Be Smart, Beta: Are you missing out on this investment strategy

There are various kinds of investors in the stock market, with the common denominator to all of them being the fact that they’re looking to achieve the right risk-to-return balance on their investments. This means that one of the defining features of different classes of investors is the level of risk they are willing to take.

Risk-seeking investors also seek higher-than-normal returns, for which they involve themselves relatively actively in the market. In contrast, the more risk-averse investors tend to have a more passive approach. They might be able to mitigate their risk, but their returns tend to get affected as well.

But there is a way for even those who wish to invest passively to enjoy a slice of the outperformance that active investors sometimes manage to get. Imagine a strategy where you could get the benefits of active investments, but with a better return than a benchmark, while technically being passively invested. This is exactly what a smart beta investment strategy aims to deliver.

Let’s understand how such an investment strategy works.

The two main flavours of investment strategies

Active investing

Active investing is an approach where a fund manager actively undertakes market research and picks stocks based on thorough analysis and years of expertise and experience. The main aim of the fund manager (and the investor) is to outperform the benchmark indices and gain returns that are as high as possible. The fund manager does this by utilising personal frameworks set up after deep-diving into the market and by constantly seeking out opportunities to increase returns.

But with higher returns comes a higher risk level. No one can accurately predict how the market will perform. Thus, with this approach, the chances of underperforming the benchmark is higher in shorter time periods.

Moreover, this approach involves higher fees (expense ratios, i.e. the fees to be paid to your fund manager), given that the active involvement of the fund manager comes at a cost. Nevertheless, this approach is popular among risk-seeking investors who aim to beat the market.

Passive investing

Under this approach, investors place their money in a fund whose composition “tracks”, or mimics, that of an underlying benchmark portfolio (i.e. an index). The aim is to earn returns in line with the benchmark index’s performance. Thus, in this situation, investment performance depends on how the benchmark performs. There is no active involvement of a fund manager or any kind of active stock picking.

Passive investing is popular because it involves a low cost and a lower level of emotional bias on the part of managers: fewer decisions, fewer interventions. However, there is no promise of excess returns over the benchmark’s– but no excess losses either, making it popular among investors who simply want to be part of the race, without stressing over how to win it or worrying about losing it.

The middle path – Smart Beta Strategies

A smart beta strategy is an amalgamation of the above two approaches. The idea behind smart beta was first developed by the economic theorist Harry Markowitz as part of his ‘modern portfolio theory’. The aim of such a strategy is to maximise diversification and minimise risk at a price lower than what is involved in active management. At the same time, it also seeks to generate returns that are higher than those obtained via simple passive investing.

A smart beta strategy is also an example of rule-based investing. Being rule-based reduces the chances of human bias in the investing process, while also ensuring that tried-and-tested methods of investing are employed. It could be implemented through ETFs, mutual funds, or separately managed accounts.

Such a strategy involves constructing indices in an alternative way. While most indices follow market-cap-based allocations, a smart beta strategy uses various “factors” to build the underlying index. This is aimed at addressing the inefficiencies arising out of passive investing. An example of a smart beta strategy in action is the Nifty 50 Equal Weight Total Return Index.

The factors involved in a smart beta strategy

A smart beta strategy can be based on factors such as growth, value, volatility, momentum, and size. However, some of these factors are subject to cyclicality due to current events, inflation, changes in interest rates, government policies, and various macroeconomic variables. Thus, investors need to be prepared to stay invested for the long term to actually benefit from a smart beta strategy.

To understand this, we can take the example of a risk-weighted approach to smart beta. For such an approach, when we examine the correlation of interest rates with different factors, we may find that it positively correlates with low volatility and quality. In contrast, it could correlate negatively with value. Thus, changes in the interest rates can affect an investment based on such an approach, depending on the factor(s) used.

All in all, a smart beta strategy can be an excellent way to earn good returns, if employed correctly. Here is an example of the sort of returns you can earn using this strategy versus the returns from a vanilla index.

Nifty 50 Equal Weight TRI vs. Nifty 50 TRI

As we mentioned above, the Nifty 50 Equal Weight Total Return Index (TRI) is an example of a smart beta strategy in action. But before looking at it more closely, let’s first understand what the Nifty 50 TRI is. Basically, the Nifty 50 TRI takes into account the price changes of the stocks of Nifty 50 companies as well as the dividends they announce, unlike the Nifty 50, which only focuses on price changes.

Applying a smart beta strategy to the Nifty 50 TRI leads us to the Nifty 50 Equal Weight TRI, which gives equal weight to all the stocks making up the index (rather than basing their weights on their market cap). But why should you invest in it? Why would such an approach help? The best way to understand this is by comparing it with the Nifty 50 TRI.

To view the graph content better, please pinch-to-zoom or rotate the screen.

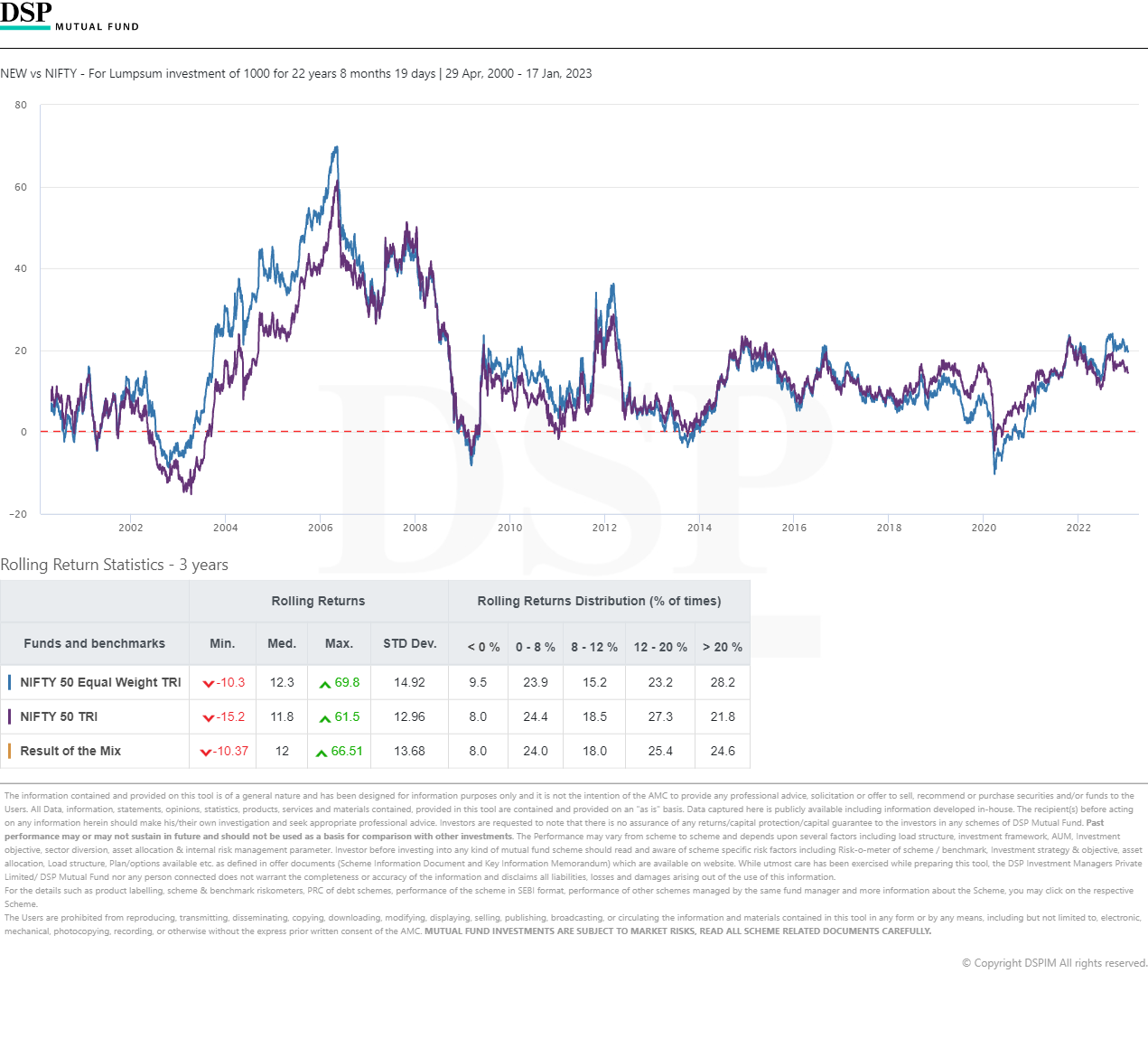

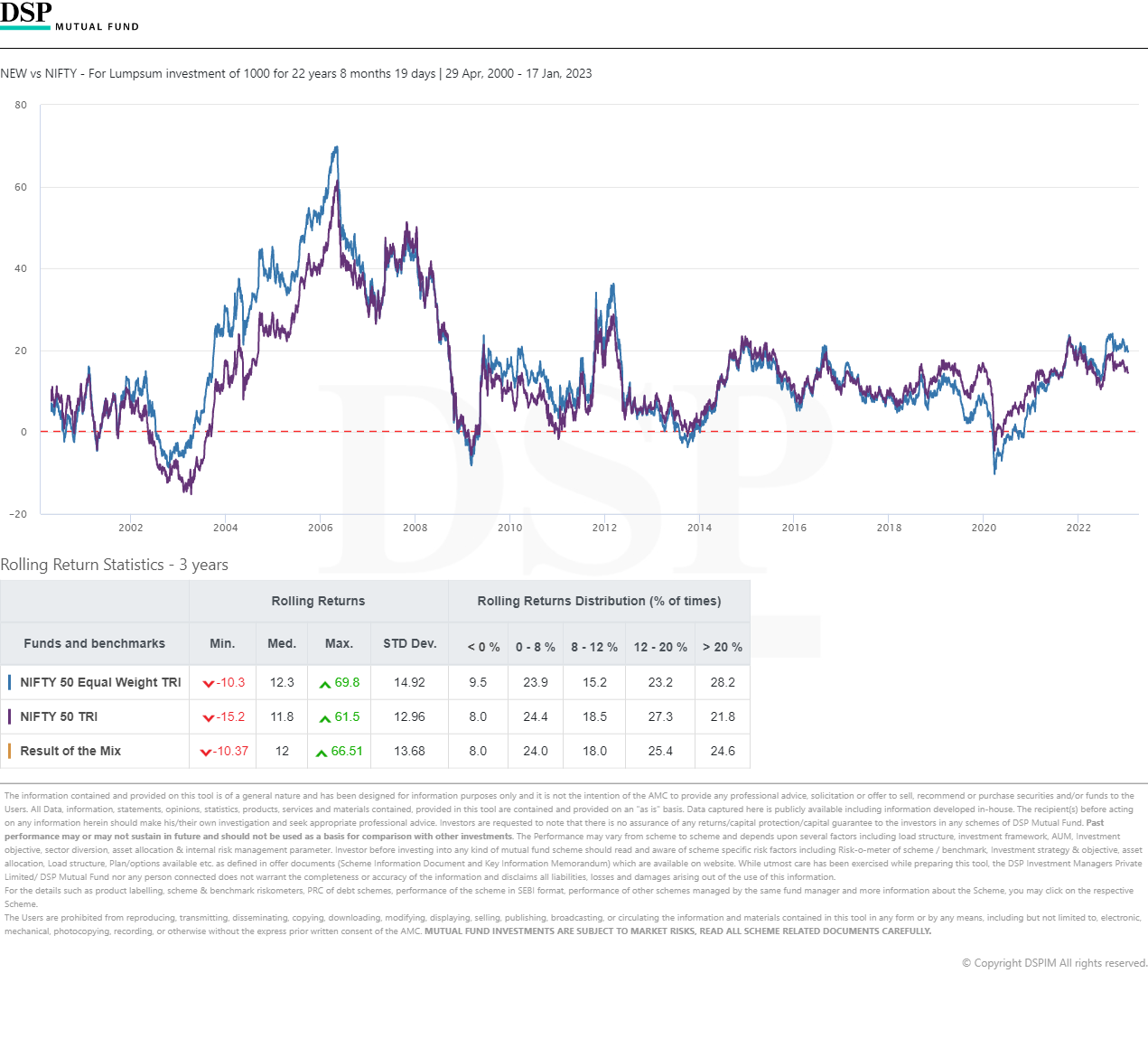

If we look at the rolling returns over three years for both benchmarks, we can see the benefit that investors have gained by using the smart beta strategy. The median return for the Nifty 50 Equal Weight TRI is 12.3%, while that of the Nifty 50 TRI lags behind at 11.8%.

Looking at the highs, while the Nifty 50 TRI gave a maximum return of 61.5%, the Nifty 50 Equal Weight TRI went all the way up to 69.8%. At the same time, while the Nifty 50 TRI dropped to a -15.2% low, its counterpart never dipped below -10.3%.

Furthermore, if we consider the distribution of the returns over approximately 22 years, the Nifty 50 Equal Weight TRI gave over 20% returns 28.2% of the time, while the Nifty 50 TRI gave the same level of returns for a smaller number of instances: only 21.8% of the time.

We can thus see how a smart beta strategy can potentially prove beneficial for investors. To continue our analysis, let us compare the vanilla Nifty 50 index with the smart-beta-based Nifty 50 Equal Weight TRI.

Nifty 50 Equal Weight TRI vs Nifty 50

To view the graph content better, please pinch-to-zoom or rotate the screen.

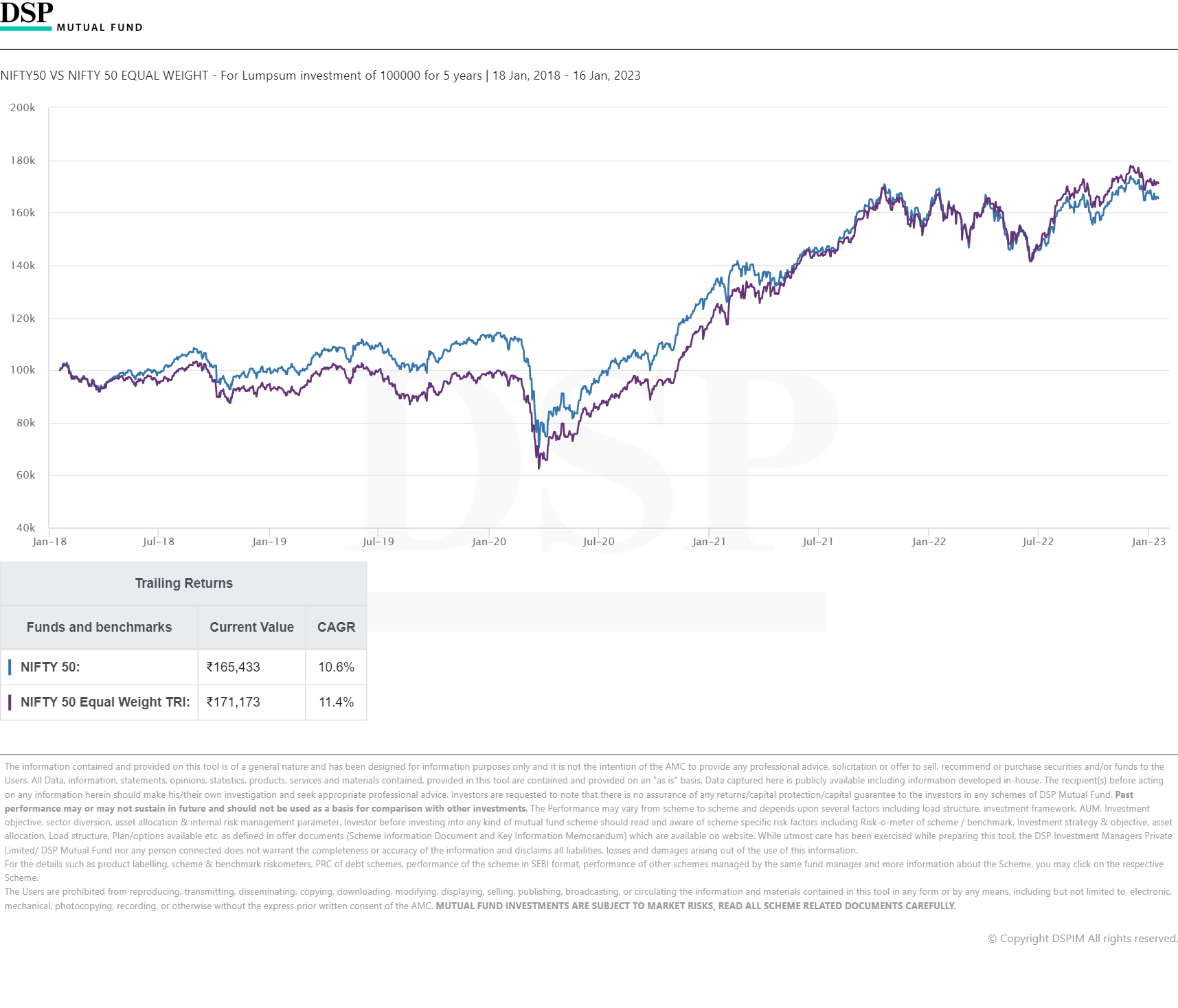

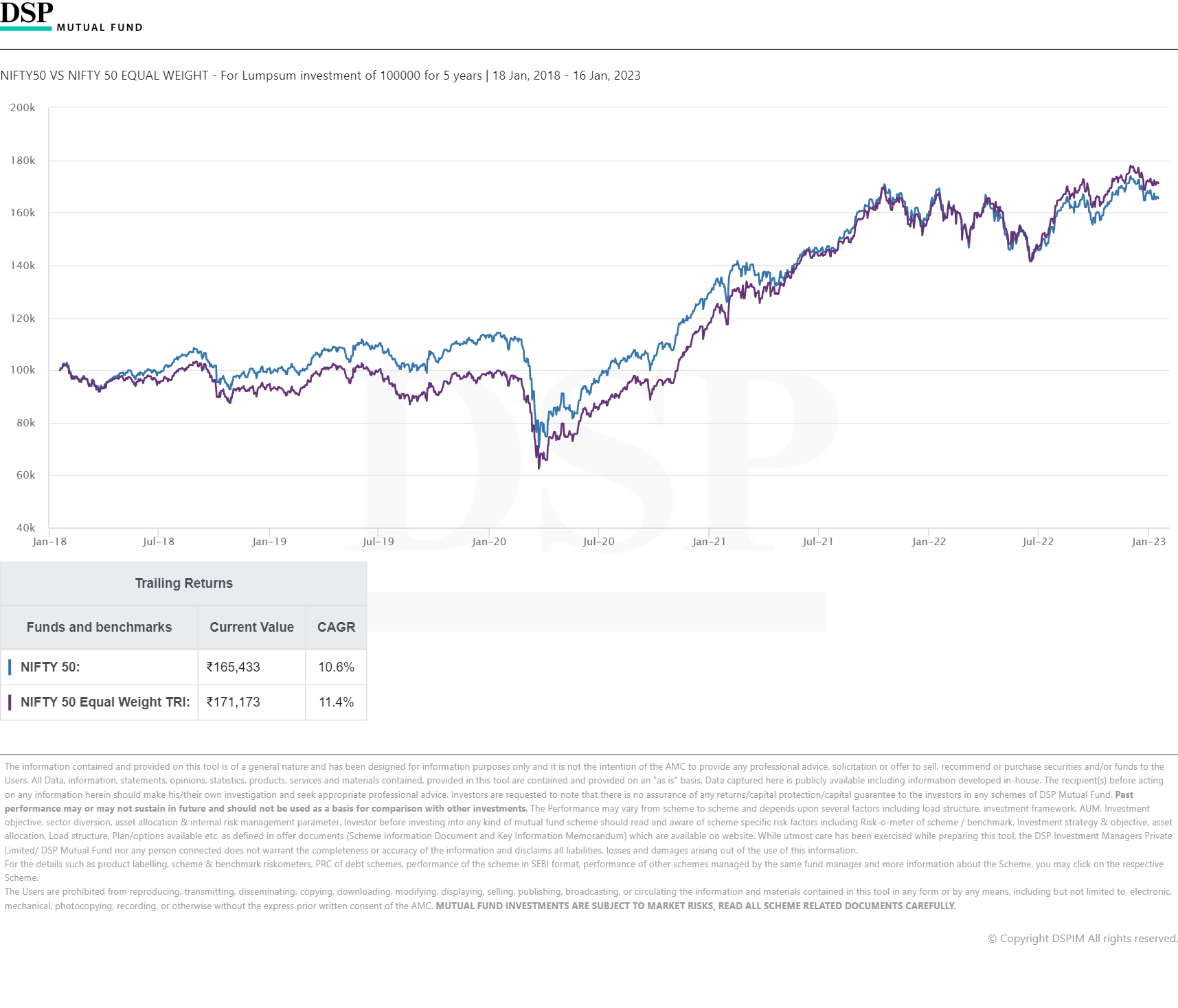

Considering a period of 5 years starting from January 2018, we can see that the smart beta strategy has helped fetch a higher CAGR of 11.4%, as against the CAGR from Nifty 50, which stood at 10.6%. For investors who put in Rs. 1,00,000 in the Nifty 50 Equal Weight TRI in January 2018, their investment value stood at Rs. 1,71,173 as at 16th January 2023. This is higher than the corresponding value of a similar investment in the Nifty 50, which is Rs. 1,65,433.

Looking at the above, can we conclusively say that smart beta will always do better than the plain (market weighted) benchmarks? No, but what it does well is to help diversify risks a bit better and consequently, reduce risk in your portfolio as well, better than the simple benchmark. Historically, it has been observed that often, smart beta performance beats the benchmark and therefore brings higher returns for passive investors who wish to get some of the benefits of active investing.

Such strategies do come with their own sets of risks, like we said. As you can see in the charts above, there have been times when the smart beta strategy has produced lower returns than the benchmark index. For instance, for the period between June 2018 and June 2021, the Nifty 50 outperformed the Nifty 50 Equal Weight TRI.

There can be many reasons for this, including the cyclicality of the factors involved in smart beta strategies and volatile macroeconomic conditions. Thus, there is also a need to be cautious while labelling a smart beta strategy as a ‘sure thing.

Smart beta: powerful but sensitive

A smart beta strategy can certainly work wonders. But for it to beat the benchmark, the correct economic conditions and market situations need to be present. For instance, if there is more polarisation in the market, which means that investors are focusing on a few specific stocks, the market-cap-based indices (e.g. Nifty 50 index) are likely to perform better. On the flip side, if there is an upward push in the market that affects a broad range of stocks, then equal-weight indices tend to outperform the market-cap-based benchmarks.

Moreover, because of the cyclicality of factors, investors’ risk appetite, and financial goals, there is no single smart beta strategy that is a perfect fit for all. Thus, as always it is important to gauge your risk-taking capacity and to establish concrete goals before investing in such a strategy.

Still unsure? Then contact your Mutual Fund Distributor or financial advisor, and understand what they can offer to you. Or DM us via Twitter/ Instagram and we’ll help!

FYI: If you are curious to find out more about the smart beta strategy we used as an example in this blog, then explore one of our index funds that is based on this very strategy, here

Please note: Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Performance figures mentioned in this blog post pertain to the performance of the cited index and do not in any manner indicate the returns/ performance of any schemes of DSP Mutual Fund. It is not possible to invest directly in Index.

Disclaimer

This note is for information purposes only. In this material DSP Asset Managers Pvt Ltd (the AMC) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author or the AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. Any sector(s)/ stock(s)/ issuer(s) mentioned do not constitute any recommendation and the AMC may or may not have any future position in these. All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them.

Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

.jpg)

Leave a comment