Here’s why you don’t make the highest possible returns every year!

Investing in equities is a crucial step towards securing your financial future, beating inflation, and achieving a comfortable lifestyle. However, the investment landscape can be perplexing, leading to decisions driven by ease, recent performance, emotions, or a lack of understanding.

Many investors grapple with questions like: Should I invest in growth stocks or value stocks? Are mid and small-cap funds preferable, or should I consider large caps, especially since they're performing well? Which sector offers the best opportunities right now? How do I earn the highest possible returns all the time?

Decisions, Decisions: Simplifying Your Approach

While the last question above has an obvious answer, here’s a 3 step approach to navigate through the available choices more effectively.

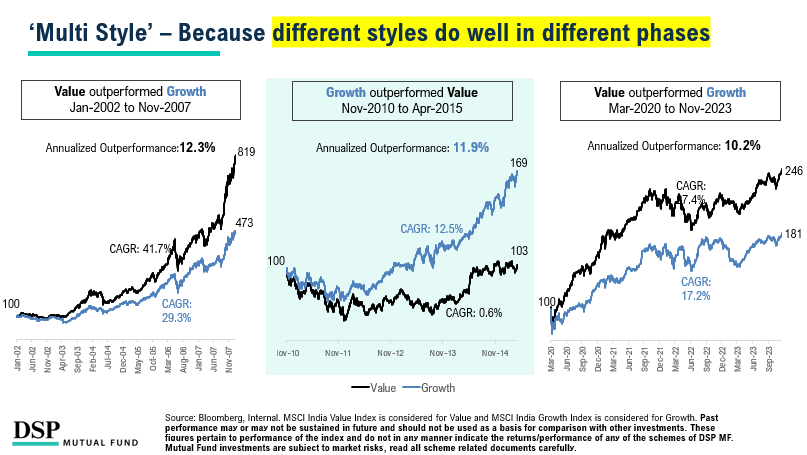

1. Adopt a Multi-Style Approach

Different investment styles come into favor at different times. By adopting a multi-style approach, you diversify your investments across various styles, increasing your chances of capturing favorable market movements.

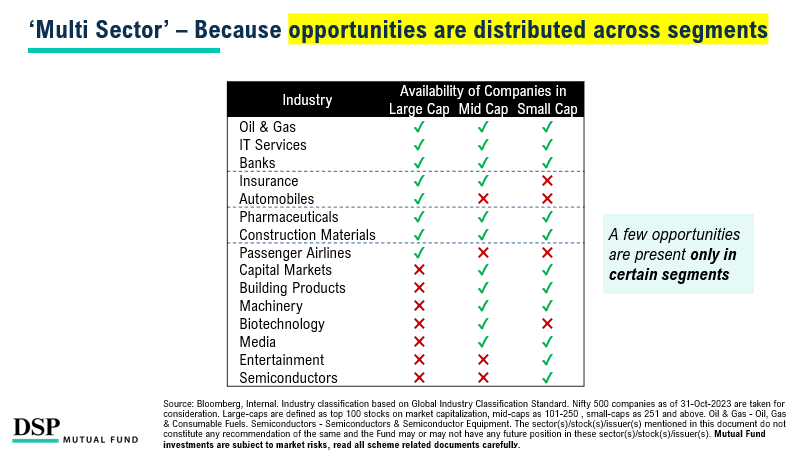

2. Embrace a Multi-Sector Strategy

Opportunities emerge across various sectors at different times. A multi-sector approach ensures diversified exposure to these opportunities, allowing you to benefit from the growth potential in different areas of the market.

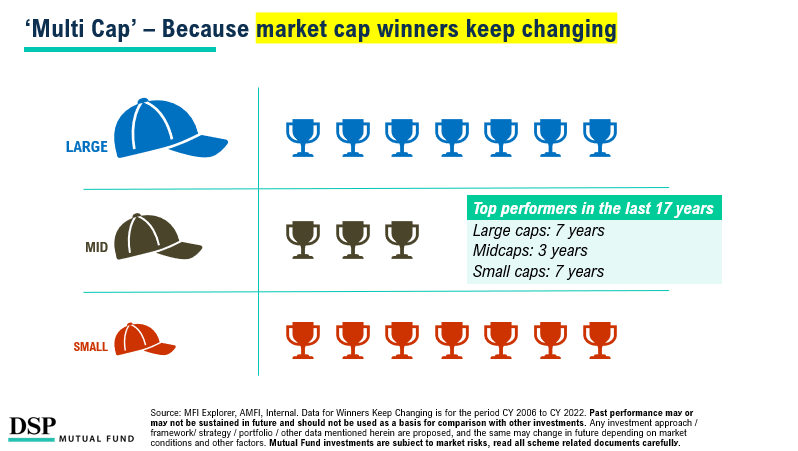

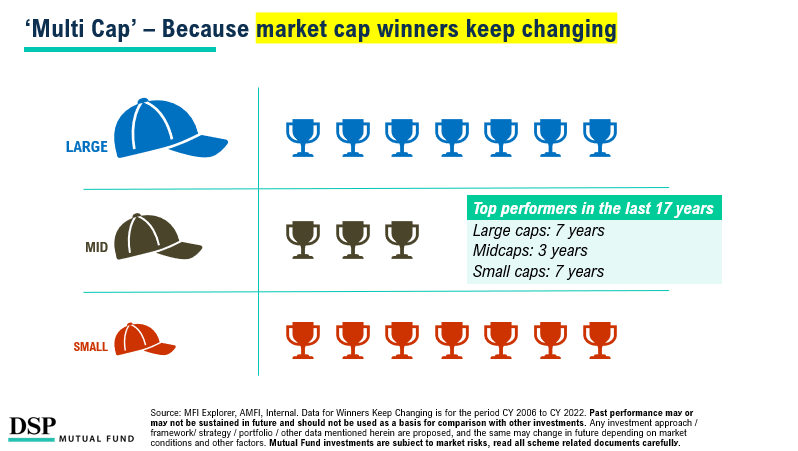

3. Implement a Multi-Cap Approach

While it's tempting to chase the recent high performers, it's important to remember that the best performing market cap segments change over time. A multi-cap approach prevents you from focusing solely on past winners and opens the door to potential future performers.

So here’s why you don’t make the highest possible returns all the time

Winners rotate every year, and no one can make perfect decisions in the market at all times. This concise table below shows the outperformers every year. No wonder, you can’t win it all!

.jpg?width=1274&height=720&name=4%20(9).jpg)

.jpg?width=1274&height=720&name=4%20(9).jpg)

The Long-Term, Direct Recommendation

Smart equity investors should combine a Multi-Style, Multi-Sector, and Multi-Cap approach. This strategy not only diversifies your investment portfolio but also positions you to capitalize on a range of market conditions and opportunities.

But how?

In almost every situation in life, theory comes easy, but practical life makes the application difficult and often, confusing. The multi approach we spoke about sounds right, but your next question will be, how?

Add to this that there's no magic, one-size-fits-all solution. Your financial goals, how much risk you're comfortable with, and how long you're planning to invest – all these are unique to you. So, what works for your friend or Mr. Sharma might not be the best fit for you.

I know all this can sound overwhelming, and that's totally okay. Not everyone's a finance expert, and that's where someone who can be a mentor and provide the right advice can make a big difference. Talk to a Mutual Fund Distributor (MFD). These experts have already helped crores of Indians plan to build wealth & prepare financially for a better future.

And if you don’t have access to an MFD, we can help. Just fill out this short form below and we’ll have one of our experts connect with you and help you take one step ahead.

Disclaimer

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

-3.jpg)

Leave a comment