Martians, Venusians & Investing.

DSP Winvestor Pulse 2022: 6 things we learnt

I still recall March and April 2020 vividly. Covid had fully reared its ugly head: governments around the world were scrambling to contain it with what seemed like harsh measures. Global markets, whether equity, gold, or crypto, seem to have crashed. Pandemonium everywhere.

Given that I’m the go-to financial expert in my circle of friends (bit of a humblebrag, but it’s also possibly an अंधों में काणा राजा type of situation), I generally have many people come to me for advice on money matters. Even so, I was quite taken aback at the ridiculous flurry of calls I had to field in the wake of the Covid-related market shocks.

Now, I’m an equal-opportunity friend. An equal-opportunity person, in fact. I took calls from male friends as well as female ones- both married/unmarried, some with children, some without. They asked the kinds of questions one would expect: Should I sell my investments at a loss? Should I invest only in debt funds since they’re safer? Should I pause my SIPs? When will the bloodbath be over? Are even my FDs safe anymore? What if my bank goes down? What will happen to Armaan’s education fund? And so on.

While many of the questions asked were normal, some bordered on the absurd. In all this, what pleased me quietly, was that far more people in my circle seemed to have woken up to the realities of investing and wealth-building due to the pandemic. Moreover, all these calls reinforced in me something I felt already to an extent- men and women approach investing in distinct ways.

The relationship they have with money, their attitude towards it, their roles in making investment decisions, how they invest, how they communicate with their children (or not?) about money matters: these are only some of the aspects I felt men and women seemed to differ in.

Have you also felt this way at some point? Then it’ll probably interest you to go through some concrete data that can shed some light on this issue.

DSP Winvestor Pulse 2022: The numbers are in.

Last week, DSP Mutual Fund published the results of the DSP Winvestor Pulse 2022 survey, conducted in collaboration with YouGov, a leading global research, data & analytics firm.

Let us now go through some of the insights the survey unearthed, on the key differences between men and women when it comes to investing.

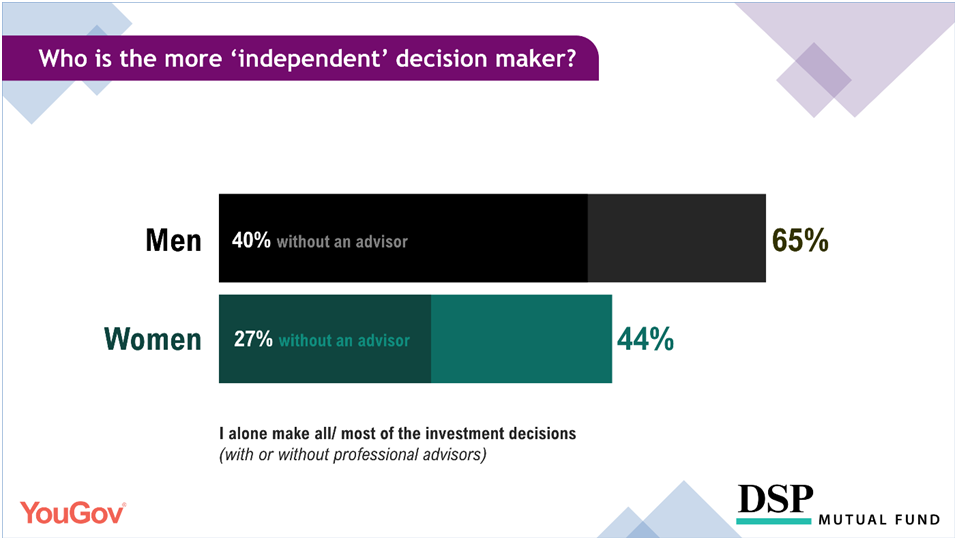

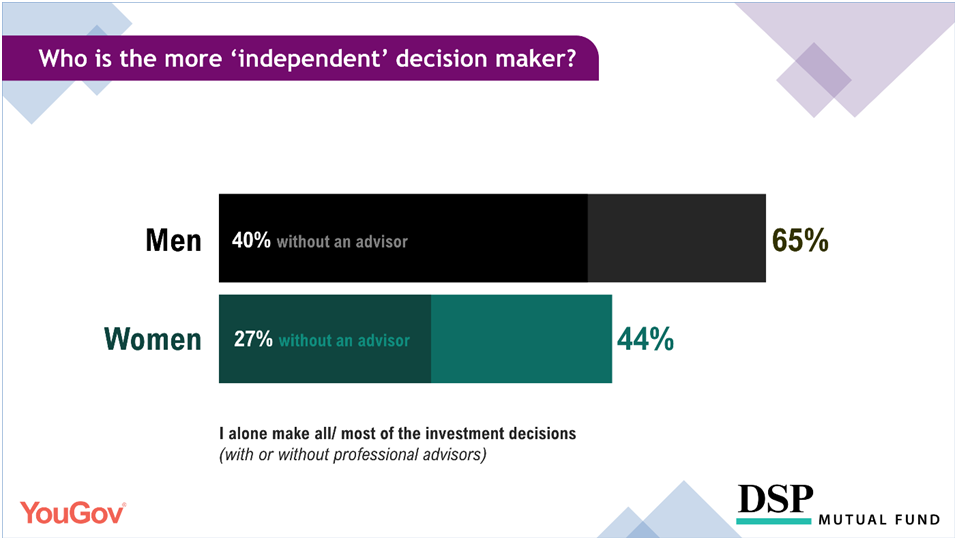

- Most men (65%) take investment decisions independently, when compared to women (44%). If you look at those who don’t take any professional advice and therefore invest entirely independently, these numbers are still largely in favour of men: 40% for men vs 27% for women.

So, what does this indicate? Do women lack confidence? Do they have lesser desire to learn about investing by themselves? Is there a lack of a social environment that encourages young girls and boys to learn about financial matters at an early age? Do women believe it’s the other gender’s responsibility to ‘grow wealth’? Worth introspecting.

And among the 52% women and 33% men who mentioned they take most investment decisions jointly, women consult their spouse much more than men (67% vs 48%) whereas men tend to discuss and take joint investment decisions with their fathers far more (26%) than women do (10%). Does this indicate a natural shift in money-related conversations post marriage to their husbands from their fathers, or a potential lack of early structure to money-related conversations for households with daughters? Let’s consider the next point to understand this. - Parents need to have personal finance discussions or investment-related conversations with their children at an early age- much more than the basic ‘saving for a rainy day’ sort of talks. While 67% of respondents said that children should learn about investing before they turn 25, are they really doing so, and if yes, then are they doing it equally with their sons & daughters?

It was striking to see that most men (21%) are self-taught investors whereas the same proportion of women (21%) were introduced by their husbands. It was also interesting to see that fathers taught sons about investing more (15%) than daughters were (12%). Given that personal finance is not a standard part of academic curricula in India, these numbers don’t bode well. Women are also most commonly being introduced to investing at a much later point in life (i.e. after getting married), and a much lower proportion of women are learning about it by themselves (13%), as compared to men. This needs to change. But will it, given the next point?

- Most parents (68%) who have sons & daughters are having different conversations about investing, depending on their child’s gender. This leads to an unequal development possibly biased with different attitudes, as represented by the different reasons they shared for teaching their sons & daughters differently.

Top two reasons why they teach sons differently are: ‘Son will support a family and will carry more financial responsibilities’ (45%), ‘Men can handle more risks and complexities (29%) than women’. For daughters, the top two reasons were: ‘Daughter will be financially supported by her husband’ (35%), ‘Savings options are better than investment options for women’ (33%)..png?width=570&height=321&name=image2%20(2).png)

.png?width=570&height=321&name=image2%20(2).png)

- This parental and societal mindset then goes on to shape men and women’s attitudes towards investing later in life, possibly landing at the legacy hunter-gatherer mindset equilibrium. Men take on the role of chasing higher returns even at the cost of higher risks as represented by their propensity to invest more in the stock markets vs women (55% men vs 50% women), while women tend to prefer control & stability far more than men when it comes to investing, preferring worry-free investment options like bank FDs, savings etc (71% women vs 68% for men).

- It is a good sign that retirement planning is emerging as a key goal for both men and women. Becoming financially independent and post marriage, preparing for their children’s needs are also key reasons why both men and women invest. Also notable was that most respondents said that if they had spare cash, they would invest in the stock market or in equity mutual funds- which is indicative of a key switch from a saver’s mindset to an investor’s mindset in India.

- Covid made a large portion of both men and women introspect much more and invest more (45%), as compared to earlier. When added to the rise of digital avenues of information and investing platforms, this has also made the prospect for investing much more palatable for both genders.

What else did we find interesting?

The survey also revealed several other ‘side’ aspects worth highlighting:

- Associations with money: No key differences, both men & women think of a better life, security, stability, better health, standard of living, fulfilling dreams when it comes to money

- Upskilling becoming important: More men in mini metros than in metros (or for that matter, than women in metros or mini metros) mentioned they’ll use spare cash for upskilling- a good sign for India

- Asset ownership: No key differences, both men and women are putting their money primarily in the equity markets, mutual funds, bank deposits, term insurance & gold (including digital gold)

- Who likes the low cost, no bias nature of index funds more? More women (57%) than men (54%)!

- Top difficulties faced while investing are similar: Unpredictability of the markets, complex charges involved while trading or investing, a desire to have easy access to their invested capital

- Most men and women (47% vs 45%) believed their responsibilities towards their son or daughter will never really end!

- Most men (79%) and women (78%) did not indicate any gender-preference for their financial advisors/ MFDs

About DSP Winvestor Pulse 2022

DSP’s Winvestor is a focused educational initiative encouraging women to ‘own their money’ and get far more involved when it comes to investment decisions. #DSPWinvestorPulse22 as a part of this initiative serves as a reflection of the differences in investing attitudes, roles, perception and behaviours among men and women.

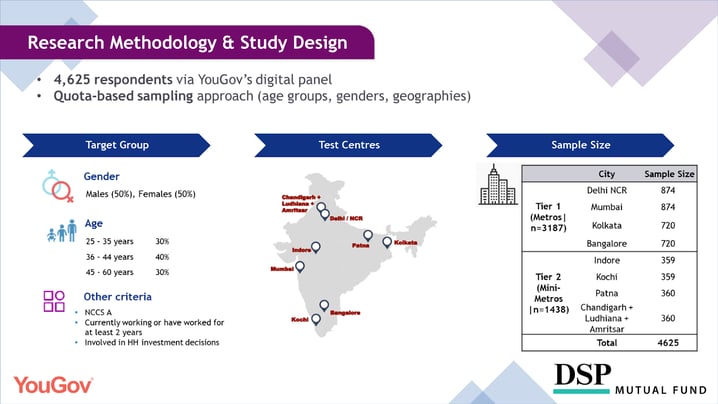

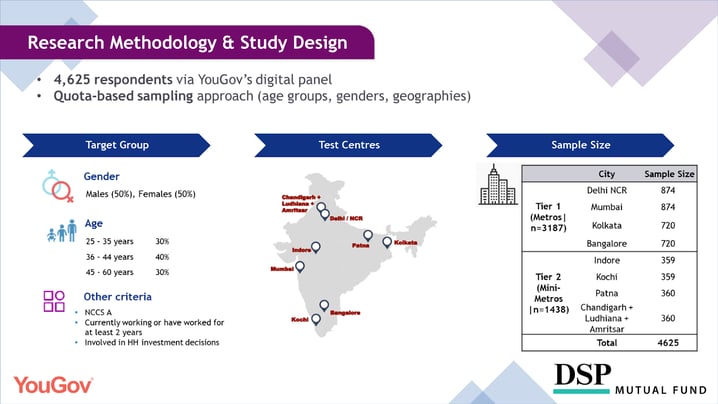

This year’s survey was conducted with a robust sample size of 4,625 respondents spread out across ten major cities, split evenly between men and women. Representative equally across different age groups, the report aims to provide a comprehensive picture of Indian investors. While any survey that’s conducted digitally is likely to carry some obvious biases, we believe this survey still serves as a good representation of how today’s Indian investors think. For more eye-opening insights, do take the time to check out the full report.

And hey- Don’t forget to #TakeCharge and #OwnYourMoney!

About the author

The Rational Ghost. This is one rational storyteller that provides interesting insights & stories about investing and tries to be completely unemotional about it. Lives in the shadows, doesn’t want anyone to know its real name.Disclaimer

This note is for information purposes only. In this material DSP Asset Managers Pvt Ltd (the AMC) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author or the AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. Any sector(s)/ stock(s)/ issuer(s) mentioned do not constitute any recommendation and the AMC may or may not have any future position in these. All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them.

Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

Leave a comment