(Not) Being Monica in the Stock Market!

You must’ve heard of Friends, right? The insanely popular sitcom from yesteryear?

Sorry, but this is going to be my reaction if you tell me you haven’t heard of it.

Sorry, but this is going to be my reaction if you tell me you haven’t heard of it.

There’s only one episode of that show that touches on the stock market, but it’s got a lesson many of us might not want to hear. 🤔

So what happens is that Monica (one of the titular friends) accidentally discovers a stock on TV whose ticker symbol is ‘MEG’*, which happen to be her initials. And that’s enough to throw her into a tizzy whenever that stock appears on TV.

Some time later, knowing that MEG has been doing very well but knowing absolutely nothing about the stock market (apart from “Buy, sell! High, low! Bears, bulls!”), she decides to buy two stocks with the symbols CHP* and ZXY*.

Why those? Well, CHP because Monica had a crush on an actor who starred in a show called ‘CHiPs’, and ZXY because it sounded ‘zexy’.

What a noob!

Yes, you know and I know that emotions have no place in stock picking: it’s no joke, and it takes a lot of work.

But what if I told you that most individual investors who pick stocks do end up faring rather poorly? In other words, what if most of us are Monicas?

Well, you don’t have to take my word for it. Let’s look at some concrete figures and see what they say!

Numbers don’t lie

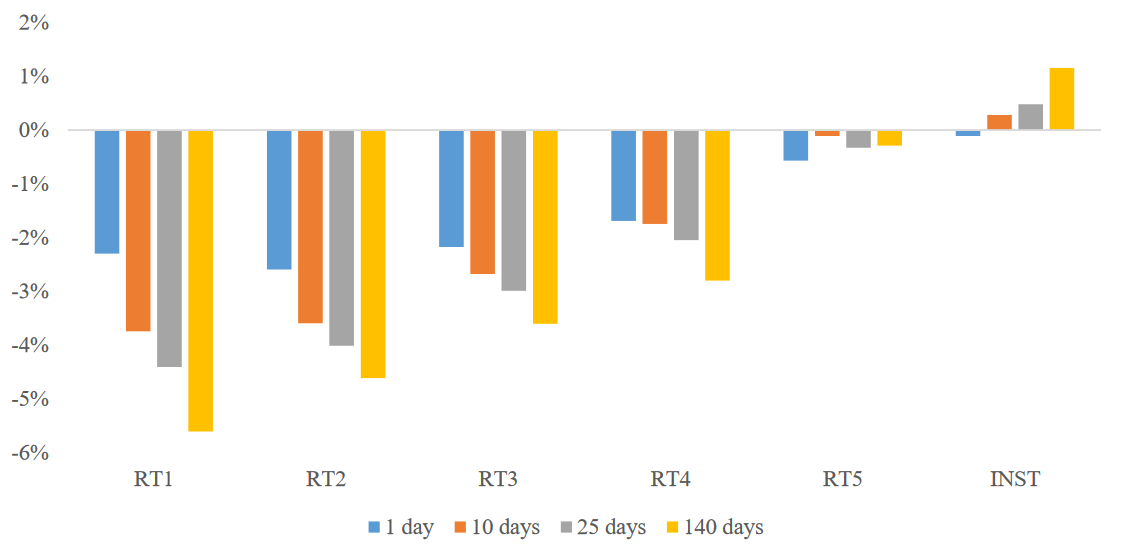

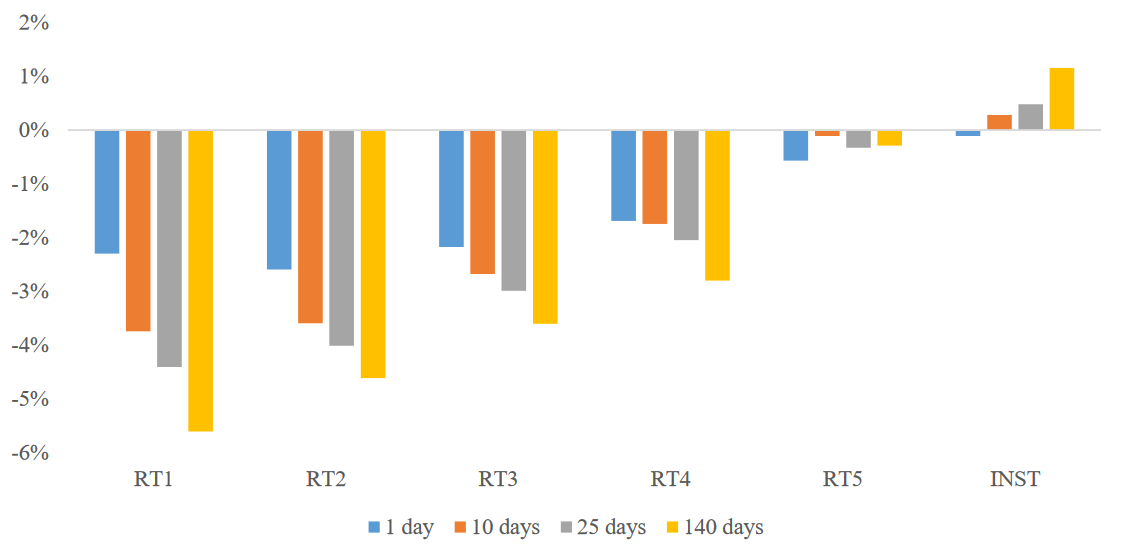

In 2019, a group of researchers conducted a study that looked at the performance of a whopping 53 million trading accounts in China over the period 2016-2019. These accounts were split into two broad classes: institutional investors (INST) and retail investors (RT). The retail investors were further split up into five sub-classes (RT1 - RT5) based on their average account size (with RT1 being the lowest and RT5 being the highest).

The researchers’ conclusion is worth quoting from

“[I]f we track the aggregate trading from the smaller retail investors group, the annual performance is -5.61%, primarily due to poor stock selection ability and trading cost, while large retail investors have a close to zero annual return, where their stock selection ability is offset by trading cost.”

In other words, retail investors just can’t catch a break. But what if these results simply reflect a bad patch in the markets? Well, let’s take the China-oriented index ‘MSCI China A Onshore Price CNY’ as a proxy for the performance of the broader Chinese market over the study period (January 2016 to June 2019). Between 1 January 2016 and 1 July 2019, this index went up 10%. So clearly, it’s not as if the market had doomed retail participants to failure.

Total performances over different portfolio holding days

Source: MSCI China

Remember that in terms of its financial markets, China is also considered to be an emerging market like India. So the findings of the Chinese study discussed above are likely to be broadly applicable to India as well.

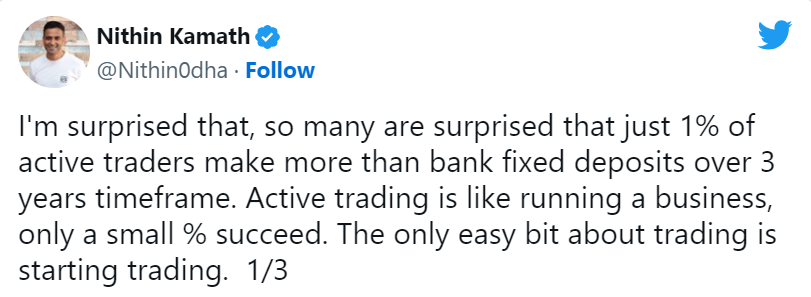

Do traders fare any better?

OK, so picking stocks to invest in seems to be fraught with risk. But what if you just decided to trade stock derivatives (i.e., futures and options, or F&O) instead? Can you regularly make a tidy profit by simply riding market trends and holding securities for very short periods?

Unfortunately, the answer is pretty much a resounding ‘No!’.

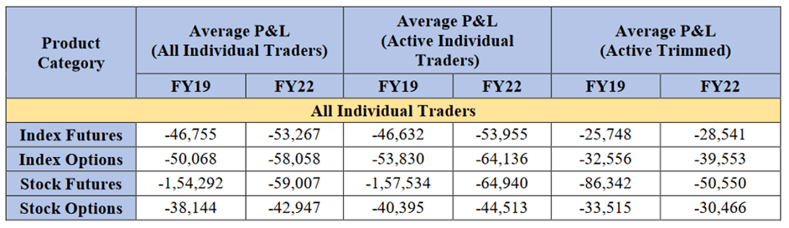

Research by SEBI has shown that during FY21-22, almost 90% of individual equity F&O traders lost money. And we’re not talking about trivial sums either: the average loss during this period was ₹1.1 lakh!

The level of trading activity made little difference: as long as you were trading, you were extremely likely to end up with a loss.

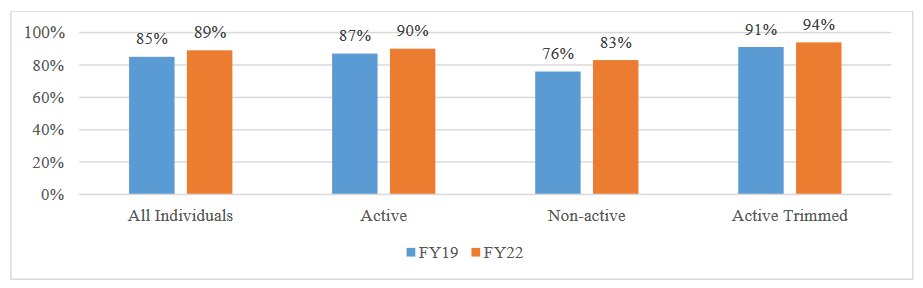

Percentage of loss-makers

Note: (‘Active Trimmed’ refers to the set of ‘Active’ traders excluding outliers) ; Source: Sebi

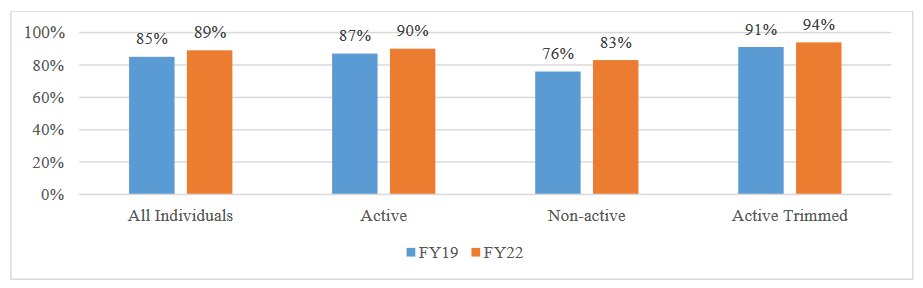

Nor did the precise choice of product flip traders’ fortunes: on average, trading in index futures, index options, stock futures, and stock options all resulted in a loss. It should be noted, however, that stock futures traders posted the biggest average losses. 😰

Product-wise net profit/loss of individual traders

Note: The figures mentioned are actual in (Rs); Source: Sebi

Note: The figures mentioned are actual in (Rs); Source: Sebi

So no matter how you slice things, it seems to be an inescapable conclusion that trading stock derivatives is a losing proposition.

The perils of stock picking

The most fundamental thing the studies above are telling us is that retail investors can’t pick stocks or stock derivatives all that well. And that should come as no surprise: they lack the time, expertise, and resources necessary to make informed investment or trading decisions.

In addition, going beyond this study, most individual investors are probably trying to time their entries and exits as well, which is not a great idea, to say the least. 😖 Moreover, they often fall prey to their personal biases and emotions when selecting stocks.

Lastly, individual investors might not have the self-control to stick to their investing plans. They can be tempted to act hastily based on recent news headlines or short-term market swings. As a result, they may get caught in a loop of buying and selling that raises transaction costs while lowering the overall returns.

One solution to fix them all?

Given all this, it sure looks like Indians who are investing in stocks or trading stock derivatives are probably frittering their hard-earned money away. So what should they do instead?

Perhaps, invest in a mutual fund. Mutual funds are professionally managed investment products that take money from multiple investors like you to buy & maintain a diversified portfolio of stocks, bonds, or other securities. The expert professional running the ship, the fund manager, is responsible for making investment decisions and managing the portfolio on behalf of the investors.

Let’s see how investing in a mutual fund would address all of the issues traders fall prey to:

- No time / energy / expertise needed for you to do research: It’s the fund manager’s job to do this on your behalf!

- Your own personal biases and emotions getting in the way: the fund manager is paid to be rational at all time, generally requiring a well-defined model/ protocol for dealing with various kinds of market scenarios.

- Your lack of investing discipline: The fund manager’s framework will add the discipline to investing or to your portfolio you mostly won’t be able to all by yourself.

- No heartache of single-stock losses: by their very nature, mutual funds diversify your investments and try to reduce the risk of 1-2 stocks not doing well at a point in time. Since you’re not putting all eggs in one basket, you’re likely to feel better.

But don’t just jump into investing, even if you’re sold. Understand your risk profile first, to make sense of what kind of investments you should be making. We can help you do this for free, via our automated risk assessment tool SARTHI. Click below to access it now!

Or if you’d prefer to speak with an expert who can guide you, fill out this form to request a call back.

A clear pick-ture!

"Stock picking is both an art and a science—too much of either is a dangerous thing."

— Investment Wisdom (@InvestingCanons) April 1, 2023

— Peter Lynch

All in all, the odds are heavily stacked against individual investors and traders trying to pick winners. And it’s not just your over-enthusiastic stock market rookies and gyaan-dropping “uncles” who get burnt.

A couple of months ago, a colleague Rakesh invited me to his place for a Sunday brunch. When I walked in through his door, I spotted what looked like a prayer area. But I was surprised- Rakesh wasn’t religious at all! A closer look revealed that his god was very different from most other people’s: the little prayer area had three garlanded photos of a famous, ace Indian stock picker - let’s call him RJ :)

Rakesh said that his day began with an aarti dedicated to RJ, that he knew multibaggers were the only way to make money, and that he had confidence that anyone can ‘DIY’. He had even invested in some stocks in the past that came recommended by RJ.

In his frenzied excitement, Rakesh rattled off a couple of stock names he had invested in & expected to be a multi bagger, over 10 years ago- a leading banking mid cap stock & a renewable energy small cap stock. He said I should consider getting into them too- “long term ka game hai, paisa hi paisa hoga!”

I opened my fintech app, with some excitement. Which disappeared instantly. Both these stocks, over the 10-year period, were in the red! Was Rakesh living purely on hope? Or some tip? Or some inside information? Who knew? But he certainly had killer confidence to continue on the path. Maybe it was just optimism bias.

Seeing his face turn red as I investigated the evidence right in front of him, I volunteered to show him a better way, if he was interested. I showed him the one small cap fund investment I had made at a similar time. Boring, unsexy, as compared to Rakesh’s ‘bets’. But it had returned over 20% CAGR on average over the 10-year period. The reaction? Admission that he had lost money in the past and was struggling with his decisions!

Long story (not so) short, while I was leaving post lunch, I gave him the name & contact number of my MFD.

The next time I visited his place, which was last week, Rakesh’s ‘prayer area’ had been replaced by a rack of fruits and vegetables. Many of the stocks Rakesh owned had been sold. A couple of small cap mutual funds had been bought.

Numbers won over emotions. The spell was broken. Rakesh was no longer a Monica. 😀

* This is a fictitious ticker symbol: any resemblance to any past or present company is purely coincidental.

Disclaimer

In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house. Information gathered and used in this material is believed to be from reliable sources. The AMC however does not warrant the accuracy, reasonableness and / or completeness of any information. The above data/ statistics are given only for illustration purpose. The recipient(s) before acting on any information herein should make his/ their own investigation and seek appropriate professional advice. This is a generic update; it shall not constitute any offer to sell or solicitation of an offer to buy units of any of the Schemes of the DSP Mutual Fund. The data/ statistics are given to explain general market trends in the securities market and should not be construed as any research report/ recommendation. We have included statements/ opinions/ recommendations in this document which contain words or phrases such as “will”, “expect”, “should”, “believe” and similar expressions or variations of such expressions that are “forward looking statements”. Actual results may differ materially from those suggested by the forward looking statements due to risks or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on our services and/ or investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices etc.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

.png)

Leave a comment