The Art of Untiming

Imagine yourself vacationing at a hill station. An alarm rings in the wee hours. You know exactly what it is for, so you leave your blanket, prepare a cup of black coffee for yourself, and go sit by the window. It’s still dark; You wait. You put on your headphones and these beautiful lines from the evergreen song play on them:

हो, एक लड़की को देखा तो ऐसा लगा

एक लड़की को देखा तो ऐसा लगा

जैसे सुबह का रूप,

जैसे सर्दी की धूप

जैसे बीणा की तान

जैसे रंगों की जान

जैसे बलखाए बेल

जैसे लहरों का खेल

जैसे खुशबू लिए

आये ठंडी हवा

हो, एक लड़की को देखा तो ऐसा लगा

… and the sun peeps out from behind the mountains. P E A C E. Or maybe, something even more divine.

Timing. A thing of beauty. It has the superpower of making any normal frame transcend the dimension of years, decades.

Murat Oztuk captured this stunning scene of an ant trying to take down a flying wasp. See, simple, yet majestic.

This image of the solar eclipse in Chiayi, Taiwan, was captured by Joe, owner of an expedition company in Iceland. The timing makes the photo appear almost animated. I’m sure you agree, surreal would be understatement!

But, just like any other thing which is short-lived, timing too is a tough bird to catch. And it has two faces, something like what Uğur Gallenkuş, a Turkish graphic designer creates through dramatic collages by combining photographs from different parts of the world to show the extreme contrast between them. His art is truly eye-opening.

But, is timing only beautiful behind the lenses, or does it make a difference in other walks of life, say your personal finances, for instance?

I remember, when I joined the beautiful industry of asset management in May 2013, someone told me thematic funds were the best bets at the time. I had 100% of my portfolio invested in thematic funds and had my own honeymoon to be planned with that kitty. In the next two years I made 30%+ CAGR returns and my stay in Thailand was absolutely amazing.

Could I have gone wrong? Oh yes! And that could have led to a destination shift for my honeymoon from Thailand to Sundarbans. Not a very bad outcome, but certainly no foreign trip that I oh-so-wanted!

What are your chances in getting as lucky as I was? And is the chance worth taking?

To test that, let us for the time being place ourselves in the driving seat of an investment portfolio with a time machine switch at hand.

From 12th May 2021 to 12th May 2022, there were 249 days that the market was open. For 129 days, the market closed on a positive (higher than the previous day). For 120 days, it closed negative (lower than the previous close).

So clearly, you had to have immense luck to get it right every time you tried. The probability for a swing either way was almost equal.

So my next question is, is this guessing game needed at all?

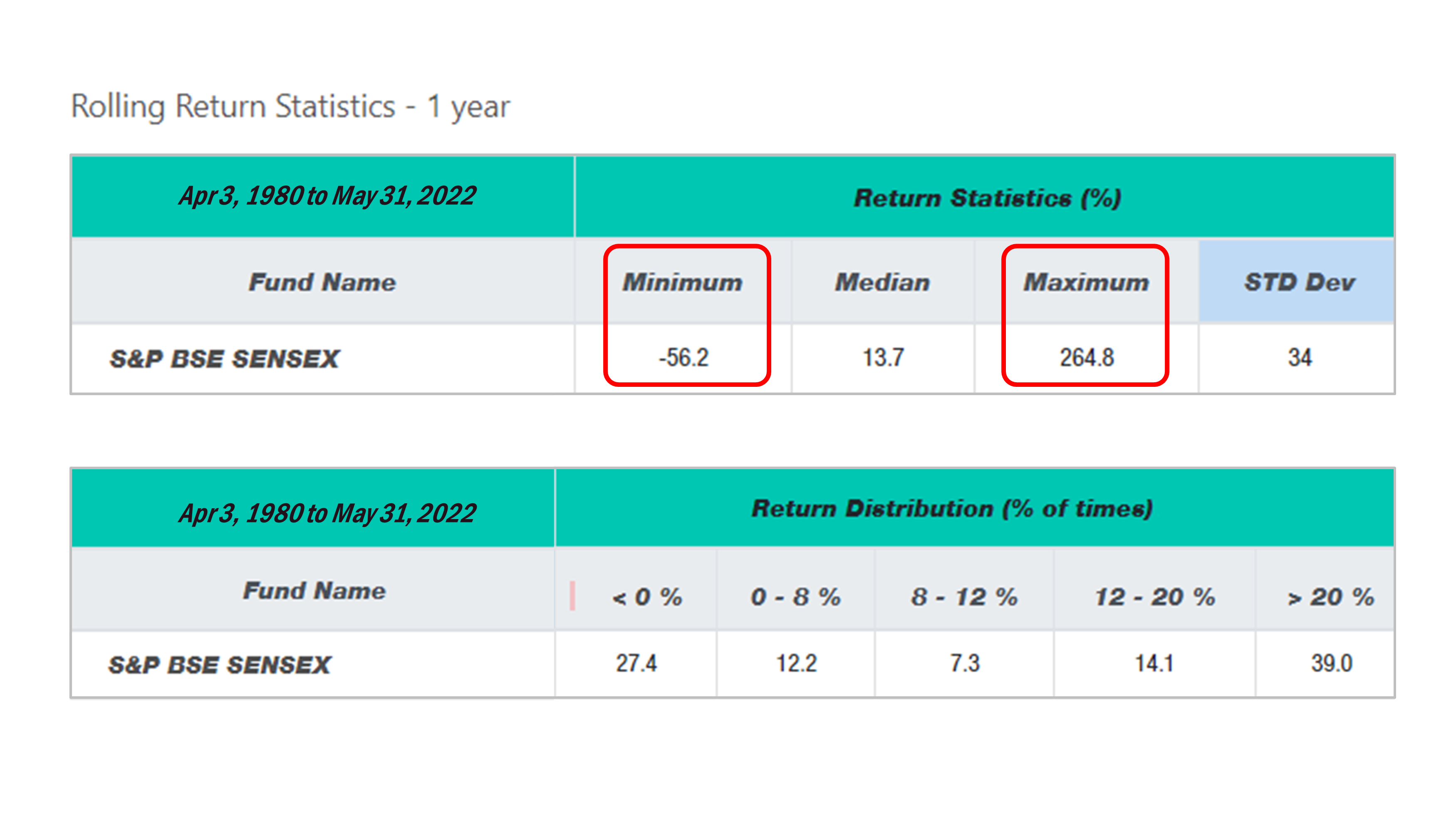

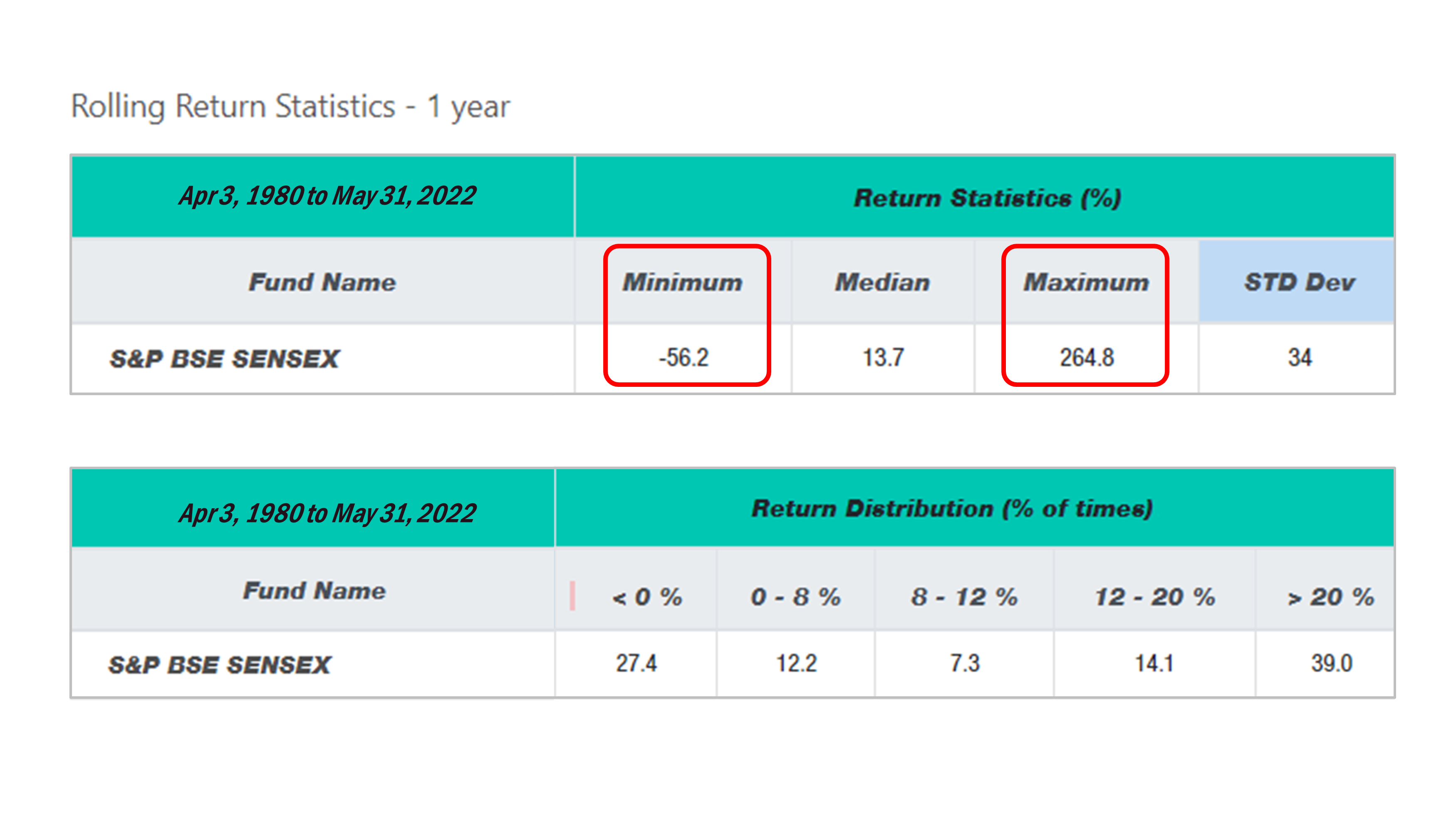

Whoever has ever invested in equity (let’s take Sensex as a starting point) and stayed for 1 year, let’s see how their experience have been. Here is the BEST/ MOST LIKELY/ WORST experience with Sensex returns in a 1-year period:

In what percentage of any 1-year period would you have earned:

- Negative return: 27.4% of times

- 0-8% return: 12.2% of times

- 8-12% return: 7.2% of times

- 12-20% return: 14.1% of times

- >20% return: 39.1% of times

(Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. These figures pertain to performance of the index/Model and do not in any manner indicate the returns/performance of the Scheme. It is not possible to invest directly in an index)

Click to view in higher quality

Looking at the data, clearly for a ONE YEAR horizon timing matters. You need to be a soothsayer to be able to get it right!

- Good timing = your highest reward has been 264.8%

- Bad timing = your worst punishment has been -56.2%

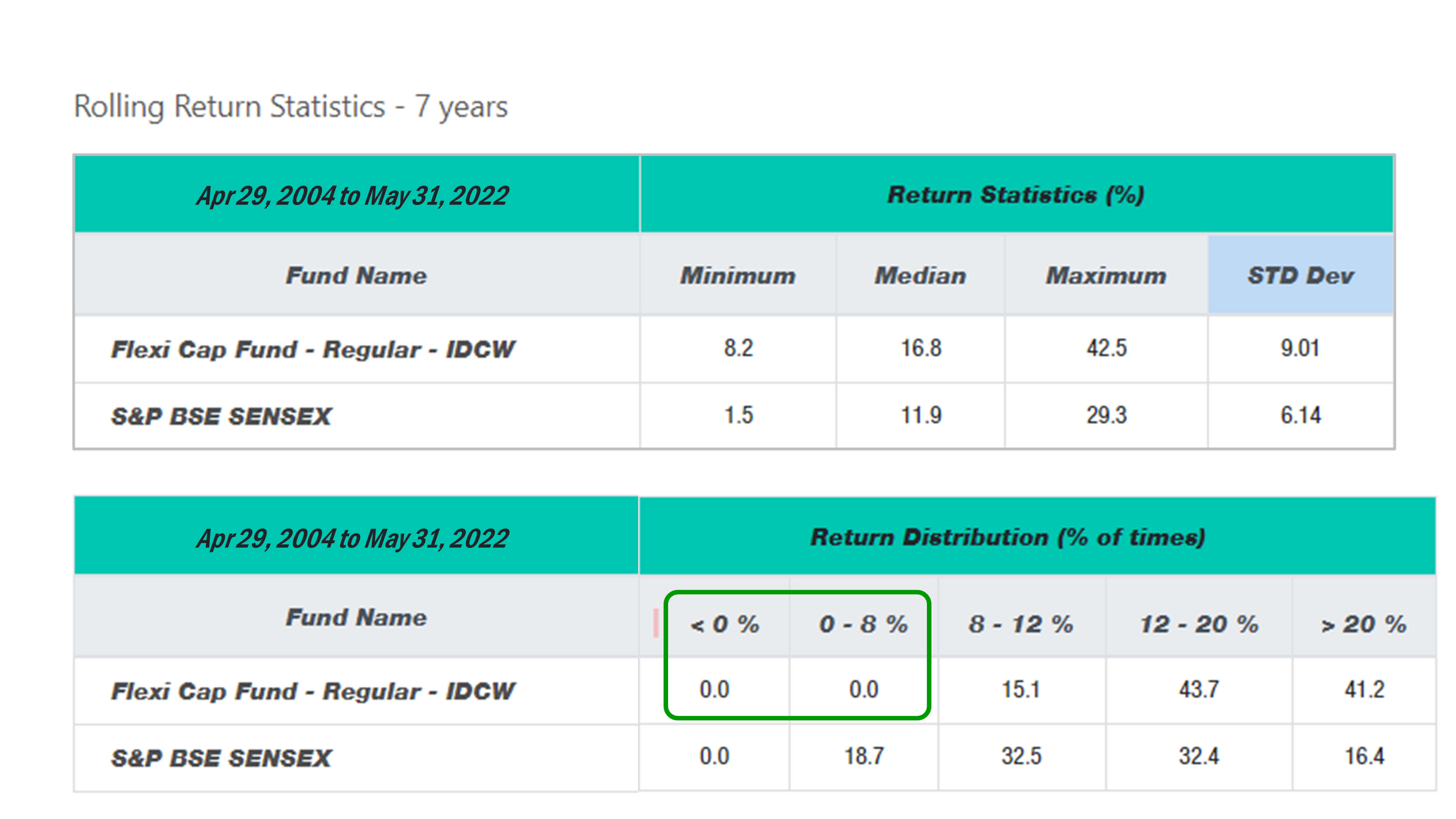

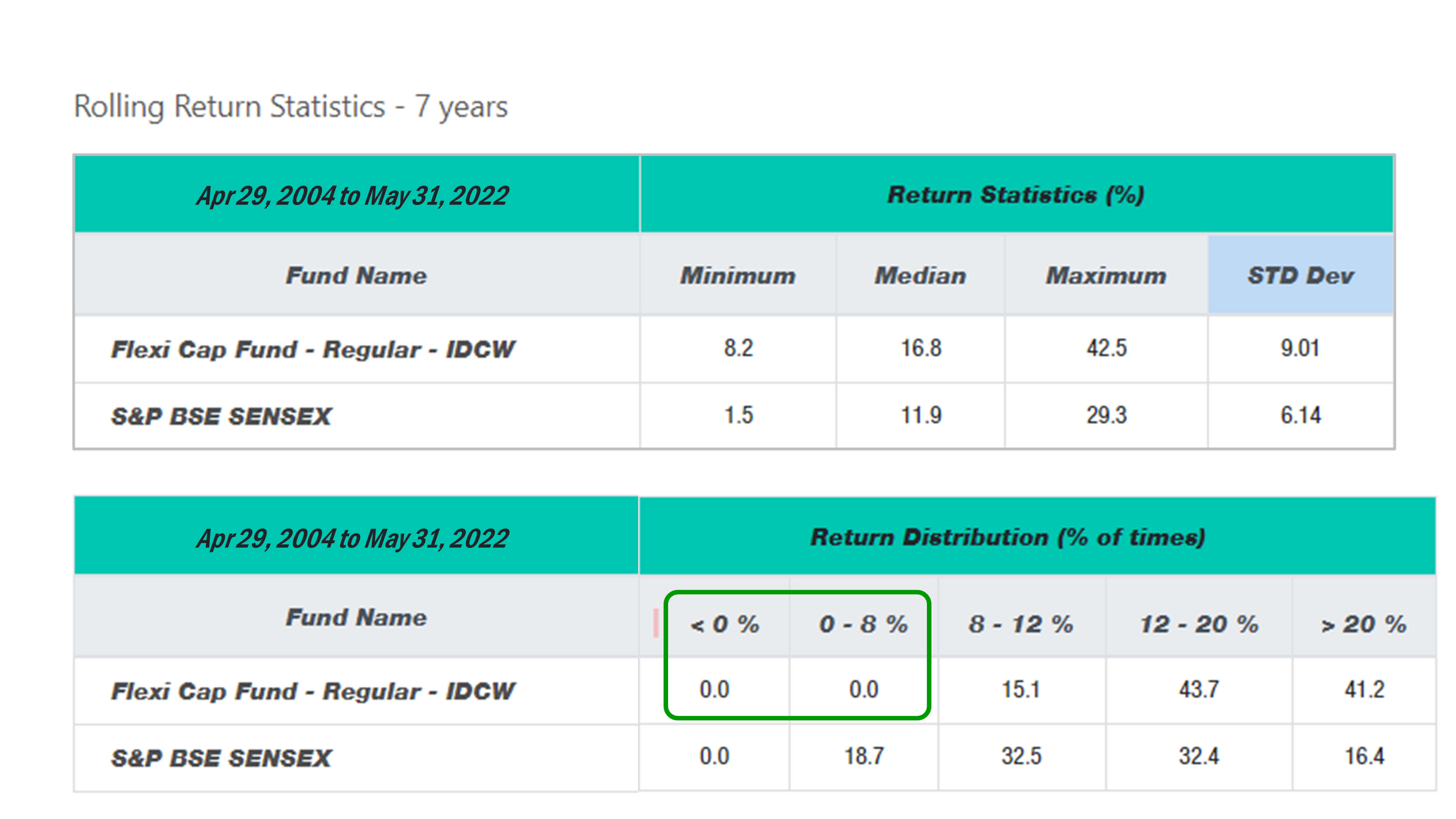

Now, let’s keep everything same and see what was the experience in any 7-year period. This time, I have added DSP Flexi Cap Fund too, to have an idea of experience in an actively managed fund, just as an example.

Flexi Cap Fund-Regular-IDCW = DSP Flexi Cap Fund - Regular - IDCW

Click to view in higher quality

If an investor has been given 7 years’ time, the experience has NEVER been disappointing.

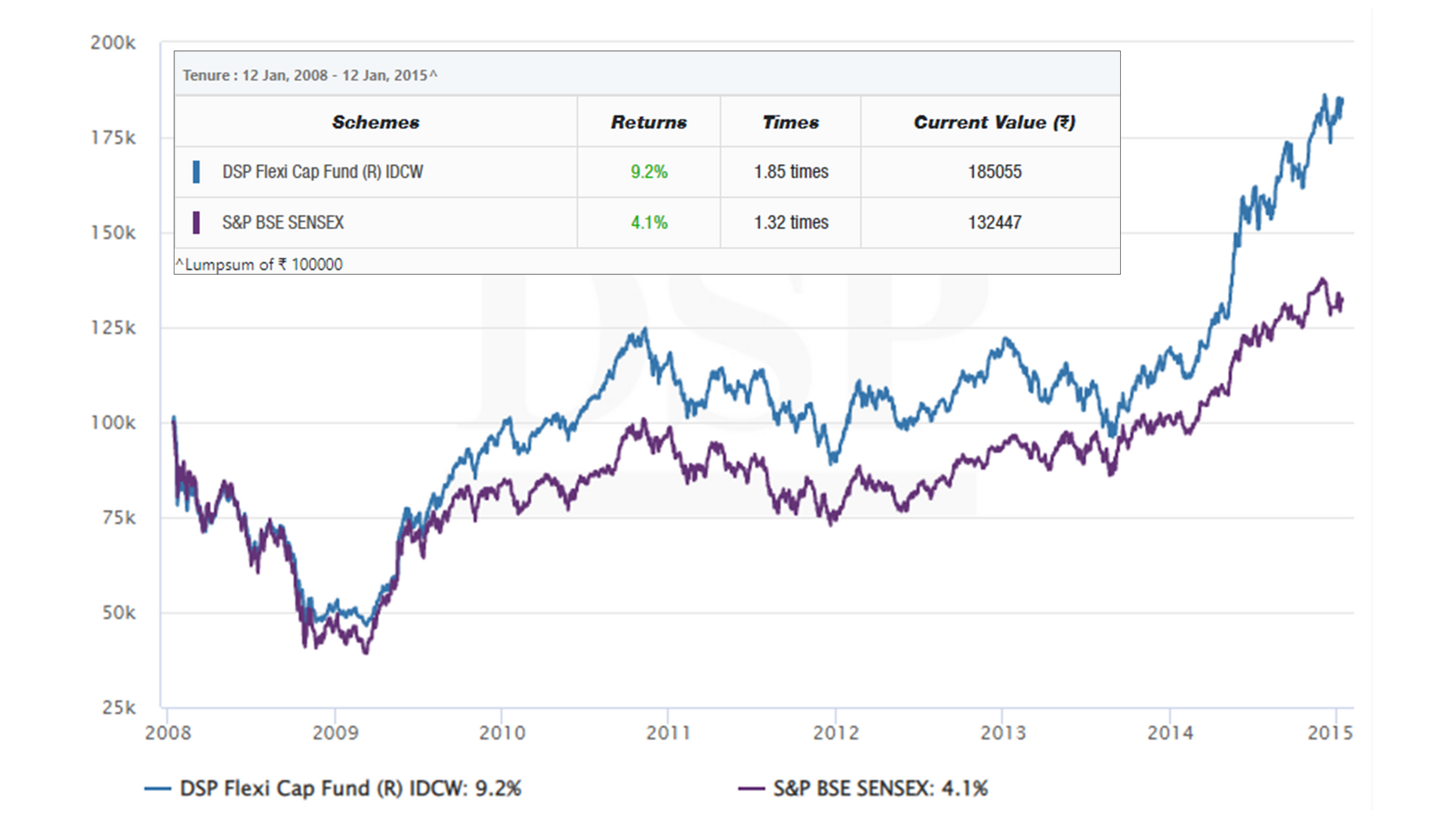

Never? Really? What if my entry was one of the worst ones? What if, on a wintery morning of 2008, when everything around reflected nothing short of a rainbow, you decided to put in a lakh in this fund and everything started slipping away from beneath your feet?

Imagine if you had put in Rs 1 lakh in DSP Flexi Cap Fund (Regular, Growth) on 12th Jan 2008, in the next nine months, the market tanked by 60%+! A horror movie, indeed! But as we all know, every horror movie has a priest who comes out as the saviour. Let’s say you waited for that priest with your only talent = the Art of Untiming, and stayed on.

Had you held on for 7 years, your investment’s value would have grown to Rs 1.85 Lakh – a 9.2% annual return.

Click to view in higher quality

Was it smooth? No.

Did investors see the fund value going down in between? Yes, more than once. In fact, the Rs 1 lakh became Rs 48,000 by 17th March 2009, but as we say, time is the great healer. If you gave it time, you gave yourself a chance.

-png.png?width=1806&name=Art%20of%20Untiming%20-%20Chart%202%20(1)-png.png)

-png.png?width=1806&name=Art%20of%20Untiming%20-%20Chart%202%20(1)-png.png)

Click to view in higher quality

Just like this, one can produce thousands of other examples to check and discover whether timing makes you feel good. But if you believe that good companies reward investors eventually, a well-laid process for selection of an equity basket is likely to not fail to make investors smile in a suitable time frame- as they say, in the long run.

Let me present one more story.

Sir Alex Ferguson is regarded as one of the best football managers ever - he built the dynasty we call Manchester United. Did you know that he had replaced the previous manager Ron Atkinson in 1986, but won his first trophy only after 4 LONG YEARS in 1990 - the FA cup? Rumour has it that he was almost on the verge of getting fired in the days leading up to this trophy. He then led Manchester United on the course to win 37 trophies in the next 23 years. Absolutely unprecedented. Had you chosen to start supporting Manchester United once Sir Alex started winning, it would be a case of great timing!

On the other end of that smile curve, Ole Gunnar Solskjær, as an ‘interim manager’ in the same club many years after Sir Alex retired, had a start one can only dream of: He memorably began his reign as a United manager with a morale-boosting 11-match unbeaten run that included 10 wins. The Norwegian followed that up during the 2019/20 season by masterminding a 19-game stretch that set a new club record in the post-Sir Alex Ferguson era. (Source)

But this story did not end as well as Sir Alex’s. Under Solskjaer, United went on to score a lot but conceded way too many goals. Unlike Sir Alex, or even the previous two United managers - Mourinho and Louis Van Gaal - Solskjaer did not manage to deliver even a single piece of silverware - Zero trophies. Had you chosen to start supporting Manchester United when Ole took over, it would be a case of bad timing!

The simple lesson for investors:

- A bad start/ a rough patch is not a constant. The art of untiming can make things even.

- A dreamy start is not also constant. The art of untiming can even out things.

Question the probabilities. Ask/ enquire about possible scenarios. Once the answers are found, once the rules of the game are understood, once you are in, do not try to time your way further in or out.

The art of untiming is the only art you can practice once the ball is on a roll. And just like Sir Alex/ the priest who walks into a horror movie after the intermission, let the trusted framework do justice in its own course.

About the author

Subrata Chakraborty. Badminton player > Football lover > Story-seller. Part of #TeamDSP's sales force from Kolkata. 8 years in mutual funds, still hunting for easier ways of connecting to the masses.Disclaimer

*All the data for DSP Flexi Cap Fund is for the Regular, IDCW Plan as on May 31, 2022 unless otherwise mentioned. Scheme date of inception - April 29, 1997. For product labelling/ disclaimers/ latest performance in SEBI prescribed format for DSP Flexi Cap Fund, click this link.

Source for all data: Internal.

There is no guarantee of returns/ income generation in the Scheme. Further, there is no assurance of any capital protection/ capital guarantee to the investors in the Scheme. It is not possible to invest directly in an index.

This note is for information purposes only. In this material DSP Asset Managers Pvt Ltd (the AMC) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author or the AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. Any sector(s)/ stock(s)/ issuer(s) mentioned do not constitute any recommendation and the AMC may or may not have any future position in these. All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them.

Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

.png)

Leave a comment