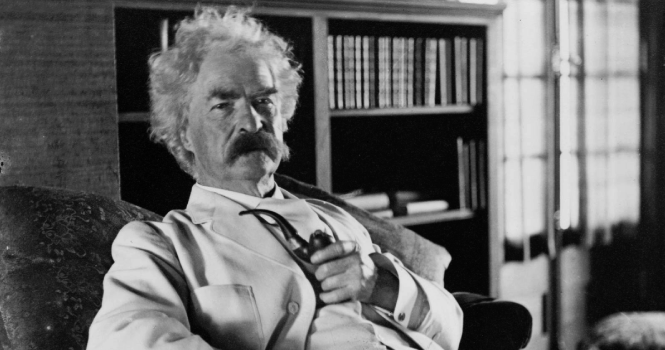

Mark Twain and the 'Law of Holes'

Mr. Samuel Langhorne Clemens, a prolific writer who was ranked among the highest paid authors in 19th century America, filed for bankruptcy at the age of 59. Known to most as Mark Twain, his literary pseudonym, he was a master of the yarn. While his claim to fame were his highly acclaimed books, including the travel narrative ‘Innocents Abroad’ and his midlife masterpiece ‘Adventures of Huckleberry Finn’, he wore another, not so flattering mantle. Despite his obvious intellectual prowess, he was a highly incompetent investor, often putting good money after bad and not really knowing when to quit.

Many of us have, at some point in time or another, suffered a common affliction that renders even the smartest of us into incompetent fools, leaving us incapable of making sound decisions. No, I am not talking about love, although it is known to have a similar impact. What I am talking about is rather elementary, one of the original sins – PRIDE, with greed perhaps following as a close second. In the world of investing, such afflictions, i.e., pride and greed, can be debilitating and have widespread ramifications on both your investment journey and outcome. The thing is that both greed and pride are fairly impartial – they can strike rich man or poor man, expert or amateur. Twain, unfortunately, battled many such afflictions for most of his earning life.

He was famously quoted as saying,

“October. This is one of the peculiarly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August, and February.”

Undoubtedly, such a gloomy perception of the market stemmed from his very own experiences. Mark Twain’s many trysts with investing often ended up with him holding the short end of the stick. As a matter of fact, his investment debacles were often plastered across major American newspapers with stories like “Mark Twain Fails” (Washington Times) and “Mark Twain’s Company in Trouble” (New York Times), for entertainment purposes and also to serve as a cautionary tale2.

The one that broke the camel's back

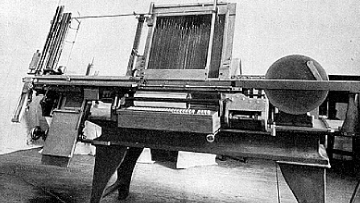

Of the many bad investment stories, one that is widely circulated, is his investment in the 1880s typesetting machine created by James Paige called the Paige Compositor or Paige Typesetter. While Twain entered the world of publishing as a newspaper reporter, he had a humbler beginning as a typesetter. Undoubtedly, his prior knowledge on printing and typesetting, coupled with his fascination for new inventions, compelled Twain to invest in a new printing technology. Completely impressed with its potential, Twain had monikered it as the ‘Shakespeare of mechanical invention’.

The Paige Typesetter1

For more than a decade, Twain kept pumping money into the Paige Typesetter, despite the company having lost value in a very short span of time. So invested was Twain in the idea of this machine that he continued putting money into the business, hoping for a turnaround that never really materialised. 14 years later, when the Paige Typesetter made its debut in the market, more efficient and less expensive competitors had already taken command, rendering it absolutely impractical.

Don't confuse investing with archeology

Now, don’t get me wrong. Every new idea that comes with a promise to disrupt an industry need not go bust. In fact, it has almost equal chances of either becoming a resounding success or a colossal disaster. However, the astute investor will be able to identify, with some degree of confidence, which way the scale will tilt and accordingly make investment decisions. Such was not the case with Twain. He made three classic investment mistakes.

- One, he fell in love with an idea.

- Two, he let his ego or pride get in the way of astute decision-making.

- Three, he bet the farm.

He loved the idea of a modern-day typesetter and kept pouring money into it despite obvious indications that it was an idea that was unlikely to fructify. Such was his conviction (misplaced) that he eventually invested virtually all of his savings and his wife’s inheritance, in addition to some borrowed money into this idea. Common accounts peg this investment at USD 3,00,000 which amounts to approximately USD 6million today!3

He ignored the Law of Holes, bet the farm, and lost big.

The Law of Holes: An adage that states that if you find yourself in a hole, stop digging. By digging it deeper, you would find it more challenging to rescue yourself from an untenable position.

Today, with the benefit of hindsight, we can assess where he went wrong and how he could have avoided some of his biggest investment mistakes. However, it is important to remember that avoiding mistakes does not mean that you run at the first sight of risk or cower under the desk. Instead, it means that you should understand the risk in your investments, be honest with yourself, and stay rational.

The bottom line is that if you find a hole, you need to stop digging. Don’t let your ego come in the way and convince you to keep digging till you hit gold. You might hit rock bottom instead. And, even though he could not really master investing and risk management, he certainly captured it perfectly with the following line:

"There are two times in a man’s life when he should not speculate: when he can't afford it, and when he can.”

About the author

The Rational Ghost. This is one rational storyteller that provides interesting insights & stories about investing and tries to be completely unemotional about it. Lives in the shadows, doesn’t want anyone to know its real name.Disclaimer

This note is for information purposes only. In this material DSP Asset Managers Pvt Ltd (the AMC) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author or the AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. Any sector(s)/ stock(s)/ issuer(s) mentioned do not constitute any recommendation and the AMC may or may not have any future position in these. All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them.

References

1 Source: Mark Twain, James W. Paige and the Paige Typesetter (twainquotes.com)

2 The Time Mark Twain Went Broke Provides Some Interesting Investing Lessons (businessinsider.com)

Leave a comment