How to invest in Disruptive Innovation?

Innovation in all areas of life is taking the world by storm. Doubt it or love it, you simply cannot ignore it. Innovation often gains traction in challenging times, and the last two years of the raging pandemic have only accelerated the pace of innovation across sectors.

But despite the massive impact and changes it creates in our consumer choices and overall quality of life, the impact of disruptive innovation and the investment opportunities it creates is often unrecognised or misunderstood by traditional investors.

To understand how even traditional investors can capitalize on the emerging disruptive innovation ideas from across the world, Sahil Kapoor (DSP’s Head Products & Market Strategist) interacted via a YouTube Live session with Renato Leggi, CFA, CAIA (Client Portfolio Manager, ARK Invest). For those who are not familiar with it, ARK Invest is an investment management company founded in 2014 by Catherine (Cathie) Duddy Wood. Headquartered in the US, ARK focuses solely on investment opportunities in the world of disruptive innovation, identifying and capitalising on the inefficiencies in this market. They manage more than $60 bn worth of assets across 14 strategies centred around disruptive innovation.

What follows below are some highlights from what was discussed during the YouTube Live session.

Before we dive deep into how to invest in disruptive innovation, it is worthwhile to first understand what the term implies.

Disruptive innovations transform expensive or highly sophisticated products or services previously accessible only to high-end or more-skilled segments of consumers, making them more accessible and affordable to a broader, larger population. This transformation disrupts the market by displacing long-standing, established competitors. (Source: Investopedia)

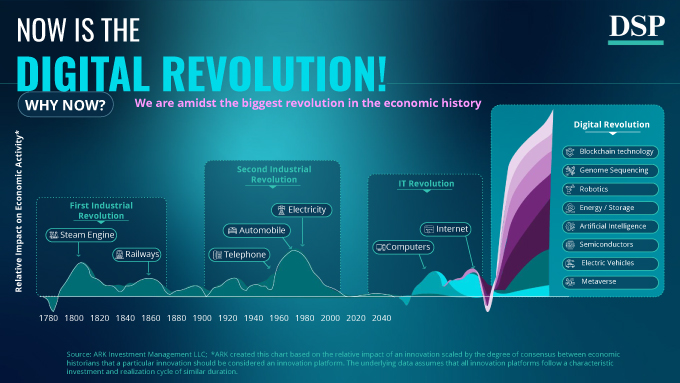

We are currently in a unique time in technological history & amidst the biggest revolution in economic history.

Click to view in higher quality

What we have today is 5 separate disruptive innovation platforms or mediums evolving at the same time. Something like this has not been seen in the last 100 years. In the late 1800s, there were 3 key innovation platforms - the telephone, automobiles, and electricity - which resulted in a 50-year economic boom cycle from 1880 to the 1920s. The internet was a major innovation platform as well, but it remains evolving to date. Can you imagine the transformative shift in our lives when 5 innovation platforms are evolving, all at the same time?

The five technologies expected to unfold major disruption in the coming decades are the following:

- Artificial Intelligence focused on deep learning by analysing all the massive data that has been collected through the internet

- Energy storage evolution that is shifting us away from traditional fuel-based vehicles to EVs and autonomous vehicles that will drive the cost of transport down

- Adaptive robots that work alongside humans, such as those in Amazon Fulfilment Centres in the US

- Genome editing or the process of determining the DNA sequence of an organism’s genome and modifying it to produce desirable results such as curing cancer and other major diseases and illnesses

- Blockchain technology which has a slew of applications, such as in decentralising banking transactions and cryptocurrency as a store of value, the metaverse, non-fungible tokens & more

ARK Invest estimates conservatively that as much as 20% of the current world GDP or $14 trillion will be the total value created by 2030 solely from these technologies. This number could well add up to a mind-boggling $75 trillion, if things go as per their predictions.

While your interest in innovations may be rising and your conviction to invest maybe building, timing can make a lot of difference in a dynamic theme like this. Even well-experienced investors often make the mistake of investing too early or too late. Investing too early means that returns may not meet your expectations in your planned time horizon. On another note, while investing in market giants such as the FAANG companies (Facebook/ Meta, Apple, Amazon, Netflix & Google/ Alphabet) seems like a good safe bet, it can often be too late and a case of having missed the wave at the time. The fact that you know so much about these large companies and are using their products or services daily means that they’ve already returned outsized value to early-stage investors.

ARK Invest looks at 3 key parameters to identify the tipping point that could make an innovation platform a viable investment over the next 5-10 years. The parameters to identify the innovation platforms are:

- A strong cost-curve decline

- Increasing adoption of the innovation across multiple sectors

- Proof that the innovation is serving as launchpads for other technologies

How does ARK look at investing in this space, what is their research and investment process?

Investing in disruptive innovation requires one to have domain expertise. It can be tempting to ignore companies because they don’t generate sufficient revenue currently. However, the right mindset is to find companies that will be key enablers or beneficiaries in the coming decade.

ARK Invest hypothesises that value will accrue and consolidate to a few key players, and a thorough top-down market approach to identify companies is crucial. It is also important to caveat that innovation is inherently controversial, and that leads to high volatility.

However, different technologies within the innovation space often have a low correlation to each other, and you can use this to your advantage through an active management process. To give you an example, the volatility in genome editing companies has little or negligible correlation to companies in the electric vehicle industry. When you invest across different technologies, this diversification helps to safeguard your portfolio.

Further, to simplify the process of what to look at while shortlisting a company, ARK looks at a 6-metric scoring system, as covered during the conversation. Scoring your portfolio on the key metrics of the company, people and culture, quality of execution, product and service leadership, moat/barriers to entry, and valuation set successful inventions apart and primed for investors. Also important to note is that a decline on any of these parameters may warrant an exit from the investment.

Lastly, having a long-term horizon while investing in disruptive innovation is imperative. Transformational innovation booms in the market often see multiple cycles. As an example, deflation can be useful because it makes innovation cheaper and accessible to a wider market. However, it can also imply that inventory is starting to build up in industries like automobiles and retail since people do not have enough disposable income to spend, which results in companies unloading and dropping prices.

So, as long as your investment horizon is long (7-10 years+) and your conviction in the process remains, you may stand to benefit from this innovation-focussed theme. Disruptive innovation is going to change lives for the better and presents many attractive investment opportunities for progressive investors to capitalise on.

While such shores have already opened up in developed markets such as the US, options for Indian investors remain limited currently. This is exactly the gap that we at DSP looked to plug for Indian investors through the launch of one of India’s most innovative mutual fund schemes, that gives investors access to disruptive innovation as a key theme. Learn all about the new DSP MF scheme by clicking the button below.

Disclaimer

This note is for information purposes only. In this material DSP Asset Managers Pvt Ltd (the AMC) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author or the AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. Any sector(s)/ stock(s)/ issuer(s) mentioned do not constitute any recommendation and the AMC may or may not have any future position in these. All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them.

Leave a comment