

‘Roll-down strategy’ to the rescue

Like I said above, certain kinds of debt funds can, in fact, come close to offering steady and relatively high return rate. How do they accomplish this feat?

The answer is that they deploy something called a roll-down strategy. There are two key ideas underlying this strategy:

- Buy and hold debt instruments until maturity, and

- Purchase new debt instruments over time in such a way that the effective maturity period of the portfolio overall is targeted to be kept roughly constant.

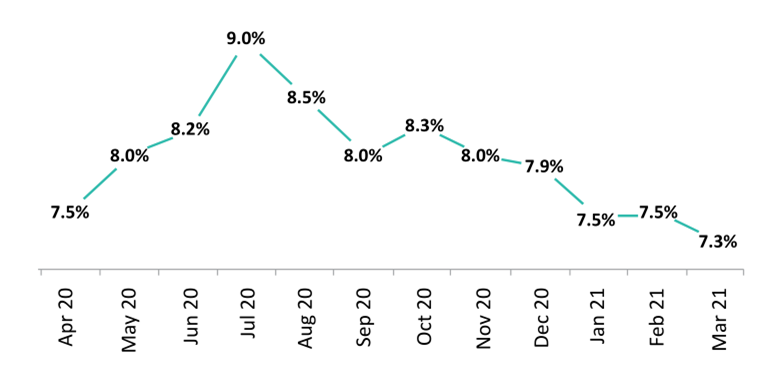

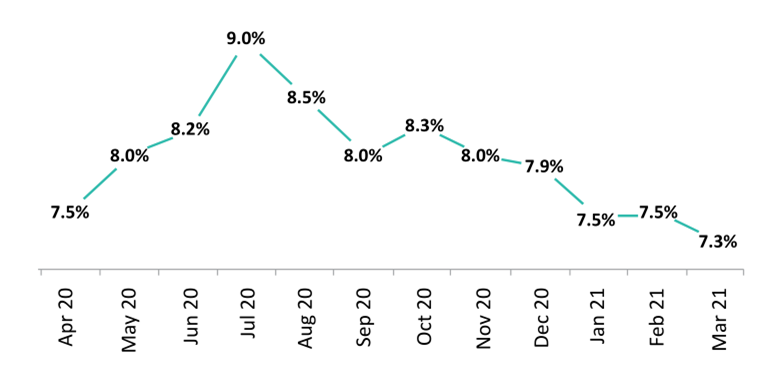

Let’s say that there’s a debt fund that follows a one-year roll-down strategy. In other words, the maturity period of the portfolio at the beginning is roughly one year. Assume the fund operates on a cycle that starts in April and ends in March. The expected returns (ignoring expense ratios for now) for investors entering the fund will differ from month to month, and might look something like this:

This means that an investor entering the fund in July 2020 could’ve expected an effective annual return rate of 9.0% if invested until March 2021. But how can the fund provide such a steady rate, given that interest rates fluctuate constantly?

This is where it gets interesting. We can see that the expected return rate for January 2021 is 7.5%. This is lower than the 9% for July 2020, which means that an investor entering the fund in January 2021 will get a lower return rate than someone who entered in July 2020.

Why this difference, though? The most likely explanation is that interest rates must’ve risen during this period. Now, remember how we discussed in the previous section that as interest rates rise, the price of existing bonds goes down? Thus, as the interest rates rose, the existing assets of the fund must’ve fallen in value (i.e. they took on unrealized losses). As a result, someone who entered the fund in January 2021, when the fund value was relatively depressed, would’ve gotten a relatively lower return rate.

However, and this is the key point, the fact that the interest rates rose during this period means that all the fresh debt instruments purchased by the fund during this period offered an interest rate higher than 9.0% (i.e. the interest rate that prevailed in July 2020). These higher interest rates can counterbalance the fund’s unrealized losses in such a way that for investors who entered the fund in July 2020, the net result works out to be a roughly steady annual return rate of 9.0%!

Even if the interest rates had fallen during that period, a similar counterbalancing in the opposite direction would’ve worked to produce a roughly steady rate of return for investors.

Quite ingenious, wouldn’t you agree? Of course, there are no guarantees that such counterbalancing will be perfect, but it can come quite close.

Blast past FD rates with roll-down strategies

To sum up, roll-down funds offer relatively predictable return profiles, which can make them far less risky than most equity-based funds. Moreover, roll-down funds with relatively short maturity periods often experience less choppiness due to fluctuating interest rates, making them steadier than other short-term debt funds.

Thus, all in all, such funds can be ideal for investors looking to park some funds for a certain period of time, while also enjoying returns that may rival or surpass those offered by savings accounts and FDs- especially when you consider applicable taxes and how in general many debt funds can offer more tax efficient returns than fixed deposits.

Shatter the traditional way of saving, switch to the smarter side! If this roll-down approach sounds interesting to you, check out one of DSP’s roll-down debt strategies that can be a good alternative to letting your hard-earned money remain underworked or worse, idle!

Disclaimer

This note is for information purposes only. In this material DSP Investment Managers Pvt Ltd (the AMC) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author or the AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. Any sector(s)/ stock(s)/ issuer(s) mentioned do not constitute any recommendation and the AMC may or may not have any future position in these. All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them.

Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

.png)

Leave a comment