Houston, we have a problem.

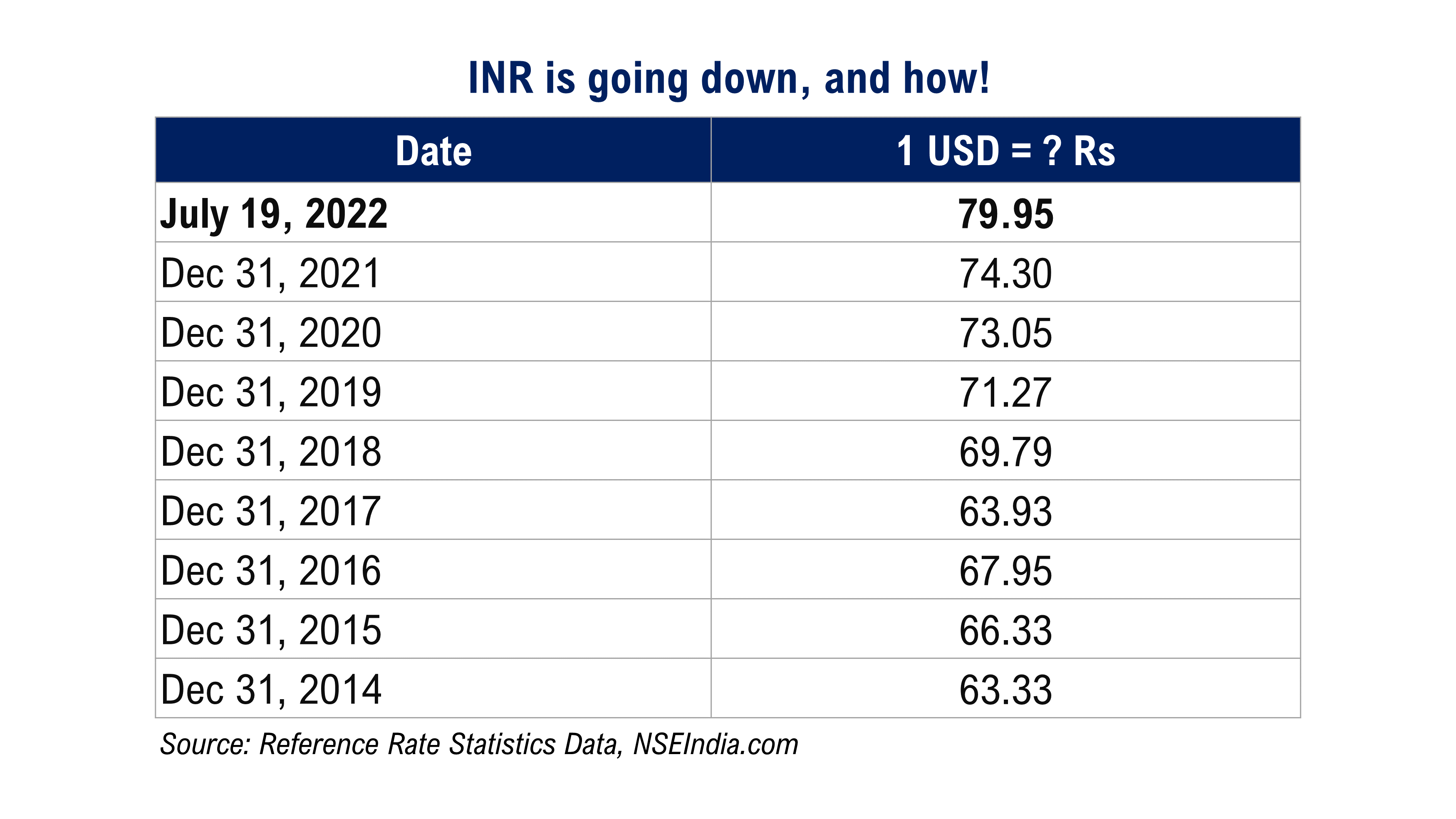

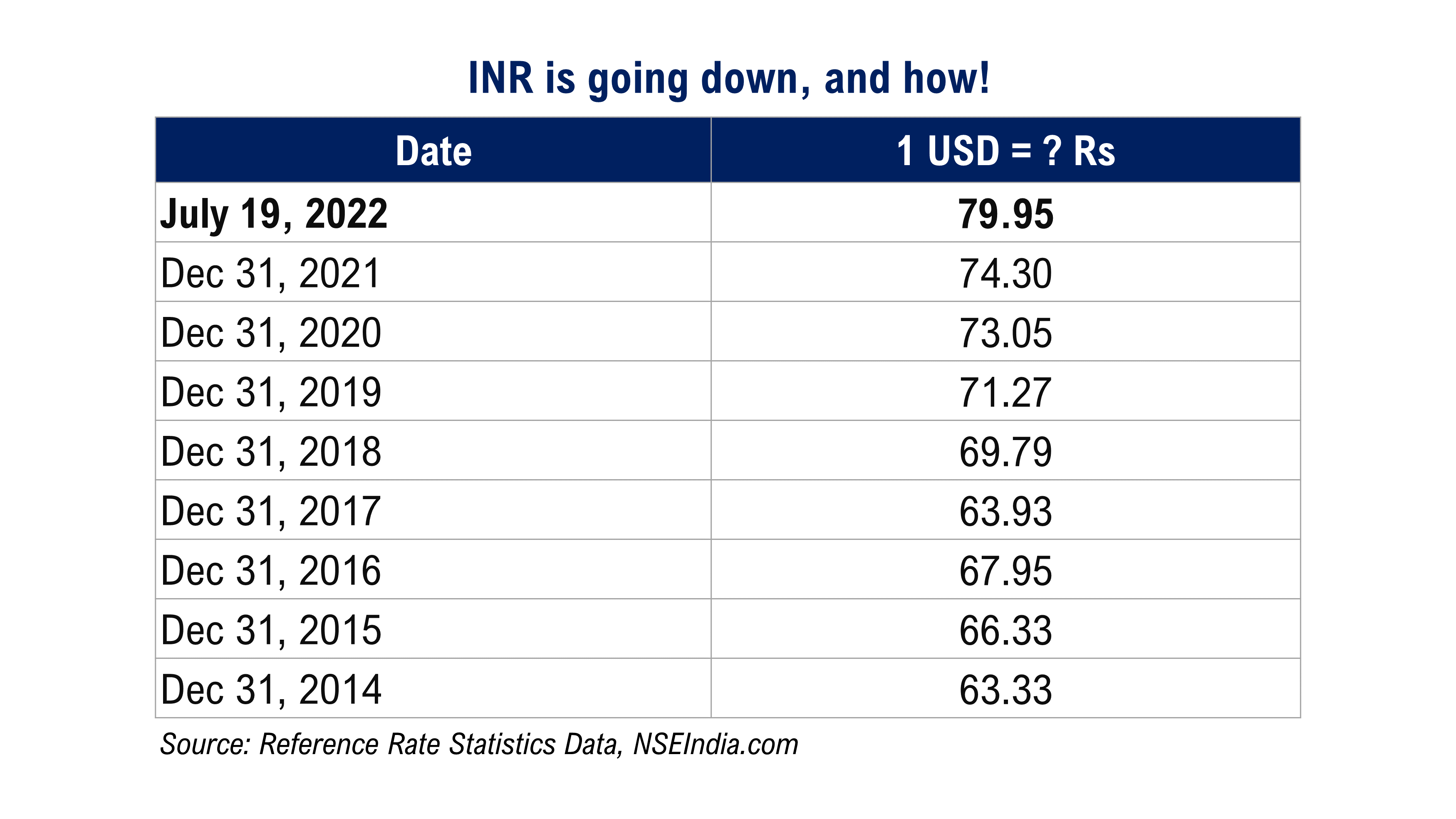

On 19 July 2022, the Indian Rupee hit a never-before Rs 80 per US Dollar in what was the 8th consecutive session of decline. As per the government, the value of the Rupee against the US Dollar has depreciated more than 25% from December 31, 2014 to July 19, 2022.

What does this mean to you and me? What is rupee depreciation and how does it affect us?

“Lingering at the [shop] window was a luxury because shopping had to be done immediately. Even an additional minute meant an increase in price. One had to buy quickly because a rabbit, for example, might cost two million marks more by the time it took to walk into the store. A few million marks meant nothing, really. It was just that it meant more lugging. The packages of money needed to buy the smallest item had long since become too heavy for trouser pockets. They weighed many pounds. . . . People had to start carting their money around in wagons and knapsacks. I used a knapsack.”

- Prominent German Artist, George Grosz (Source)

This was the bleak reality that faced Germans in the 1920s, in the aftermath of World War I: a single meal for a family of four might’ve cost ten million marks (note for the Millenials - Mark was the currency of Germany before the Euro was introduced in 2002) on one day, and fifteen million marks the next day. The price of everything was way up in the stratosphere and was rising at an absurd pace. But how did Germany end up in such a horrifying mess?

-png.png)

-png.png)

(Source}

Well, when World War I broke out, Germany decided to fund its war effort by borrowing (unlike France, for instance, which paid for the war by introducing an income tax). The plan was that once Germany had won, the borrowed money could be paid back by imposing a war indemnity on the defeated nations.

Alas, as fate would have it, Germany lost, and the victors saddled it with the obligation to pay massive war reparations (Compensation payments intended to cover for damage or injury inflicted during war). Moreover, these reparations had to be paid back in the form of gold, goods, bonds, securities, or strong foreign currencies; Marks were not acceptable.

As a result, Germany started to buy large amounts of foreign currencies using Marks, which was effectively equivalent to selling Marks and accepting foreign currencies as payment. This caused the market supply of Marks to swell, which caused the Mark to decline in value with respect to foreign currencies (i.e., the Mark experienced what is known as depreciation), which then resulted in more and more Marks being needed to buy foreign currencies.

Yes, that’s quite a complicated chain of causes and effects already, but we’re not done yet. This depreciation meant that importing foreign goods became more expensive, which negatively affected the supply of such goods. As a result, goods sold in Germany became more expensive as well (i.e. Germans were facing a high rate of inflation). Moreover, the government’s operating costs were also increasing day by day.

With few options before it, at some point, the German government simply started to print more and more money, which further diluted the Mark’s value. A more garden-variety kind of inflation now gave way to the terrifying monster known as hyperinflation where inflation spirals out of control with seemingly no upper limit in sight.

Just how bad can hyperinflation get? Well, at one point in time, there was a 50 trillion Mark note in circulation (photo below). Yes, you read that right: 50 TRILLION!

-png.png)

-png.png)

(Source. Note that ‘Billionen’ in German means ‘trillion’, not ‘billion’)

While hyperinflation is extremely rare, currency depreciation, which was one of the intermediate causes of this particular episode of hyperinflation, is a much more commonplace phenomenon. Let’s drill down into what it means, its causes, and what Indian investors should do when the rupee depreciates.

What currency depreciation means

There was a time not too long ago when most major global powers followed what’s known as a ‘gold standard’, which is an economic system where each unit of account is backed by a fixed quantity of gold. In other words, back when the USA followed this system, you could go to a bank and exchange a US Dollar bill for a certain amount of physical gold (only in principle, though: in practice, such ‘convertibility’ was often suspended during and in the wake of economic or political turbulence).

For various reasons, however, most of the world has moved on to a system where, rather than being “pegged” to other currencies or to commodities such as gold, each currency can be exchanged against another currency at a particular rate (known as the ‘exchange rate’ for the two currencies in question) decided by market forces.

Currency depreciation is when the value of a given currency (say, the INR) falls with respect to a reference currency (usually, the USD). Given that foreign exchange (forex) markets are volatile, the term ‘depreciation’ is typically used only in the context of a relatively long period of time (roughly a month or more).

A decade ago:

— Suresh Phaneendra K (@suresh144k) July 16, 2022

Who will reach 100 first, Sachin or Petrol?

Now:

Who will reach 100 first, Virat or INR?

Times flies so quickly 😄🥲@sachin_rt @imVkohli #IndianCricketTeam

The causes of depreciation

There are several political and economic factors that can cause currency depreciation, whether directly or indirectly. Some of these are:

- Economic fundamentals: Weak fundamentals can result in foreign investors choosing to stay away, leading to a low demand for the domestic currency, which can reduce its value.

- Growing imports: Imported goods need to be paid for in a foreign currency, so as demand for that currency (say, the USD) increases, its price in the domestic currency (INR) goes up, reducing the INR’s value with respect to the USD.

- Risk aversion: Fears of an imminent bear market or recession, political instability, a lack of clear laws or regulations, or unpredictable behavior on the part of the Government can spook investors and lower their interest in investing in a given country. This can lead to the depreciation of the domestic currency.

- Speculation: Traders speculate on exchange rates in the forex market. If enough traders lose confidence in a currency, they might trade it in a way that actually drives its relative value down.

- High rates of inflation: Inflation that is unusually high over a sustained period of time can be a sign of poor national economic management, which doesn’t inspire confidence among foreign investors. Moreover, high inflation in a given country can also increase the input costs for its exports, which raises their prices in international markets and makes them less competitive. This can worsen that country’s trade deficit (i.e. the gap between its imports and exports), which can also lower its currency’s relative value.

- Central bank interest rate differentials: The interest rates set by central banks (the Federal Reserve for the US, the RBI for India) affect the returns that investors receive on instruments such as bonds, and also have an impact on the ease of borrowing.

Since capital chases returns, if the Federal Reserve’s interest rates were more attractive than those of the RBI, more foreign investors would be tempted to withdraw their investments from countries such as India and park them in the US instead. This would decrease demand for the INR, causing its relative value to drop.

The effects of depreciation

As was evident from the story of Germany in the 1920s, currency depreciation can, in certain circumstances, play a role in pushing economies and people’s lives towards a calamitous fate. However, that was a rare, pathological outcome; more typically, the effects of currency depreciation, while significant, are much milder. Some of them are:

- Cost-push inflation: Depreciation raises the cost of imports, which then get passed on to consumers, leading to what is called ‘cost-push inflation’.

Thus, if a country relies heavily on certain imported goods, a currency depreciation can reduce living standards and hamper economic growth.

- Demand-pull inflation: A higher cost of imports also increases domestic demand, causing the prices of domestically produced goods to rise as well, a state of affairs known as ‘demand-pull inflation’.

- Greater competitiveness of exports: Depreciation makes domestically produced goods cheaper in international markets, which should theoretically improve their competitiveness and lead to a rise in exports. However, in practice, things might not work out that way, as other factors such as the demand for those domestic goods will also play critical roles.

Moreover, in the long run, exporters can become complacent due to higher exports, which can make them less likely to cut costs and improve productivity; this can have a negative impact on the economy as a whole.

In general, the impact of depreciation also depends on the state of the economy. If a recession is under way, then a rise in exports can help boost the economy without greatly increasing inflation. However, if the inflation rate is already high, then typically, depreciation tends to take it even higher.

— Cartoonist Alok (@caricatured) May 9, 2022

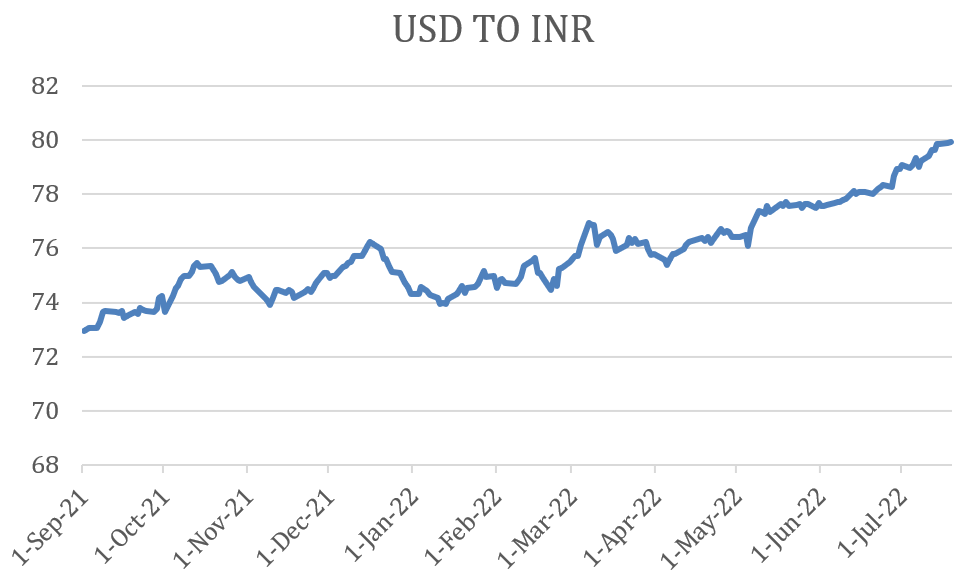

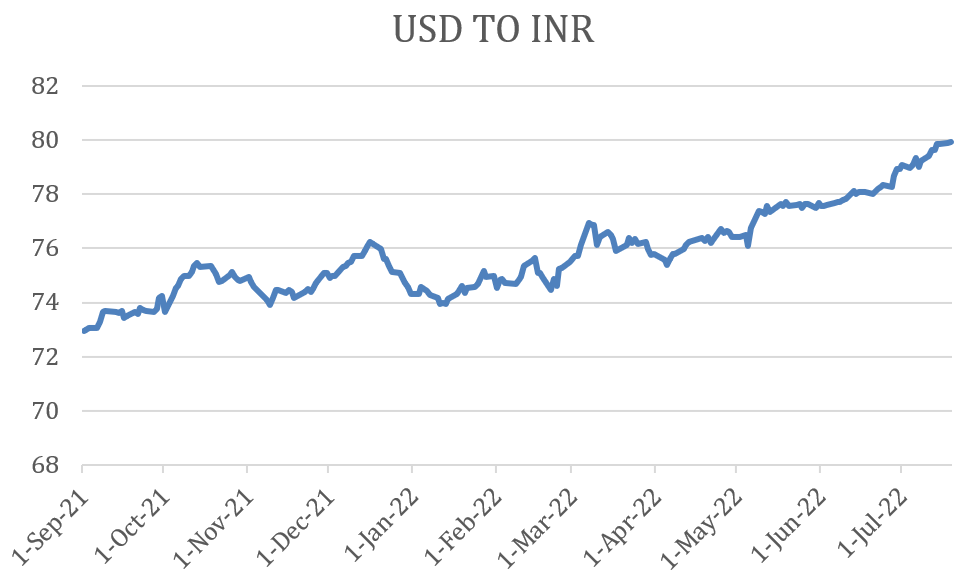

The ongoing depreciation of the Indian rupee

Ever since the Russia-Ukraine war began in February 2022, the INR has been on a downward spiral with respect to the USD. It fell sharply by 8% roughly in the immediate wake of Russia’s invasion, and had hit record lows by the time May 2022 rolled around. Now, for the first time in history, the USD/INR pair has breached the 80 mark, that is, the point where 80 INR can buy you just 1 USD.

(Source)

There are several factors that led to this situation and that are propping it up, including:

- Investors looking for safe havens: Since the Russian-Ukraine war broke out, investors have been looking to park their funds in safe and stable markets, such as the US. This has reduced incoming investments into India, weakening the INR.

- The US rate of return: Investors also expect the Federal Reserve to aggressively hike interest rates soon in a bid to control inflation in the US; this will lead to better yields for investors in the US, thereby making more Indians want to explore investments in USD, which in turn might lead to further depreciation of the INR.

- Indian imports: India relies heavily on imports for its fuel requirements, and also imports a significant proportion of the edible oil it consumes. The rising import costs have further weakened the INR.

- Inflation: The rise in fuel costs in India has resulted in a rise in transportation costs in general, which in turn has affected the prices of many essential commodities. As discussed above, a high inflation rate over a long period of time is liable to spook investors, which will cause further outflows of foreign capital from India.

Annual Inflation Rate

(Source)

With the Russia-Ukraine tensions still ongoing, fuel prices high, rising inflation around the world, and fears of a recession, it’s quite likely that the rupee will remain weak for some time to come.

The main takeaways for Indian investors

Ok, so with that discussion out of the way, let’s come to the meat of the matter: what does all this mean for you, the Indian investor?

There are three main pieces of advice that you should pay heed to:

1. Invest as much as you can: Given the high inflation rate accompanying the ongoing rupee depreciation, setting aside more cash than you need is going to erode its value. Once you have a tidy and generous emergency fund set aside, and have taken out the appropriate insurance policies, it’s generally a good idea to invest whatever capital you have left over. Essentially, don't let your money remain idle. Or just in savings. You will need to do more with it.

2. Find out which sectors are the most vulnerable: Companies in certain sectors typically need to take out huge foreign currency loans, and import raw materials regularly. Such sectors will be especially prone to taking a beating due to a falling rupee.

Some such sectors are oil and gas, aviation, power/energy and construction. Thus, it might be prudent to talk to your financial advisor about aligning your goals and risk profile with your interests before seeking exposure to these sectors.

3. Take a look at global funds, if you haven’t already: When you invest in global funds (say, in the US), you effectively buy USD using INR first, and then buy your chosen asset in USD. What this means is that if you withdraw your money from a US-based investment after the rupee has depreciated somewhat, then you stand to get an INR amount that is higher than what it would otherwise have been simply by virtue of the INR having depreciated. Maybe consider this offering which may be worth your while.

Now, whether you actually make a profit in such a situation will, of course, depend on several additional factors, including the movement of the foreign asset, the cost of investment involved, and currency conversion costs.

While currency depreciation and inflation can lead to a gloomy outlook, investors can ride through such uncertain times by keeping a cool head and arming themselves with knowledge, discipline, and good advice.

Bare minimum, please do not let your money remain idle in times like this. Even if you don't want to invest internationally, consider deploying any money you won't need in the next 3-6 months in a basic hybrid fund like this, which could give you a decent balance between Equities and Debt.

If not sure what to do, do what the best do: Speak to an expert Mutual Funds Distributor. Remember, #HelpHelps

About the author

The Rational Ghost. This is one rational storyteller that provides interesting insights & stories about investing and tries to be completely unemotional about it. Lives in the shadows, doesn’t want anyone to know its real name.Disclaimer

This note is for information purposes only. In this material DSP Asset Managers Pvt Ltd (the AMC) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author or the AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. Any sector(s)/ stock(s)/ issuer(s) mentioned do not constitute any recommendation and the AMC may or may not have any future position in these. All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them.

Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

-1.png)

Leave a comment