3 key takeaways from Netra, September 2023

The September 2023 edition of Netra has arrived, offering a comprehensive exploration of critical economic and investment insights in an ever-evolving landscape. In this edition, we unravel the uncertainties surrounding the weakening US employment and housing landscape amid rising interest, thus, the emerging recession signals, highlighting the necessity for economic stability and policy response. As we embark on this exploration, our goal is to equip you with the knowledge and foresight necessary to make informed decisions in these dynamic and uncertain times, where economic resilience and adaptability are of paramount importance.

Unmasking economic uncertainty with weakening US employment and emerging recession signals

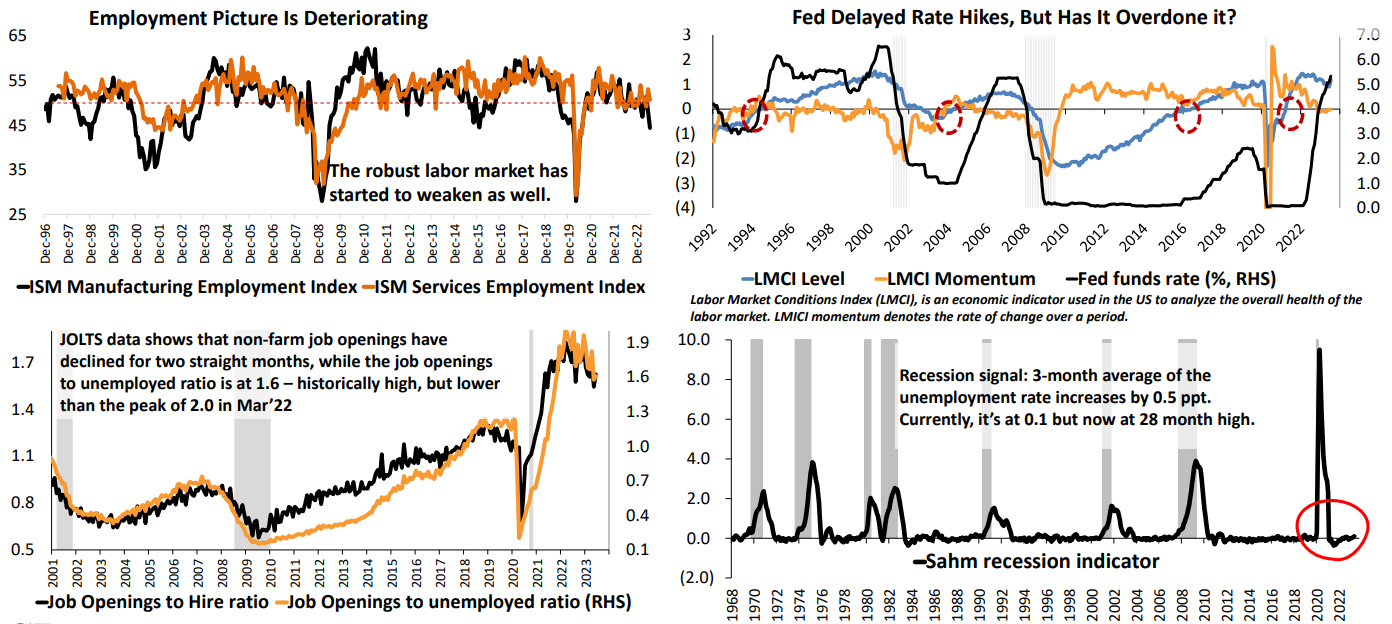

Source: Madhavi Arora, Emkay Research, DSP, Data as on Aug 2023

The US employment landscape, once considered the bedrock of the current economic cycle, is now exhibiting worrisome signs of deterioration.

Examining the data from the Job Openings and Labor Turnover Survey (JOLTS), a troubling trend emerges. Non-farm job openings have declined for two consecutive months, albeit the job openings-to-unemployed ratio remains relatively high at 1.6, but still lower than its peak in March 2022. However, the real red flag emerges when considering the three-month average of the unemployment rate, which is currently at 0.1, marking a 28-month high and serves as a potential recession signal. This subtle shift in unemployment rates, when analysed over time, can signify deeper economic challenges on the horizon, making it imperative for policymakers to monitor the situation closely and adapt strategies accordingly to steer the economy in a more stable direction.

Navigating high valuations and the margin of safety

Source: NSE, DSP Data as on 31 Jul 2023

In the investment world, valuations are crucial for prudent decision-making. The "Margin of Safety" concept, vital for equity investors, acts as a protective cushion against potential losses. Key to assessing this margin is the Price to Earnings (P/E) ratio, which measures what investors pay for each unit of earnings. The current P/E ratio for the Nifty 50 index is 22.5x, signifying a premium paid for earnings. Historical data reveals that when P/E ratios exceed 22x, three-year forward returns tend to be subdued, highlighting the link between high valuations and muted returns, warranting caution.

Considering India's growth story, the margin of safety gains importance. Optimism for economic growth must be balanced with valuation scrutiny. High growth expectations but with steep valuations often result in disappointing equity returns, though there are exceptions like the post-COVID recovery. Given the current high valuation landscape, prudent strategies are advisable. Diversification, staggered purchases, and Systematic Investment Plans (SIPs) help navigate elevated equity valuations, safeguarding portfolios.

Devising a smart investment strategy with key considerations about risk

A fresh edition of #DSPNetra is out now!

— DSP Mutual Fund (@dspmf) September 5, 2023

Netra helps you keep track of the latest economic trends & gives you the insights that matter

Follow the thread below or download https://t.co/SHZhSGV6U4

This time, let's begin differently.

Ask this every time you make a decision. 1/16 pic.twitter.com/C2hC3wqa3c

When evaluating investments and managing risk, follow a prudent approach. Warren Buffet's quote, "I don't try to jump over 7-foot hurdles; I look for 1-foot hurdles I can step over," captures this mindset.

Can I afford it?

Assess the height of the hurdle, representing the investment's risk level. Just as you wouldn't attempt a 7-foot jump if it's beyond your ability, avoid taking on excessive financial risk. Examine your financial situation, considering income, savings, and commitments. Ensure you can handle and absorb the risk to prevent financial hardship if the investment underperforms. Seek "1-foot hurdles" that match your financial capacity.

Is it worth it?

Evaluate potential rewards relative to risk. Determine if the effort to clear the hurdle justifies the reward. Scrutinise risk-reward trade-offs, including expected returns, success likelihood, and alignment with financial goals. Look for "1-foot hurdles," offering a balanced risk-reward ratio, avoiding overly challenging or incompatible options.

Incorporating these questions promotes a measured approach to risk. It helps you select opportunities that fit your financial capacity and offer reasonable chances of success. This approach contributes to a balanced investment strategy, reducing unnecessary risks while pursuing opportunities aligned with your financial objectives.

The Bottom line:

As the economic landscape evolves, Netra empowers its readers with crucial insights to confidently navigate uncertainties, capitalise on opportunities, and make informed decisions that foster stability and growth.

Apart from these, the September 2023 edition of Netra offers several other key insights. You can download the full report here.

Disclaimer

In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house. Information gathered and used in this material is believed to be from reliable sources. While utmost care has been exercised while preparing this document, the AMC nor any person connected does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The recipient(s) before acting on any information herein should make his/their own investigation and seek appropriate professional advice. The statements contained herein may include statements of future expectations and other forward looking statements that are based on prevailing market conditions / various other factors and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. The sector(s)/stock(s)/issuer(s) mentioned in this presentation do not constitute any research report/recommendation of the same and the schemes of DSP mutual fund may or may not have any future position in these sector(s)/stock(s)/issuer(s). All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them. These figures pertain to performance of the index/Model and do not in any manner indicate the returns/performance of the Scheme. It is not possible to invest directly in an index.All data source is Internal unless specifically mentioned, and is up to Jul 31, 2023

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments.

-1.jpg)

Leave a comment