Striking Gold: Your ticket to a glittering portfolio

Growth is on a sharp decline around the globe, as per World Bank economists. This can impact 70% of emerging markets, 95% of advanced economies, and even increase poverty in places. Now add the ongoing geo-political crisis, inflation, volatile stock markets, and the fact that we are yet to beat the pandemic’s effect completely, to the mix – you get apprehensive investors.

So, what might keep the investor spirit buoyant, optimistic or golden during uncertain times or crisis situations? Gold!

This precious yellow metal has long been an integral part of Indian culture for eons. As you already know, it is not only gifted on weddings (which accounts for around 50% of India’s gold demand) and worn on all special occasions, but Indians tend to store it as well, be it in the form of coins, bars or jewellery.

Gold is, in fact, a great hedge against inflation or volatile economic situations, compared to bonds or equities. Its supply is limited compared to fiat money, and it therefore offers tangible value through real-world uses.

In recent years, gold ETFs have especially garnered a lot of attention, for good reason. This open-ended scheme that tracks domestic gold price is not only safer than holding physical metal, but also promises better transparency, lower operational costs, flexible trading, and greater tax efficiency.

So, does it make sense to add gold to your investment portfolio? Wondering how to go about it? Read on to find out.

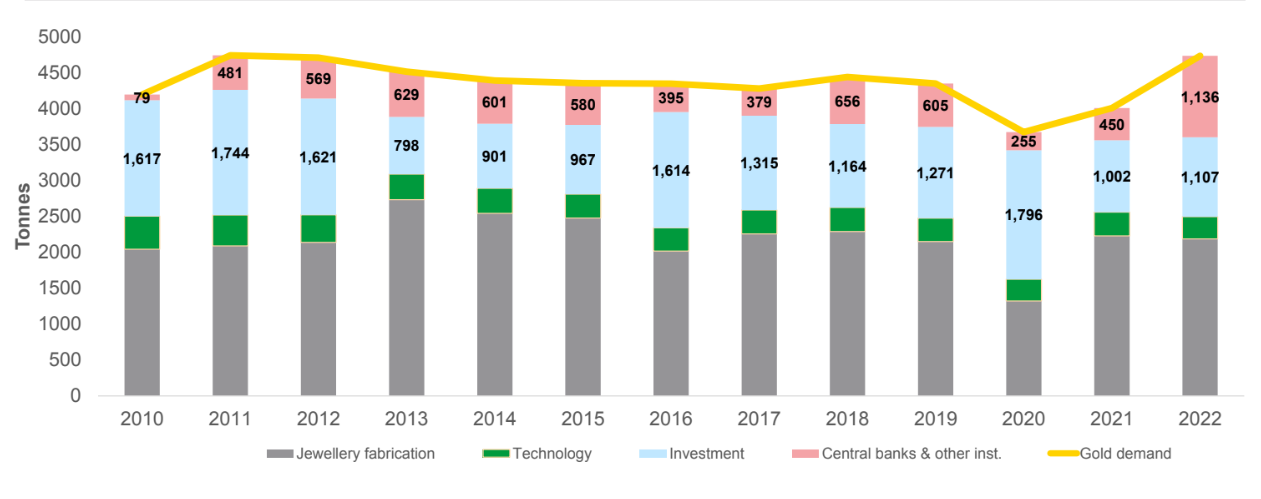

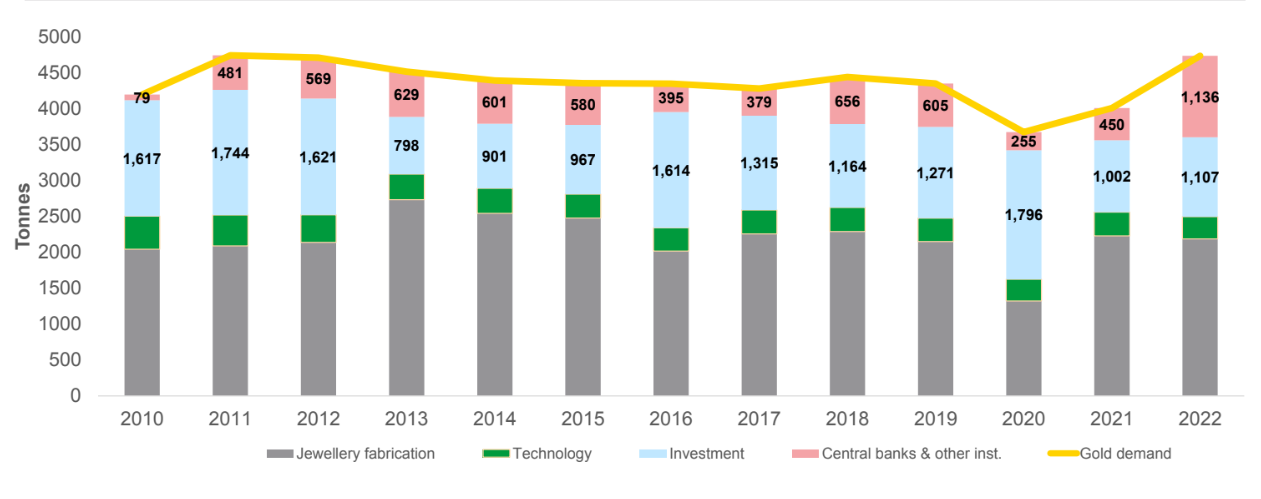

Strong demand for investment in gold

Over the last decade that has seen multiple instances of economic uncertainties, demand for gold has remained resilient. In recent years, it in fact sees a sharp increase. The amount of gold reserves being held by central banks has also witnessed an uptick. In 2022, India was one of the key emerging markets to strengthen its gold reserves.

The chart below shows the steep rise in central banks’ demand for gold from 2020 to 2022. As you can see, even before the pandemic hit and caused a temporary lull, the demand was mostly steady. Gold’s demand for investment purposes sharply increased during the crisis as well, indicating the preference for the precious metal over other asset classes. In technology, demand for gold remained steady in the last decade, while in the case of jewellery fabrication, demand for gold bounced back strongly after 2020.

Source: World Gold Council, Data as of 31 December, 2022

Naturally, this has caused gold’s price to rise steadily over the years. In 2021, the average annual price of gold was Rs. 48,720 per gm in India. It rose to Rs. 52,670 per gm in 2022, and today, it has crossed Rs. 60,000 per gm.

There is no denying that the overall outlook for gold is almost always bullish, and savvy investors can make the most of it.

Does this mean the sun never sets on the golden island? Not really.

Short gold cycles

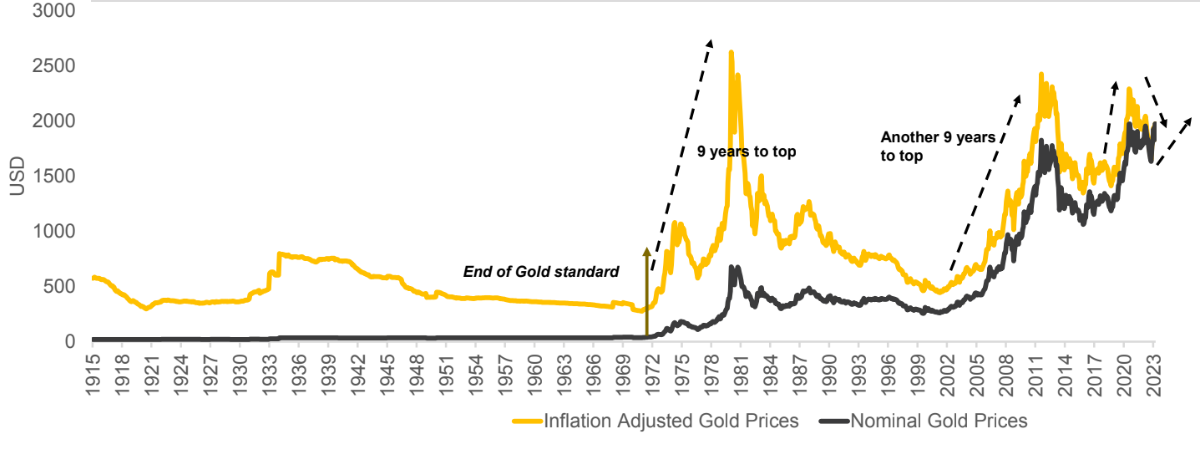

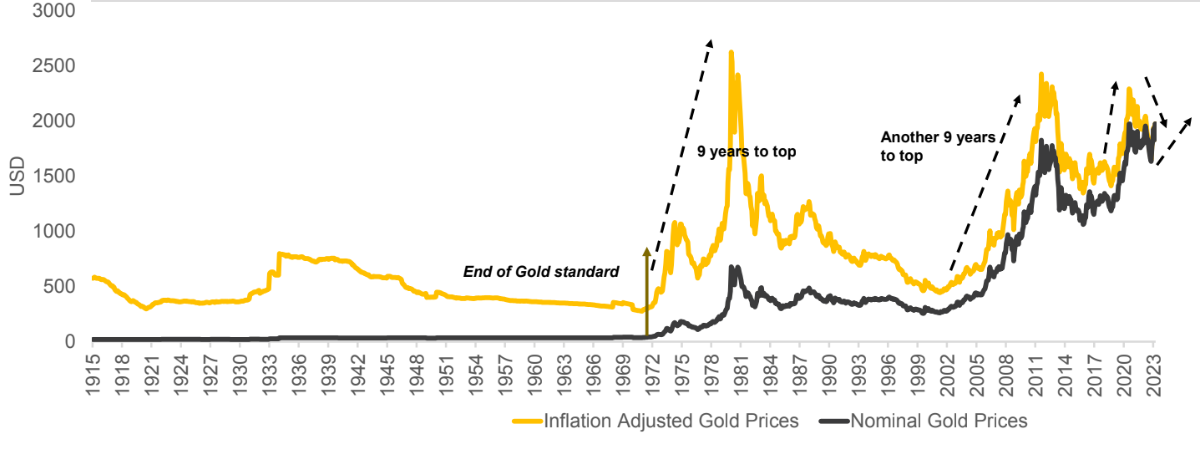

Just like seasons, the gold market goes through cycles. It indicates a regular and repeated trend, though it’s hard to predict when a gold market cycle will begin or end. These cycles are primarily of two kinds – bear and bull. While a bear gold cycle happens when gold’s price falls, albeit temporarily, and a bull gold cycle happens when the metal’s price soars.

Currently, we are in the middle of a bull gold cycle, which was mainly triggered by the pandemic and associated economic uncertainties. With equity prices falling sharply, investors have been increasingly flocking to gold as a protective measure.

Gold was previously seen moving in long cycles since the end of the Gold Standard in 1914 (a system in which almost all countries used a specified amount of gold to fix their currency value). However, the recent cycles are short, which gives traders and short-term investors the perfect opportunity to make money in the bullish gold market.

The chart below shows how it initially took long cycles of 9 years for the gold market to set high price records since the collapse of the Gold Standard. But, from how the yellow line is seen moving, it is evident that it is taking shorter cycles now for gold’s price to peak.

Source: Macro Trends, Data as of 29 March, 2023

Presently, gold is near its support level as well, which means it is at a price point where the interest to buy can overcome the pressure to sell, thereby pushing the metal’s price higher still. This is another reason to invest in gold now.

Weakening dollar

In January 2023, a weakening dollar caused gold prices to rise by around 1%. The first week of April 2023 witnessed the US dollar sink to a two-month low. If the dollar continues to weaken, you might do well to invest in gold. The reason is simple.

When the dollar’s value declines against other currencies, the demand for gold in other countries increases. This demand causes gold’s price to rise. In fact, with an impending economic slowdown, a steadily weakening dollar might kickstart a multi-year bull market for the yellow metal.

Declining real rate

A real rate of interest is derived by deducting the effect of inflation from the nominal interest rate (the one quoted in the market). When it is high, it makes sense to invest in assets that pay interest or dividend rather than in gold. We won’t lie - this is a very rare situation.

However, when real rates fall, and especially when it becomes negative, investing in gold is ideal. The increased demand for gold during such times causes its price to shoot up.

Portfolio diversification and better risk adjustment

As an investor, you already know that putting all your eggs in one basket is not a wise move. However, the portfolio diversification strategy you use during normal times might not work when there is a global recession on the cards. Gold can help in such a situation by balancing out the risks from equity exposure.

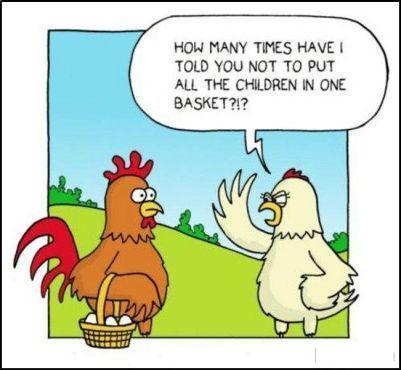

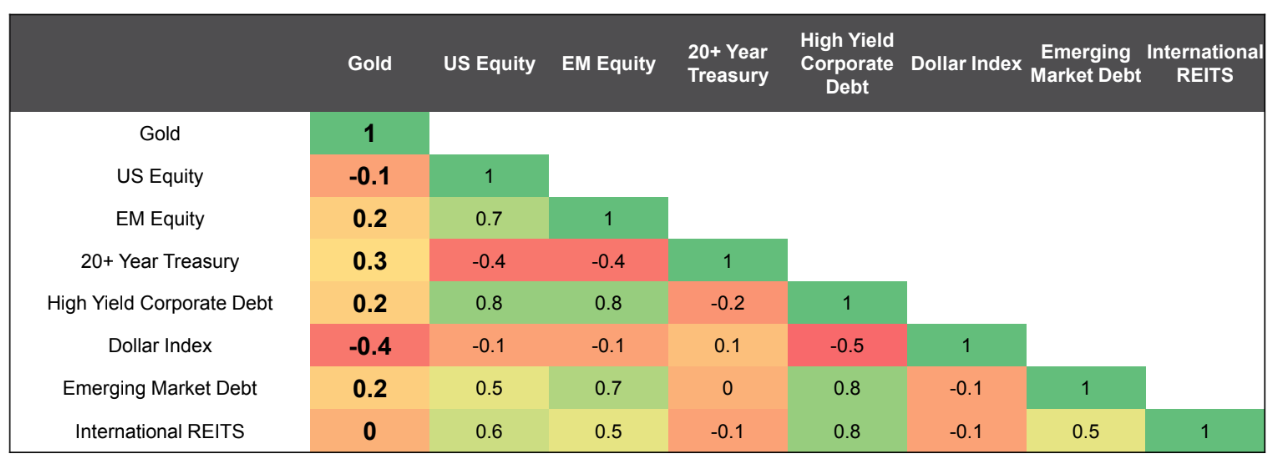

Gold is a great hedge against inflation. This is because gold experiences no depreciation in value unlike other assets; it acts as a storehouse of value. Additionally, it is a limited resource that couples with high demand. This makes it gleam all year round, with only an upward price movement in the future which helps beat rise in inflation. The table below also shows the negative correlation between gold and Dollar Index as well as US Equities. Also note the low correlation between gold and Emerging Markets' Equities or Debt instruments.

Source: Bloomberg, Data as of 29 March, 2023

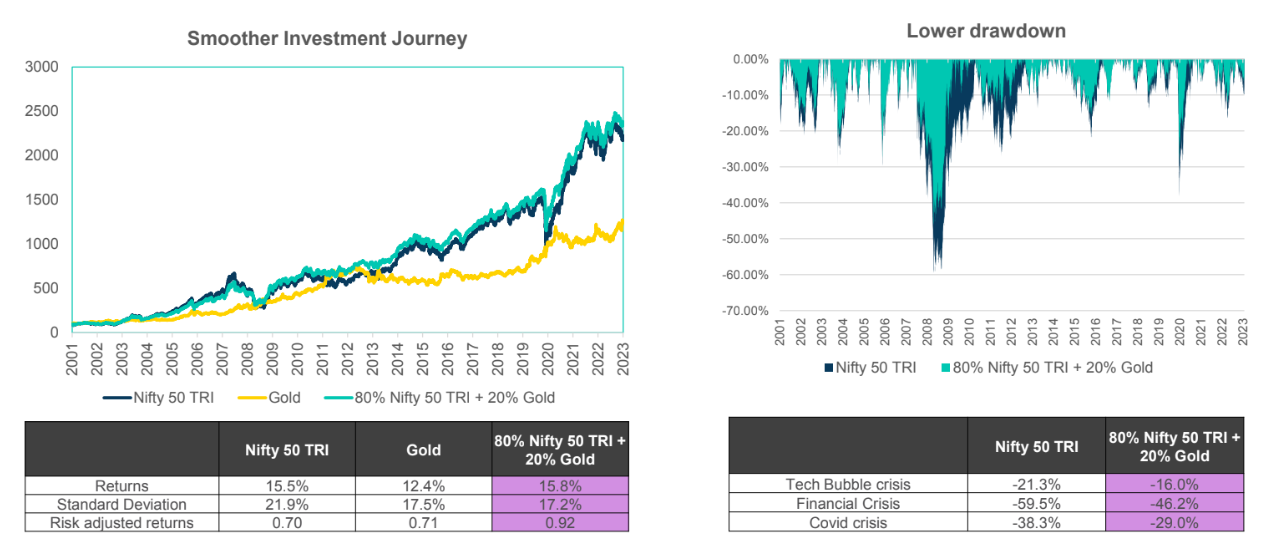

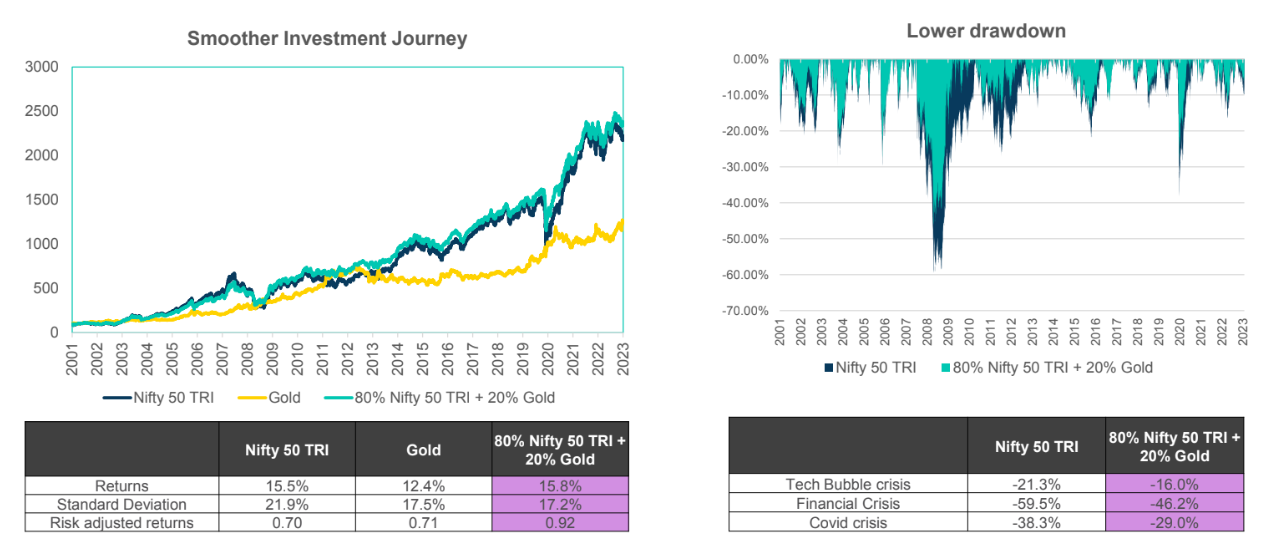

Looking into the technicals, it has been found that the returns as well as the risk-adjusted returns are higher when you have a mix of gold (20%) and Nifty 50 TRI (80%) in your portfolio. The standard deviation is lower, which makes your investment experience more stable and secure. In the long run, drawdowns (decline from peak to trough during a certain period) reduce as well, helping you maintain a better position and minimise losses during crisis. See chart below.

Source: Bloomberg, Data as of 31 March, 2023

Well, we really don’t need to convince you about the glitter of Gold. But let’s recap.

Gold is:

- all-weather asset class

- inflation hedge

- value storehouse

- less volatile

But how does one add the yellow metal to portfolios?

Invest in gold wisely

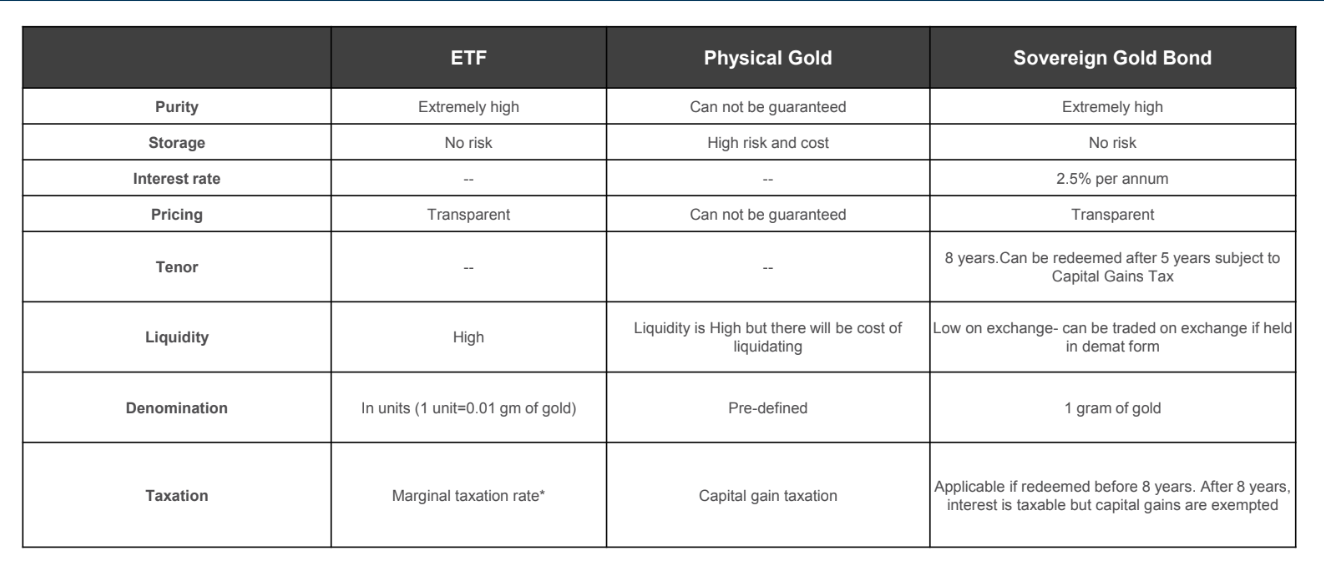

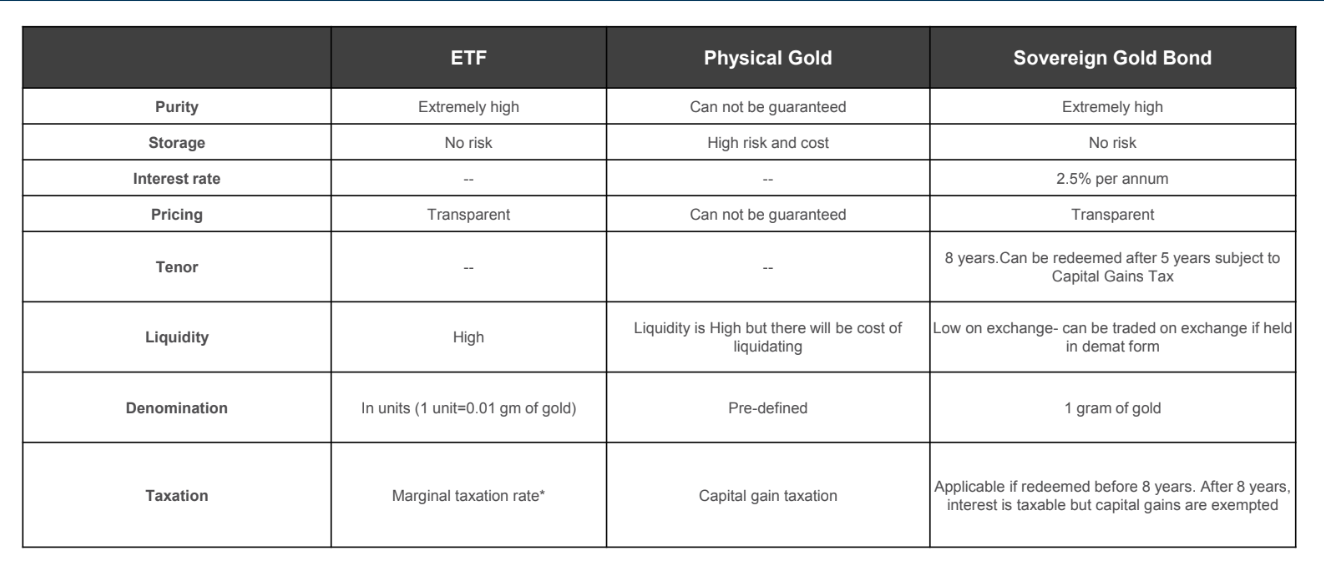

While Indians have traditionally been massive consumers of physical gold as jewellery or household articles, with increasing financial awareness, households are beginning to ‘invest’ in gold as an asset. Aided by digitization knocking at our doors, gold ETFs are quickly gaining traction. Frankly, they may just be a better bet if you are looking at features such as cost effectiveness, liquidity, and easy and safe storage for your purchase of the yellow metal.

What are Gold ETFs? They are passive investment instruments that aim to track the domestic price of gold. ETFs offer you an equivalent amount of gold to your investment amount, and this is credited to your trading account in dematerialized format. ETFs are highly liquid compared with physical gold and can be bought and sold instantly at the markets.

- ETFs also score better on purity, as each unit you buy is backed by pure gold’s price.

- Gold ETFs have zero storage risk and better transparency, as mentioned earlier, and you can even buy very small quantities.

- There is no premium associated with these ETFs, which makes them a more cost-efficient option (no making charges, wastage, etc.).

- Gold ETFs can act as collateral too, in case you are applying for a secured loan.

Here’s a quick comparison of the features of Gold ETF with other forms of gold as an investment to help you make informed decisions.

Source: RBI, AMFI, Data as of 31 March 2023, w.e.f. 1 April, 2023

Source: RBI, AMFI, Data as of 31 March 2023, w.e.f. 1 April, 2023

Things to remember while investing in gold ETFs

While investing in gold ETFs has many advantages, as discussed above, here are a few things to keep in mind, so you can maximise your returns and minimise your risks.

- Have a detailed discussion with your financial advisor to understand gold ETFs better, how well the fund is likely to perform in future.

- Monitor gold price trends. Track your account and trades closely to improve portfolio performance gradually.

- If you have an appetite for moderate risk, Gold (ETFs) may well account for up to 10% of your portfolio for stable returns.

- Remember that it can be difficult to zero in on the intrinsic value of gold and liquidity may vary over time.

- Since gold is a cyclical asset, if you enter the cycle at the wrong time, it can affect your short-term returns.

Ready to add some golden shine to your life?

Investing in the precious yellow metal is apt for staying safe against inflation, recession, and volatile stock markets. Declining real rates and the weakening dollar make the case for investing in gold stronger. You can also make your portfolio more robust by incorporating some gold in it, especially in the form of ETFs, and balance returns and risk in the long run.

Interested in investing in gold digitally, conveniently in an ETF format? Click here.

Make sure to consult a financial advisor before investing.

Disclaimer

In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house. Information gathered and used in this material is believed to be from reliable sources. The AMC however does not warrant the accuracy, reasonableness and / or completeness of any information. The above data/ statistics are given only for illustration purpose. The recipient(s) before acting on any information herein should make his/ their own investigation and seek appropriate professional advice. This is a generic update; it shall not constitute any offer to sell or solicitation of an offer to buy units of any of the Schemes of the DSP Mutual Fund. The data/ statistics are given to explain general market trends in the securities market and should not be construed as any research report/ recommendation. We have included statements/ opinions/ recommendations in this document which contain words or phrases such as “will”, “expect”, “should”, “believe” and similar expressions or variations of such expressions that are “forward looking statements”. Actual results may differ materially from those suggested by the forward looking statements due to risks or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on our services and/ or investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices etc.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

.jpg)

Leave a comment