What 'The Big Short' taught me

Ever ventured into the tumultuous world of "The Big Short," the cinematic rendition of American author and financial journalist Michael Lewis' journey through the intricate labyrinth of the 2007-2008 financial chaos? It's not merely a silver screen spectacle; rather, it resonates like the sagacious advice of an old neighbour cautioning, "Watch your step!"

This film unfolds as a gripping narrative, peeling back the layers of the crisis, unravelling the minds that not only foresaw the impending disaster but navigated through the chaos to turn a profit.

In case you haven’t seen the movie or read the book, spend 5 minutes on this video. Trust me, you won’t regret it!

In its essence, "The Big Short" serves as a stark reminder, shouting, "Beware the allure of quick profits—it's akin to stepping into quicksand!" Simultaneously, it pays homage to the timeless wisdom that patience isn't merely a virtue in life; it's a transformative force in the realm of investing.

Today, let us understand some profound lessons that can help reshape our approach towards financial sensibility.

Journey through the plot and what it tells us about money matters

In the heart of the booming housing market of the early 2000s, a group of contrarian investors dared to question the prevailing narrative of easy money and unchecked growth. While others were blinded by the allure of quick profits, these astute individuals recognized the inherent instability lurking beneath the surface.

Despite facing scepticism and ridicule from their peers, these investors placed bets against the market, their actions guided by a deep understanding of financial risks and the cyclical nature of economies. They saw through the illusion of perpetual prosperity and recognized the ticking time bomb embedded within the subprime mortgage system, a complex financial instrument that was built on shaky foundations.

As the housing market inevitably crumbled in 2008, triggering the global financial crisis where most people lost a lot of their money, the foresight of these contrarian investors proved invaluable. They were able to engineer profits from the collapse of the market, while those who had blindly pursued short-term gains suffered crippling losses.

Diving deep: The contrast between short-term speculation and long-term investment

The Big Short isn't just about a financial crash. It brings to the foreground the investment industry’s deep-rooted issues: greed-driven decision-making, an often loose understanding of the market, a lack of transparency, an inherent resistance to contrarian viewpoints, and an extremely small percentage of investors getting richer despite crises. What gets them?

- The lure of immediate gains: Many investors wrongly prioritize immediate gains, chasing after quick profits that, like the bundled subprime mortgages in the film, are tempting but precarious. They overlook the importance of sustainable growth, akin to neglecting the long-term strength and stability that comes from patiently nurturing investments over time.

- The scare of market volatility: The rapid downfall post the housing bubble burst was dizzying. If you will – think of the U.S. stock market as a piggy bank. In 2008, it's as if someone shook out $2 trillion of its contents. Yet, for long-term investors, these shocks are more like turbulence during a cross-country road trip. Unnerving, but part of the journey.

.gif?width=480&height=270&name=unnamed%20(1).gif)

.gif?width=480&height=270&name=unnamed%20(1).gif)

- The power of compound growth: As research from S&P highlights, the S&P 500, reflecting the market's general trend, has never registered a negative return over any 20-year period. Okay, 20 years might sound like a lot, but these extreme long-term holding periods are what often separate average investors from great ones. This emphasizes the gains from staying steadfast in one's investment approach and reaping the rewards of compounded growth. It's like planting a seed; with time, it grows into a mighty oak, providing shade and stability. Interrupt it, and it’ll hurt.

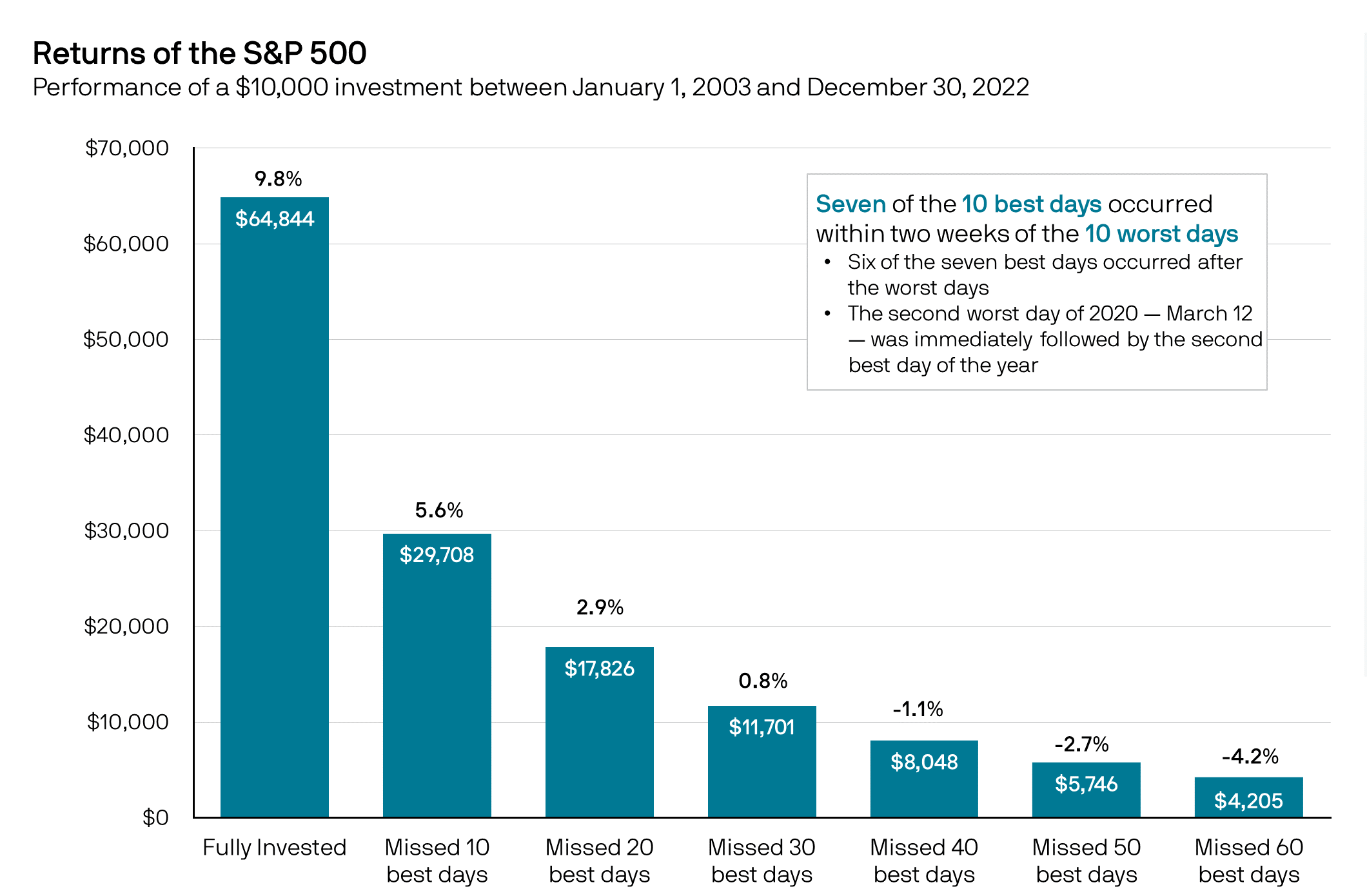

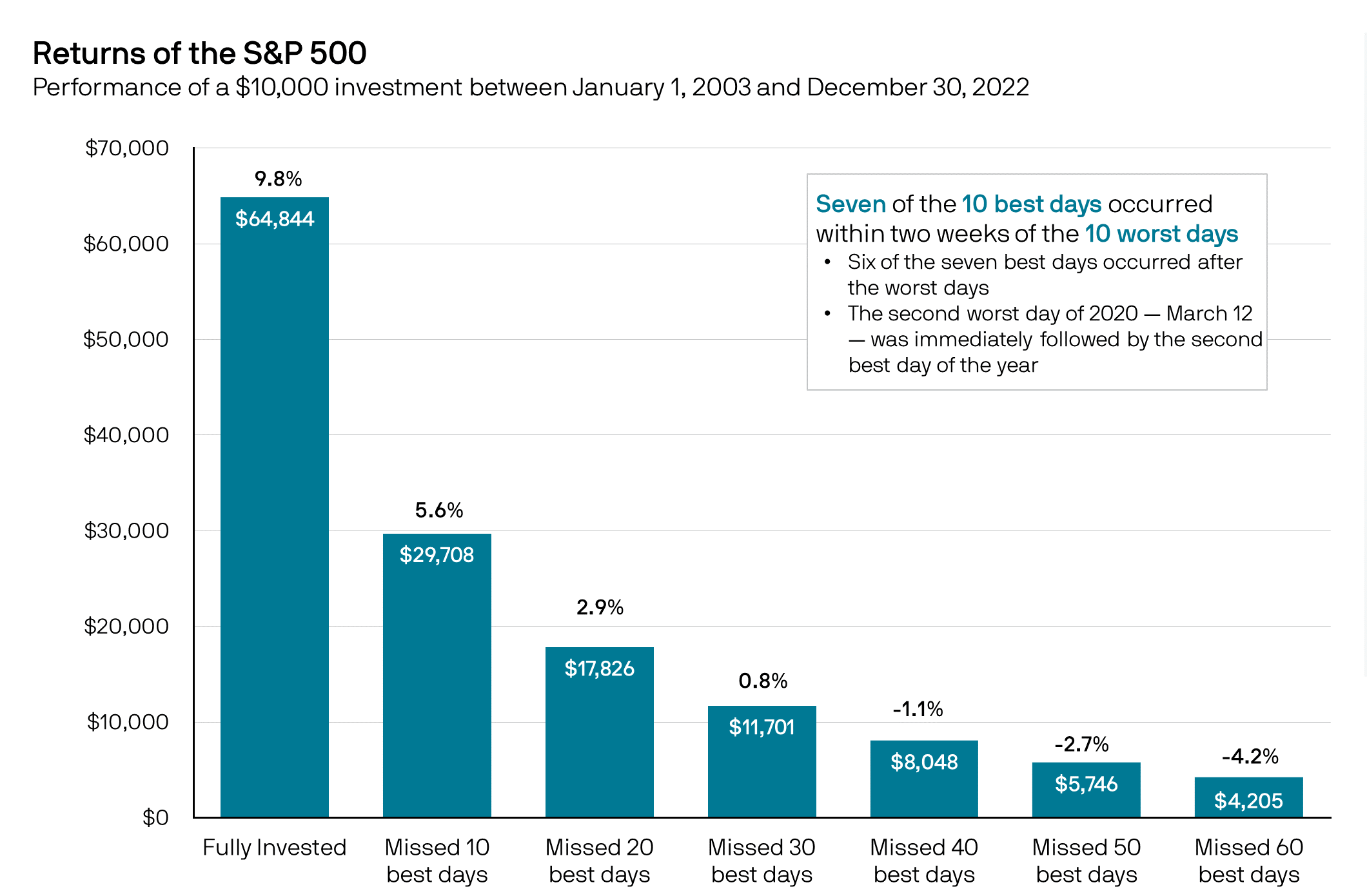

- The perils of missing out: An enlightening piece of data from J.P. Morgan underscores the pitfalls of an erratic, short-term approach. If an investor were to miss just the 10 best days in the stock market over 20 years, their returns would dwindle by nearly half. The lesson? Stay in(vested).

Source: JP Morgan

As the report says: “During periods of extreme market declines, a natural emotional reaction can be to “take control” by selling out of the market and seeking safety in cash. This is due to “loss aversion” – or the fact that losses hurt more than gains feel good. The results of this action can be devastating because, during periods of market volatility, the best days are likely to occur close to the worst days. This chart compares an individual who was fully invested for the past 20 years in the S&P 500 to investors who missed some of the best days as a result of being out of the market for a period of time. Missing the top 10 best days reduced the annualized return by almost 50%; missing the top 40 days resulted in a negative annualized return on the original $10,000 investment. Staying the course with a diversified long-term investment strategy may produce a better retirement outcome.”

Financial myopia: It has a human cost

The financial crisis of 2007-2008 was not just about falling stock prices and collapsing banks; it had a profound impact on real people.

Research by the Pew Research Center found out that in December 2007, only five out of 100 Americans were actively seeking employment. By October 2009, that number had doubled, reflecting the widespread economic hardship caused by the crisis. Families were forced to tighten their belts and make difficult financial decisions, watching in dismay as their carefully accumulated savings dwindled.

The ripples of the crisis were also felt in India. When the stock market crash hit, Ajay Lakhotia, like many others, lost a significant portion of his investments. Without a proper understanding of market dynamics, he had been chasing the elusive promise of maximizing returns. This gamble resulted in a loss of ₹80 lakh, a harsh lesson in the importance of informed investment decisions.

These were not merely stories of shrinking bank balances; but of dashed aspirations, homes at risk, and uncertain futures. When big financial institutions prioritize short-term profits over long-term stability, it is ordinary people whose stories are rewritten, whose dreams are deferred, and whose lives bear the scars.

Concluding insights

'The Big Short' is more than a cinematic revelation; it's a timeless financial lesson. It spotlights the pitfalls of short-term gains and the virtues of patience and vision in investing. The 2008 crisis underlines the dangers of ignorance and greed, researching the need for informed decisions. Of course, it also points towards the need for acute financial acumen and expertise, especially while taking the less-trodden path involving contrarian calls.

True prosperity in the financial landscape hinges on education, understanding, and unwavering commitment. As you chart your financial journey, let this movie be a beacon, guiding you toward sustainable, long-term success. Remember, in the realm of investing, it's the marathon runners, not sprinters, who are most likely to win.

Recently, a friend shared with me a seemingly "guaranteed" method to make a quick profit. He suggested that investing in a new cryptocurrency called *DoglaCoin could double my money in a matter of weeks. Sceptical but curious, I decided to give it a try and invested Rs 10,000 in it, a substantial amount for me. When all it took for the price to crash to less than half was a tweet from a famous celebrity, I realized what I thought was contrarian- in this case, was stupidity.

*Name changed to protect identity :)

I learned a valuable lesson that day: there is no such thing as a guaranteed way to make a quick buck. If it sounds too good to be true, it probably is. So, if you're looking to invest money and grow your wealth, don't try to time the market or get rich quickly. Instead, invest in a long-term portfolio of stocks and bonds. It may not be as exciting, but it's a much safer way to reach your financial goals. And in the meantime, enjoy the ride!

Investing can be a lot of fun, even if you're not making a killing. Just remember to be patient and do your research. And most importantly, don't be afraid to laugh at yourself when you make a mistake- especially small ones. Big ones- well, that might mean something else altogether.

About the author

The Rational Ghost. This is one rational storyteller that provides interesting insights & stories about investing and tries to be completely unemotional about it. Lives in the shadows, doesn’t want anyone to know its real name.Disclaimer

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments.

-2.jpg)

Leave a comment